Summary:

– For several years now, most economies in sub-Saharan Africa have been characterized by excess liquidity in their banking sectors, reflecting commercial banks’ reluctance to lend to the private sector.

– This excess liquidity, which stems from the weak institutional and legal environment in these countries, is a major obstacle to investment and the development of small and medium-sized enterprises.

– It is therefore urgent that the governments of these countries, with the help of the World Bank and the IMF, take concrete measures to reduce the amount of idle cash held by commercial banks, redirecting it towards productive investments that drive growth and economic development.

If we were to ask someone we know what they think are the main problems currently affecting Africa, it is almost certain that AIDS, child labor, low school enrollment, and civil wars would top the list. It is also highly likely that the problem of excess bank liquidity would never be mentioned. However, for many years, excessive bank liquidity, like low school enrollment rates, has been a powerful obstacle to economic development in sub-Saharan African countries.

What is meant by « bank excess liquidity »? This phenomenon simply reflects the fact that banks in these countries prefer to hold on to their often substantial cash reserves rather than lend out some of the savings they have collected to finance business investment projects. As a result, companies facing this credit rationing often find it very difficult to carry out their investment and development projects, which is undoubtedly a major obstacle to growth and economic development in sub-Saharan African countries. After highlighting the importance of bank excess liquidity in these countries, we will review the likely causes of this phenomenon. Finally, we will provide a brief overview of the economic policy measures that could reduce this « waste » of liquidity.

The importance of excess bank liquidity in sub-Saharan Africa

The primary role of a commercial bank is to recycle savings, i.e., to transform the resources it collects from agents with financing capacity into loans to agents in need of financing. This activity carries a major risk for the financial intermediary: liquidity risk. This liquidity risk is inherent in the transformation activity itself. It reflects the fact that long-term financing is generally backed by short- and/or medium-term resources. Indeed, the profitability of companies’ investment projects requires them to be able to borrow long term, while at the same time savers have a preference for liquidity, which may lead them to withdraw their assets. To address this risk, banks therefore need to retain a portion of the liquidity they collect in order to cover unexpected withdrawal requests from their customers.

However, in sub-Saharan African economies, commercial banks choose to retain a much larger amount of liquidity than they need to cover their customers’ potential liquidity demands, hence the term « excess liquidity » in the banking sector. A commonly used measure to understand the extent of this phenomenon is to compare the excess reserves of commercial banks in a given country with the money supply in circulation or total bank deposits, with excess reserves corresponding to the difference between reserves held with the central bank and reserve requirements (regulatory reserves imposed by the monetary authority).

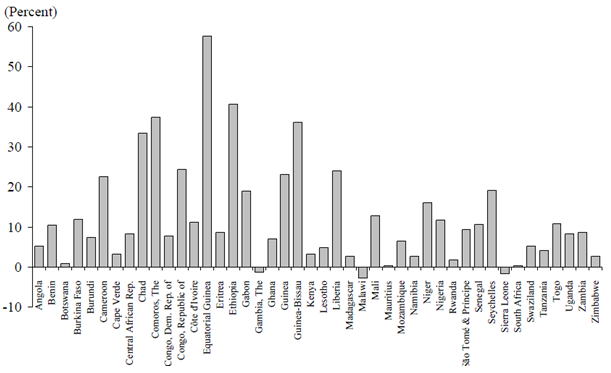

According to a study conducted by Saxegaard (2006), in 2004 most sub-Saharan African countries had excess liquidity in their banking sectors, i.e., a situation in which the total amount of reserves held by commercial banks with the central bank exceeded the amount of required reserves. However, the graph below shows considerable heterogeneity between countries in the region.

Excess reserves (as a percentage of total bank deposits) at the end of 2004

Source: Saxegaard (2006)

The causes of excess bank liquidity

At first glance, excess bank liquidity appears to be irrational behavior on the part of commercial banks. Indeed, the opportunity cost of holding large amounts of idle cash is very high [1]. What, then, could explain why banks in sub-Saharan Africa behave in this way?

A number of academic studies have addressed this question (see, for example, Doumbia, 2011). These studies show that banks’ reluctance to provide more credit to the economy is mainly due to a lack of bankable investment projects, shortcomings in accounting standards, and a poorly developed judicial system that is often unable to resolve potential disputes between lenders and borrowers. It is precisely this weakness in the institutional and judicial environment that makes banks reluctant to offer loans to private sector companies, particularly small and medium-sized enterprises.

Other factors that may explain the excess liquidity in these economies include weak competition in the banking sector. Coupled with a weak institutional and judicial framework, the strong market power of banks is characterized by high lending rates and stringent conditions for access to bank credit. Alongside these structural factors, a number of other elements have contributed to this excess liquidity, including capital controls, which limit the investment of bank liquidity abroad, and foreign currency inflows linked to oil revenues and remittances from migrants.

What solutions are available to limit excess bank liquidity?

The abundant excess liquidity in the banking sectors of sub-Saharan Africa contrasts sharply with the strong financing needs of these economies. The difficulties companies face in obtaining financing from the banking sector severely constrain their emergence and development, which is a major obstacle to the economic development of these countries.

Beyond this aspect, excess bank liquidity is also a source of inflationary pressures and has a significant impact on the effectiveness of monetary policy. Indeed, due to their excess liquidity, commercial banks have a relatively low need for refinancing and therefore rarely turn to the interbank market to meet their liquidity needs. Changes in the central bank’s key interest rate are therefore very difficult to pass on to bank rates.

It is therefore urgent that the governments concerned, with the support of international organizations (World Bank, IMF), take the necessary measures to better channel savings towards investment and economic development. Among the possible measures, it would of course be necessary to improve the business environment, in particular by adopting accounting standards and creating independent accounting firms, but also by establishing a sound judicial system to facilitate the settlement of contractual disputes between lenders and borrowers (Kauffmann, 2005).

Nevertheless, the effective implementation of these measures will take a number of years. In the shorter term, it is possible to imagine the introduction of a number of financial instruments (public guarantee funds, inventory-backed credit, factoring, etc.) aimed at reassuring commercial banks about their perception of the risk associated with financing investment projects. Finally, from a monetary policy perspective, the recent experience of some African countries has shown that issuing Treasury bills is an effective way of recycling some of the excess liquidity in the banking system, while allowing governments to limit their recourse to external debt.

Notes

[1] Opportunity cost, or foregone cost, corresponds here to the financial gains that commercial banks forego by choosing not to lend excess liquidity to their customers.

Bibliography

Doumbia, S. [2011]: Surliquidité bancaire et « sous-financement de l’économie » – Une analyse du paradoxe de l’UEMOA. Revue Tiers Monde 2011/1, No. 205, pp. 151-205.

Kauffmann, C. [2005]: Financing SMEs in Africa. OECD Development Center, Benchmarks No. 7, May 2005.

Saxegaard, M. [2006]: Excess liquidity and effectiveness of monetary policy: Evidence for Sub-Saharan Africa. IMF Working Paper 06/115, International Monetary Fund.