Abstract:

- Particularly affected by the dual crisis of 2020 (oil and health), the United Arab Emirates (UAE) has benefited since 2021 from the rebound in hydrocarbon prices and production, as well as the recovery of non-hydrocarbon activities (tourism, transportation).

- The real estate sector is also experiencing a notable rebound after several years of falling prices, particularly in Dubai.

- In addition to reforms to strengthen the business climate, the UAE is signing a growing number of agreements (commercial and financial) with other nations (Indonesia, China, India, and Iran in particular). The aim is to usher in a new economic era for the UAE and assert its position as a leader in the region.

The United Arab Emirates is one of the most diversified economies in the Arabian Gulf, with dynamic service activities (financial services, real estate) and re-exports in Dubai, while activity in Abu Dhabi relies heavily on hydrocarbon exploitation (the economic weight of the other emirates remaining insignificant compared to that of Abu Dhabi and Dubai).

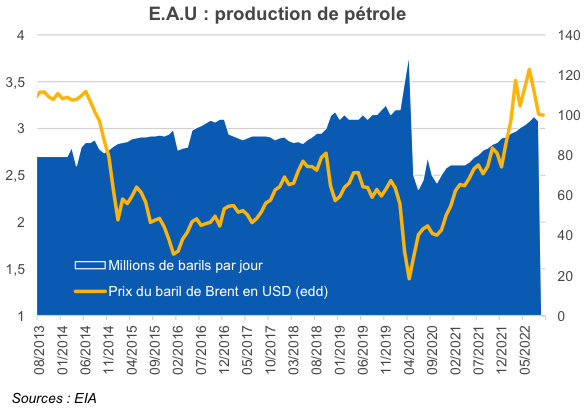

However, this economic model remains highly dependent on changes in barrel production and price levels. Aware of this vulnerability, particularly when oil prices fall, as was the case in the period 2014-2020, the authorities are now seeking to enter a new era by further diversifying their economy. Faced with growing regional competition from their Saudi neighbor, the United Arab Emirates (UAE) has decided to step up its efforts to boost its attractiveness.

In 2021, the UAE announced its intention to attract USD 150 billion in foreign investment. This note provides a brief overview of recent economic developments and reviews the recent agreements signed between the UAE and their contribution to strengthening the potential of the Emirati economy.Market-based solutions have been applied to the problem of biodiversity loss in the form of offset banks. The aim of these banks is to prevent a net loss of biodiversity. The idea behind offset banks is quite simple: as with our bank accounts, it is possible to make debit or credit transactions. If a developer damages a habitat with their project, it is a debit that they must pay. On the other hand, if an organization restores a habitat, it is a credit that it can sell to the bank. One of the main challenges is to find credits that are equivalent to the debits. Given that the « value » of one habitat generally differs greatly from that of another, these exchanges via credit/debit transactions are almost never in balance.

1. Economic recovery after the double crisis of 2020

1.1 Favorable growth prospects

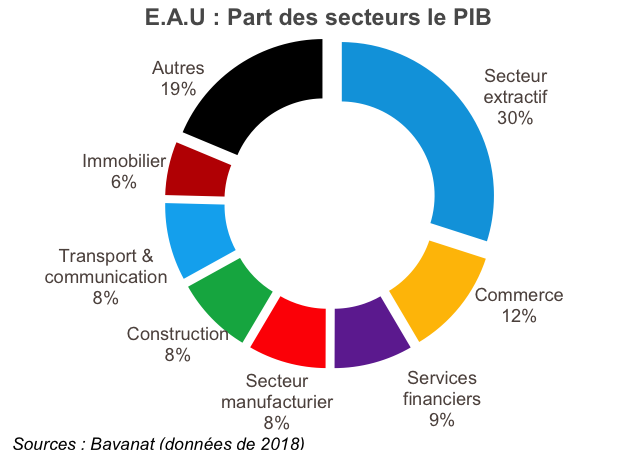

Although highly dependent on the hydrocarbon sector (30% of GDP), the UAE’s economy is nevertheless relatively more diversified than its neighbors and relies on several important sectors, with wholesale and retail trade remaining the most important non-hydrocarbon sector (see chart below), followed by financial services, manufacturing, construction, and real estate.

After growing by nearly +2.8% in 2021 (down -6.1% in 2020), real GDP rose by +8.1% year-on-year in the first quarter of 2022, according to the Central Bank of the United Arab Emirates. Oil GDP accelerated sharply, driven in particular by the rebound in tourism-related sectors.

According to estimates, non-oil GDP grew by 6.1% year-on-year in the first quarter of 2022, benefiting from the lifting of several COVID-19 restrictions during the first quarter of 2022 and the resumption of global travel. The UAE also saw an increase in private consumption and investment, with telecommunications and transportation activities rising sharply and real estate sales also recovering. Domestic consumption picked up in the first quarter of 2022, supported by increases in employment and wages. Based on the Wage Protection System (WPS), the number of employees and wages increased by 8.1% and 4.9% year-on-year, respectively, at the end of March 2022.

In the first quarter of 2022, oil production averaged 2.95 million barrels per day and was estimated to be in line with OPEC+ agreements. As a result, hydrocarbon GDP increased by +13.0% year-on-year. Shocks to global oil supply and demand contributed to higher oil prices. The average price of a barrel of Brent crude oil reached nearly $106 on average in the first nine months of 2022, compared to nearly $70.7 in 2021 and $41.8 in 2020. Oil GDP is expected to grow by +8.0% and +5.0% in 2022 and 2023, respectively, according to the UAE central bank, a dynamic growth that remains conditional on the evolution of the Ukrainian conflict and the continuation of the post-COVID-19 recovery.

Overall real GDP is expected to grow by +5.4% at the end of 2022 and +4.2% at the end of 2023, respectively (UAE Central Bank).

1.2. Recovery of the real estate sector after several difficult years

In the real estate sector, residential prices continued to recover towards the end of last year. The latest available data shows that property valuations saw average annual increases of +9% and +6% in Dubai and Abu Dhabi, respectively, in December 2021. These results were supported by growth in sales transactions (Dubai Land Department).

The office market in the UAE showed signs of recovery in the fourth quarter of 2021. Towards the end of 2021, the UAE introduced reforms such as switching to a Monday-to-Friday work week, aligning itself with global markets, as well as new labor laws and visa options. In the medium to long term, these initiatives will help strengthen the UAE’s attractiveness by attracting and retaining skilled labor.

Supported by the World Expo (Expo 2020, postponed by one year to 2021 due to the health crisis) and the return of international visitors, the UAE hotel market performed well in the first quarter of this year. The increase in overall performance was driven by waterfront and luxury developments, which benefited from strong leisure demand.

Real estate activities in the broad sense (including certain construction-related activities) are the fourth largest non-hydrocarbon sector, contributing 8.2% to non-oil GDP. During the first quarter of 2022, activity levels and performance in the UAE real estate market increased significantly. In the future, however, rising interest rates could have a negative impact on demand for real estate.

2. Agreements to stimulate trade and investment

While the outlook appears favorable due to the recovery of the oil sector and the acceleration of non-hydrocarbon activity, the UAE needs to embark on a new phase of economic development and ensure more sustainable growth in the medium to long term. The UAE authorities have decided to implement reforms to improve the business climate and to conclude agreements with other countries. The underlying objective is to create and/or deepen ties with other countries, particularly economies with high growth rates, and thus attract inflows of foreign investment.

Indonesia

On November 20, 2021, the UAE and Indonesia signed free trade agreements worth USD 10 billion. The agreement covers many sectors: energy, aviation, financial services, artificial intelligence, agriculture, and defense. Thanks to this agreement, the United Arab Emirates will be able to diversify its trade links and, above all, benefit from better access to the Indonesian market of more than 270 million people. This agreement would therefore offer new opportunities, particularly for exports, and is in line with the authorities’ goal of creating nearly 1 million jobs.

Dubai Ports World has signed a $7.5 billion agreement with the Indonesian sovereign wealth fund to develop the Southeast Asian country’s seaports over a period of up to 30 years. Etihad Credit Insurance(the United Arab Emirates’ federal export credit agency) has signed an agreement with the public reinsurance provider Indonesia Re to improve access to financing for small and medium-sized enterprises and mid-sized companies in order to boost exports.

At this stage, Indonesia’s main exports to the United Arab Emirates are palm oil, jewelry, and precious metals, while Emirati exports to Indonesia are mainly petroleum gases and non-crude oils, iron, and steel. Bilateral trade between the UAE and Indonesia reached approximately $2.5 billion in 2020, and the goal is to double or even triple trade between the two countries by 2025. According to estimates by the UAE Ministry of State for Foreign Trade, this free trade agreement could generate an additional $4.6 billion by 2030. Export revenues would increase by $3.2 billion, while imports would increase by $2.6 billion by 2030.

India

In February 2022, the United Arab Emirates signed a Comprehensive Economic Partnership Agreement (CEPA) with India to reduce tariffs on nearly 90% of traded goods, a measure that is expected to double non-oil trade to at least $100 billion over the next five years, up from nearly $43.3 billion currently. The UAE aims to gain market access for a greater volume of domestic products (petrochemicals, steel, aluminum) and to make it easier for exporting SMEs to access the Indian market. At this stage, the United Arab Emirates is India’s third largest trading partner globally, after the United States and China, and nearly two-thirds of exported goods are raw materials (mainly petroleum products, precious metals, and minerals).

China

As a reminder, in July 2019, the United Arab Emirates and China signed 16 memoranda of understanding in the field of energy and to stimulate investment ties. The agreements also cover defense and military cooperation between the two countries, nuclear energy, environmental protection and conservation, scientific and technological cooperation, with a focus on artificial intelligence, food security, and agriculture. Among the main agreements signed was one between Dubai-based Emaar (a construction company) and Beijing Daxing International Airport for an $11 billion project at the airport.

In November 2021, the UAE announced its intention to sign a contract with China National Aero-Technology Import and Export Corp for the purchase of 12 L-15s, with the aim of strengthening its defenses.

Iran

The United Arab Emirates ranked second among Iran’s trading partners in 2021 (up from third place the previous year, after China and Iraq).

The UAE’s significant economic interests in Iran are justified by the fact that the UAE is by far the largest exporter of non-oil products to Iran, accounting for 68% of Iranian imports. Exports from the UAE represent $7 billion worth of goods (although this figure is likely underestimated, as many exporters refrain from declaring their goods due to the risk of sanctions).

On the Iranian side, Iranian exports to the UAE reached $4.62 billion last year (March 2020-21), an increase of 6.5% over the previous year. Exports to the UAE account for 13.4% of Iran’s total exports.

Israel

Nearly two years ago, the UAE officially ended its nearly half-century boycott and became the first Arab country to sign a free trade agreement with Israel. The agreement is estimated to increase trade between the two countries to more than $10 billion within five years.

In 2021, this trade generated USD 1.2 billion, according to Israel’s Central Bureau of Statistics. Israel had been seeking to enter the Gulf market for years, and there is no better opportunity than being backed by UAE credit insurance to obtain loan guarantees, and sometimes direct financing to foreign buyers, and facilitate the export and supply of goods or national contractors. In December 2020, Etihad Credit Insurance and the Israel Foreign Trade Risks Insurance Corporation signed a cooperation agreement aimed at supporting exports, trade, and investment between the two countries.

In terms of tourism, a historic agreement was signed in February 2022 related to the opening of a daily direct route between Tel Aviv and Dubai.

Adapting its strategy to remain a key regional and even international player

The hydrocarbon sector will remain a key pillar of economic activity in the United Arab Emirates in the coming years. Abu Dhabi has announced that it will increase its investments in this sector. The financial windfall from hydrocarbon revenues gives the UAE the means to pursue its ambitions for a transition to a more diversified economy focused on cutting-edge technologies and services. The recent signing of trade and financial agreements seems to be in line with this objective, offering new opportunities for the UAE. The stakes are high in terms of competing with growing competition from neighboring Saudi Arabia and thus maintaining significant regional influence, but also strengthening its international appeal.

[1]Supply in Abu Dhabi remains limited, with Al Raha Beach, Al Maryah and Reem Islands accounting for 71.1% of planned deliveries (REIDIN data). During the same period, average prices in Dubai rose by +11.3%. The total value of sales in Dubai’s residential market increased by 83.4% in March 2022 compared to the previous year (Dubai Land Department).

[2]The countries of the Gulf Cooperation Council, of which the UAE is a member, base their decisions to raise or lower interest rates on those of the Federal Reserve in the United States, a policy that helps anchor their currencies to the USD. The UAE Central Bank has therefore raised its rates by +225 bps since the beginning of 2022.

[3]Raising the ceilings on foreign investor participation in the private sector (up to 100% in several sectors outside free zones), creating special 5- to 10-year visas to attract high-potential profiles (scientists, entrepreneurs, investors), etc.