Summary:

- Geopolitical tensions between Taiwan and China peaked in 2022 with the visit of Nancy Pelosi, Speaker of the US House of Representatives, to the island in August.

- Taiwan has a virtual technological monopoly on a component found in almost every sector: semiconductors.

- However, a semiconductor shortage already occurred in 2021 due to the Covid crisis, illustrating the dependence of certain sectors on these strategic electronic components.

To counter this dependence, the United States and Europe are embarking on a process of reindustrialization for these components, but are lagging far behind in terms of truly competing with Taiwan.- Consequently, it is likely that in the short term, for example in the event of renewed geopolitical tensions or a new resurgence of the epidemic, this situation will increase production costs, particularly for the most exposed sectors.

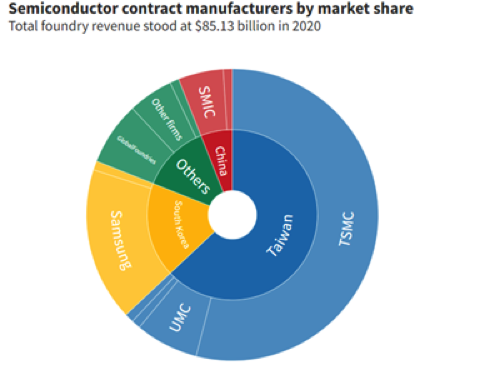

Semiconductor materials, which are ubiquitous in all sectors (health, transportation, energy, automotive, etc.), enable computers to perform fundamental logical calculations between different electronic components (e.g., microprocessors, analog circuits, microcontrollers, diodes, transistors, sensors). These materials are at the heart of the Taiwanese economy, which has a very large share of the global market for these components, 60% in 2020.

Beyond the industrial issues alone, there are also links with China, which considers Taiwan to be an inherent and integral part of a united China—the One China policy. Given the prevalence of these components, particularly in Europe, it seems legitimate to question the degree of dependence of the European economy on semiconductors on the one hand, and on the other hand to assess what the consequences for Europe might be if tensions in Taiwan were to rise again.

1. A quasi-monopoly exacerbated by renewed tensions in the region

In early August, the visit of the Speaker of the House of Representatives, the first American dignitary of this level to visit the « rebel » island since 1997, drew Beijing’s wrath, as the visit ran counter to the One China policy, according to which Taiwan belongs to China. The visit led to the largest military operations ever seen around the island and demonstrated that Xi Jinping’s China could potentially invade Taiwan or at least impose a blockade. This scenario could have a major impact on the global economy, given its dependence on Taiwanese semiconductors.

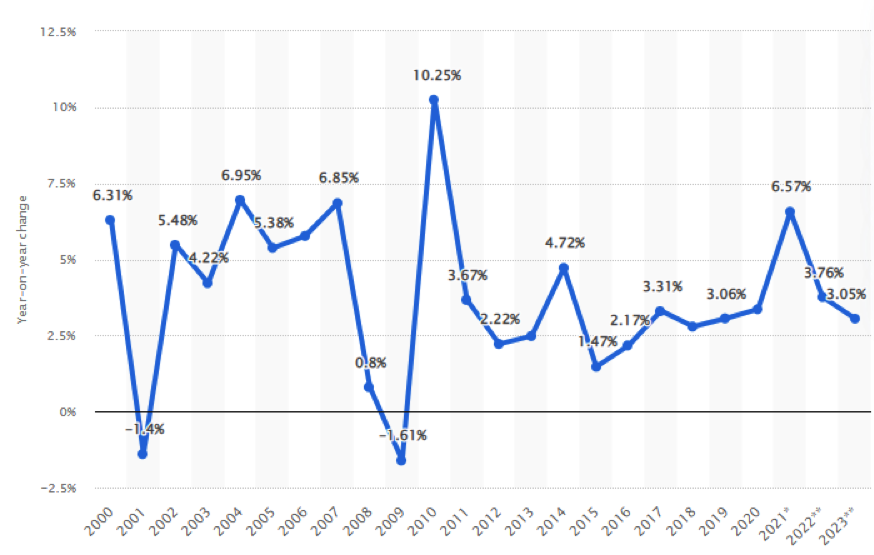

Taiwan has a particularly dynamic economy based on information and communication technologies (ICT) and high technology. In 2021, its growth reached 6.6%, boosted by its largely positive trade balance and the numerous foreign investments generated by the digitalization of economies during the pandemic. Figure 1 below shows the growth of the Taiwanese economy over the last two decades (with average growth of around 4%) and its resilience to crises, except in 2001 during the technology sector crisis.

Figure 1 – Growth of the Taiwanese economy since 2000

Source: Statista, BSI Economics

Taiwan’s industry accounts for more than 25% of its GDP, with the semiconductor sector alone accounting for more than half of that. In addition, the island produces nearly 60% of the world’s semiconductors and manufactures 85% of the latest generation of semiconductors smaller than 7 nanometers (nm), see Chart 2 below. The Taiwanese company TSMC, which alone accounts for more than 50% of global production, is a good example of this technological monopoly. For this reason, any deterioration in relations between Taiwan and China could have serious economic consequences.

Figure 1 – Market share of companies and countries in terms of semiconductors

Source: Trendforce, BSI Economics

2. The 2021 shortage

In 2021, after a year marked by the Covid-19 crisis in 2020, the world experienced a semiconductor shortage due to very high demand for electronic devices (e.g., phones, PCs, screens) and supply chain disruptions caused by lockdowns. According to a European Commission survey of businesses[1],on average, suppliers were only able to produce components 22 weeks after an order was placed, compared to 12 weeks in normal times.

In addition, shortages of other raw materials (chemicals, plastics, metals, wood) and delivery disruptions exacerbated the situation, creating multiple supply chain disruptions in European companies, particularly in Germany. Twenty-three percent of companies in the eurozone reported shortages of equipment and/or materials limiting their production, compared to an average of 6%.

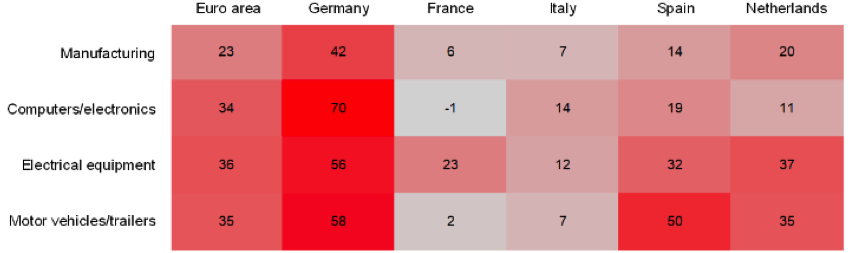

Table 1: Shortages of materials and/or equipment limiting production, as a percentage of companies by industry in the euro area. The time series are seasonally adjusted, which explains the negative values.

Source: ECB, European Commission Business Survey, April 2021, BSI Economics

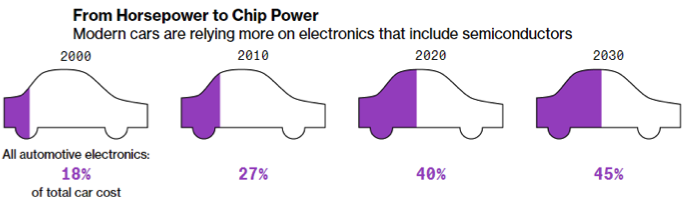

The motor vehicle industry appears to have been the most affected by microchip shortages (see Table 1). According to national accounts, it suffered a 14% drop in production in the eurozone between Q1 2021 and Q4 2020, particularly in Italy (-27%), Germany (-19%) and Spain (-13%). However, while there was initially no obvious effect of the semiconductor shortage on the rise in prices of electronic devices and cars in Europe, the duration of the shortage and the decline in inventories contributed to widespread price increases. This scenario is considered plausible in the event of a Chinese blockade or embargo on Taiwan. This is particularly true given that the use of these components in the automotive sector is expected to increase between now and 2030, regardless of vehicle production (see Figure 2).

Figure 2 – Presence of semiconductors in automobiles. Estimates from April 2019.

Sources: Bloomberg, Deloitte Analysis and IHS, BSI Economics

3. What would be the consequences of a blockade on the global economy?

3.1 Blockade and likely consequences for the European economy

A blockade of the island by the People’s Republic of China could have profound consequences for the Taiwanese economy, which is highly dependent on China in terms of both exports (42% of the island’s total) and imports (22%), as well as for the global economy. According to the Financial Times, the US military even considers it plausible that China could invade Taiwan before 2024, a much closer horizon than initially envisaged (2027). While there are alternatives for China to source supplies elsewhere, particularly locally orin South Korea and Singapore, Taiwan remains by far the leading supplier of semiconductors to China to date.

The Financial Times andthe Japan Times report that a prolonged embargo on Taiwan would jeopardize global supply chains for technology industries, at an estimated cost of more than 1% of GDP, not counting the interdependencies between the two Asian countries. In addition to the island’s export stoppage, nearly half of the world’s container ships pass through the Taiwan Strait. Closing it would have consequences for the European economy that are incomparable to the recent disruptions in logistics chains.

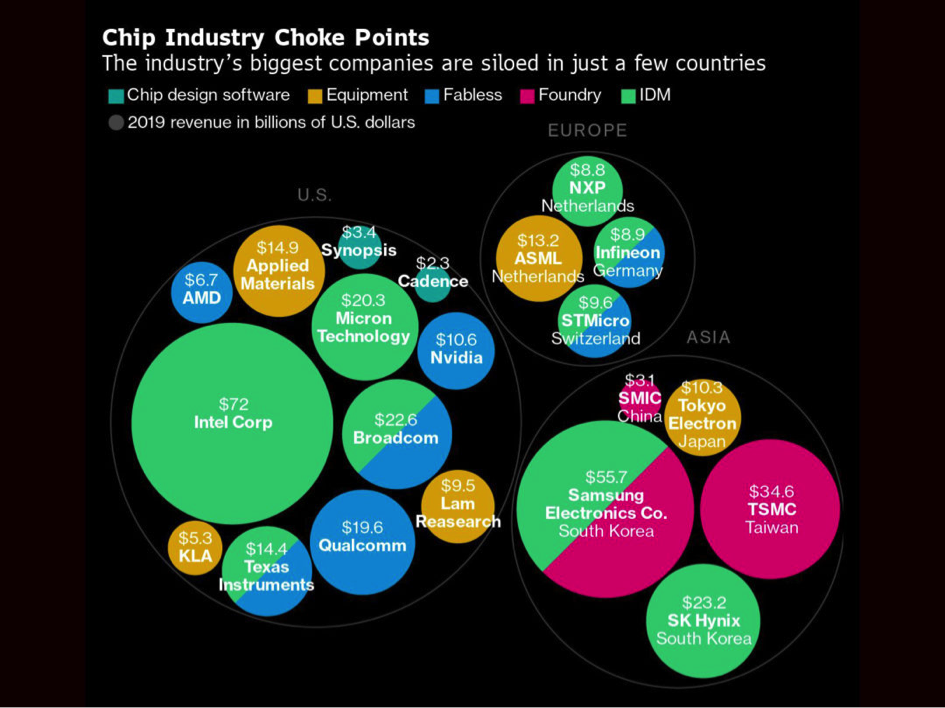

Finally, as shown in the figure below, while semiconductors are used in most sectors, only a small number of companies distribute them. This concentration would lead to sharp price increases, with semiconductor inflation exceeding 8% in one year in July 2022, according to the US Bureau of Labor Statistics.

Source: Supply Chain Brain, BSI Economics

3.2 The beginning of (re)industrialization

To overcome this dependence, on February 8, 2022, the European Commission presented the « Chips Act, » a legislative package on semiconductors that would enable Europe to double its market share by 2030 to reach 20%[2]. To achieve this goal, the European Union will mobilize €43 billion in both public and private investment. This plan, initially targeted at SMEs and start-ups, will focus on the transport sector, but also on next-generation technologies and digital sobriety. However, it still needs to be finalized by the Member States and integrated into existing R&D programs such as Horizon Europe andthe Digital Europe program.

Across the Atlantic, after several years of hesitation, the US Congress also voted for a $52 billion package to improve the competitiveness of this sector in the United States[3] with no defined time frame, out of a total budget of $280 billion for innovation and R&D as a whole. The US market share has fallen from 37% in the 1990s to 12% today. These are subsidies for the construction of new factories on US soil. For example, Intel has already announced two factories in Arizona and two more in Ohio, while TSMC and Samsung have announced factories in Arizona and Texas respectively to complete the package. This is another direct consequence of the renewed tensions in the region: an expected reindustrialization of Europe and the United States by 2030.

Conclusion

Ultimately, renewed tensions over Taiwan would be highly detrimental to all economies, and there appears to be an urgent need to reduce industry’s dependence on Taiwanese semiconductors. However, this trend is likely to continue until at least 2030 and, paradoxically, would primarily affect China, given both the interdependence between the two countries (42% of Taiwan’s exports go to China) and the expected delays in industrialization in this sector in the EU and the United States. TSMC (Taiwan Semiconductor Manufacturing Company) operates the world’s largest silicon wafer factories and produces some of the most advanced chips used in everything from smartphones to cars to missiles. Mark Liu, TSMC’s chairman, has announced that in the event of a Chinese invasion of its factories, 90% of which are located in Taiwan, the group would render its industrial facilities « inoperable » rather than leave them in Chinese hands.

Sources: