On December 5, 2014, Standard & Poor’s decided to downgrade Italy’s sovereign rating to BBB- with a stable outlook.

Although Italy is expected to emerge from recession in 2015 (+0.2%) after three consecutive years of GDP contraction, the recovery will be very weak due to the absence of inflation and risks weighing on growth drivers: i) the business environment is holding back private investment, ii) private consumption is sluggish against a backdrop of historically high unemployment (12.6% of the working population in 2014), iii) foreign trade is making a weak contribution given the deflationary pressures threatening Europe. S&P has therefore revised its projections for average real growth between 2014 and 2017 to +0.5% per year, down from 1% previously. However, it is the outlook for nominal growth, taking inflation into account, that is particularly worrying in the scenario adopted by S&P (1.2% per year, down from 1.9% previously), which will automatically slow down debt reduction (130% of GDP according to the agency) and reduce government budget revenues.

Furthermore, this revision of the growth outlook is impacting the trajectory of Italian public debt, with S&P estimating that it will reach 133% of GDP in 2017, a level €80 billion (nearly 5% of GDP) higher than the latest projections from June 2014. The agency also questions the government’s ability to reduce public spending, which limits its budgetary room for maneuver to reduce taxation in the country.

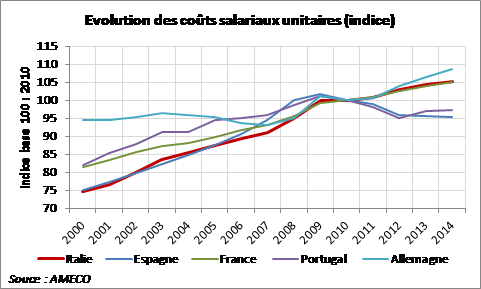

Finally, S&P highlights the deterioration in the cost competitiveness of the Italian economy. While the agency welcomes the labor market reform (Jobs Act, passed in broad terms in October 2014) as a means of stimulating the creation of stable jobs, particularly among young people, its effects will only be visible in the medium term. In fact, S&P is calling for further reforms to restore competitiveness: reviewing the level of labor taxes, decentralizing wage negotiations in order to link wage growth to productivity growth, and reforming the services market and the judicial system.

However, some indicators remain positive and justify the stable outlook accompanying the rating. The substantial external adjustment achieved in recent years, with imports falling sharply (driven by the decline in household consumption in recent years in line with a gradual decline in gross disposable income), has enabled Italy to post a current account surplus (a first since it joined the eurozone). In addition, the reforms implemented under the previous Monti government and continued by Renzi’s government should have a medium-term impact on Italy’s growth potential.

Overall, in a particularly difficult economic environment, only the government’s reform efforts are enabling Italy to maintain an « investment grade » rating, just one notch above the threshold.

Given the amount of liquidity available on the markets and the prospect of massive sovereign debt purchases by the ECB, we do not expect to see significant pressure on Italian sovereign bond yields. However, while the stable outlook implies that the rating will remain at BBB-, any deterioration in the economic environment and slowdown in the pace of reforms could prompt the agency to downgrade Italy to speculative grade. In this case, many institutional investors (particularly insurers and banks), which remain the main holders of sovereign debt, would be forced to sell part of their Italian sovereign assets for regulatory reasons. This is because, on the one hand, certain investors cannot hold bonds that are not rated « investment grade » and, on the other hand, the probability of default associated with a speculative-grade security requires a strengthening of capital to meet solvency requirements.

The Italian Treasury should therefore continue to enjoy historically low rates (1.96% for the 10-year rate on December 9, 2014) as long as Italy’s rating remains in the « investment grade » category. However, this artifice created by the ECB’s liquidity does not correspond to economic reality.