Abstract:

- While economic activity is expected to rebound in China in 2023 (nearly +4.8% after an estimated +3.2% in 2022 according to the December 2022 Bloomberg Consensus), several downside risks surround GDP growth forecasts. The Chinese economy is expected to face four major challenges in 2023.

- Despite the announcement that the « zero Covid » strategy is being abandoned, the new wave of infections poses a real threat and is likely to delay the recovery in private consumption.

- The real estate crisis, which erupted in late 2021, intensified in 2022. By weakening several major economic players (real estate developers, but also banks and local governments), this real estate crisis is expected to continue to weigh on activity in 2023.

- After significant public support in 2022, further measures are expected in the first half of 2023. However, the fiscal and monetary authorities’ room for maneuver does not appear to be as wide as it seems.

- While local uncertainties raise questions about China’s growth figures, the international context is hardly more favorable and could result in a sharp slowdown in external demand.

In China, economic activity was rather disappointing in 2022. In a rather unusual move, the GDP growth target of +5.5% announced by the authorities in March 2022 was ultimately not achieved; growth was close to +3% for 2022, according to the main forecasting institutes, and the World Bank even predicted +2.7%[1]. Health management and the relentless pace of lockdowns weighed heavily on activity, particularly on domestic demand.

In November and December 2022, the authorities finally opted to shift their « zero Covid » strategy, which in principle should promote an economic recovery in 2023. A rebound in activity in the world’s second-largest economy is therefore anticipated for 2023 (real GDP growth of between +4.3% and +5.2% according to forecasters), but many doubts remain. The Chinese economy is likely to face several challenges, and downside risks weigh on the short-term outlook: (i) the health threat, (ii) a deep real estate crisis, (iii) the limits of proven economic policies, and (iv) a delicate international context.

This first article focuses on the first two challenges. It will be followed by a second article that will address the other two challenges facing the Chinese economy.

Challenge1: The health threat

What is the situation?

Concerns focus on the vulnerability of China’s healthcare system and its economic repercussions.

Regardless of how effective the Chinese vaccine is in combating the epidemic, administering a new dose to the most vulnerable people[2] is a key concern for the Chinese authorities this winter. This is all the more necessary following the announcement of less restrictive measures[3] to deal with the rise in infections.

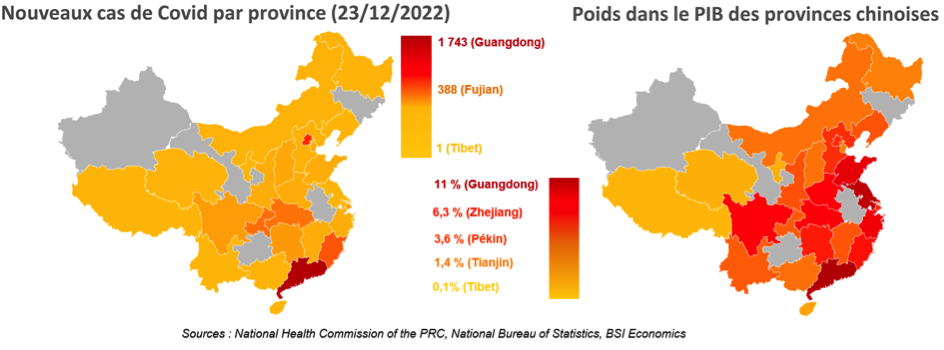

Since the end of December 2022, local authorities have stopped reporting new cases of Covid-19, even though the number of new cases exploded[4] at the end of the year. As of December 23, 2022, almost the entire Chinese territory was affected by this new wave (see map on the left below). The six provinces most affected by the new wave of cases[5] account for nearly 30% of GDP. Taking into account all provinces that had recorded at least one case by that date, 90% of China’s GDP could be directly threatened by various slowdowns linked to the epidemic in 2023 (see map on the right below).

Why is this important?

The rollout of easing measures would only be very gradual during the first quarter of 2023. Given the relatively more diffuse effects of health measures on private consumption (38.5% of GDP) over time, a significant rebound in the latter would not occur before the second quarter in the best-case scenario. In an extreme scenario requiring the reintroduction of more restrictive measures, the slowdown in activity in the first half of 2023 would be more pronounced.

Beyond the negative repercussions of a decline in demand on supply, maintaining a stable health situation remains necessary to ensure the continued strength of industrial production, which was a major driver of activity in 2022 before declining at the end of the year. The effects on the labor market, where figures are deteriorating, would also be negative and would fuel wait-and-see attitudes among households, leading to an increase in precautionary savings, to the detriment of the recovery in private consumption.

Depending on the severity of the health situation, new measures to support economic activity would be necessary (see Challenge3 ), even though 2022 showed that the measures ultimately have very little impact on private consumption[9].

While the international context in 2023 looks particularly unfavorable in developed countries (see Challenge4 ), a downward revision of Chinese growth would cast a further shadow over the global outlook. The impact on global supply chains would most likely be significant[10]. One of the few positive aspects of slower Chinese growth in 2023 would be raw materials, whose prices could fall in such a context[11].

What indicators should be monitored?

- The vaccination rate of the population (if data becomes available again) to estimate the authorities’ ability to respond in order to reduce the health risk and formalize the effective easing of health restrictions.

- Daily/weekly indicators of public transport and road traffic usage, to see whether the easing of measures is indeed leading to greater mobility.

- Retail sales during the Chinese New Year and the holidays from January 21 to 27 (public holidays in China that cause a spike in consumption and travel to visit relatives) to see if recent measures are having an effect on consumption.

- Monthly indicators for industrial production, to see whether the rise in Covid cases is affecting the activity rate or worker attendance at factories.

- Indicators relating to delays, whether in deliveries or docking times at the country’s main ports, to gain an overview of the impact on supply chains.

Challenge #2: A deep real estate crisis

What is the situation?

The Chinese real estate sector, which accounts for nearly a quarter of GDP, has been in deep crisis since the end of 2021. There are many reasons for its decline: a decline in demand, whether structural (demographic shift, slowdown in urbanization) or cyclical (since 2020 with Covid-19); tighter regulations to control real estate debt since 2016 and especially 2020; and the deterioration of the financial situation of real estate developers.

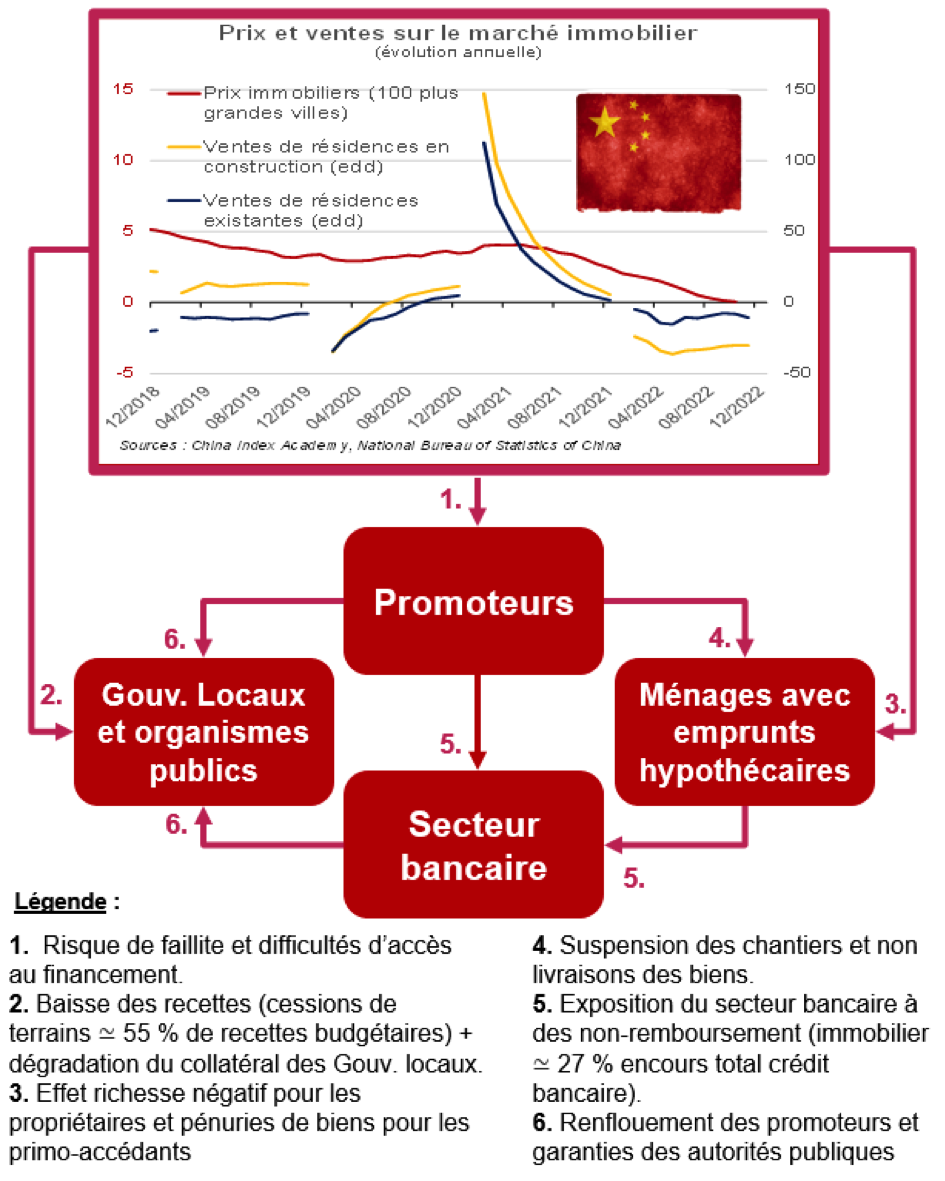

This context led to a sharp slowdown in prices, followed by a decline at the end of 2022 and a contraction in sales (see chart below), which had repercussions on developers[12], who are heavily indebted and are finding it very difficult to meet their commitments. In 2022, despite financial support from the authorities amounting to 1% of GDP, 40% of developers defaulted on their offshore debt, according to Bloomberg. The deterioration in their financial situation had several effects: contagion to all real estate players, asset disposals by major developers to raise the cash needed to meet their commitments, and a freeze on new construction starts.

The support measures[13] observed in 2022 will be extended or even strengthened in 2023. These measures would promote a potential recovery in the real estate market in the second half of the year, with an acceleration in construction starts. However, this scenario remains highly uncertain, as the restructuring of major players (Evergrande, Kaisa, Sunac) seems increasingly likely and would have repercussions on the completion of several construction projects. Nevertheless, a very moderate rebound in prices could be seen in the second half of 2023, given the scarcity of housing supply (due to the high number of construction starts frozen since 2022). On the housing demand side, mortgage rates will be lowered for first-time buyers in2023; however, a sharp recovery in consumer confidence would be needed to hope for a sustained recovery in demand.

Why is this important?

The impact of the real estate sector is not limited to property developers, but also extends to households, banks, and local governments. While at this stage a systemic crisis seems to have been averted by the intervention of the authorities, this real estate crisis tends to reveal or increase the fragility of local players. All of these impacts and interactions between players linked to the real estate crisis are shown in the diagram below:

Summary diagram of the transmission channels of the real estate crisis

Which indicators should be monitored?

- Indicators related to the real estate market (prices and sales—new and second-hand, and according to city size—real estate investment) to observe a potential turning point in 2023, which would likely mark the beginning of a recovery phase for the sector.

- Announcements regarding a potential relaxation of the famous « Three Red Lines » rules[14], which would be a positive signal for developers, who would then benefit from higher margins, at least in the first half of 2023, to meet their regulatory targets, particularly in the context of restructuring.

- A potential restructuring agreement between Evergrande and its creditors by the end of February 2023. Whether or not an agreement is signed and the terms of the restructuring will have a significant impact on i) the conditions of access to financing for real estate developers and the involvement of public authorities in bailing out public developers ii) the ability of developers to complete the construction of prepaid properties.

- Banks’ non-performing loan ratios (both for developer loans and for households, some of which refuse to repay their bank loans if the homes they have purchased in advance are not delivered), to assess the impact on their solvency.

- Changes in the 5-year Loan Prime Rate, the benchmark interest rate for mortgages, to assess the degree of willingness of monetary authorities to activate the credit channel to support the real estate market.

- The amount of transfers from the central government to local governments to offset the fall in their revenues linked to the market downturn.

Note completed on January 10, 2023.

[1]Forecast dated December 20, 2022. A figure of +2.8% would imply either a slight decline in activity in the last quarter (quarter-on-quarter) or at least a downward revision of the estimated figures for the third quarter.

[2]According to the latest official data from December 14, 2022, only 69.8% of people over the age of 60 have received the equivalent of three doses of the vaccine, and this figure drops to 42.4% for those over 80.

[3]These include more targeted lockdowns in certain neighborhoods, requiring a negative test result to enter grocery stores, etc.

[5]Guangdong, Beijing, Fujian, Chongqing, Hubei, and Hunan.

[6]This could be considered in the event of an increase in the infection and/or mortality rate, but no official communication suggests such a reversal.

[7]For example, the youth unemployment rate reached 17.1% in November 2022, compared to 12.8% two years earlier.

[8]As a reminder, China’s savings rate is one of the highest in the world: 45.7% of GDP in 2021 according to the World Bank, compared with 28% on average worldwide and 22.7% in OECD (Organization for Economic Cooperation and Development) countries. This very high level of savings is often cited as a brake on the expansion of private consumption in China.

[9]Almost exclusively a reduction in VAT on vehicle purchases.

[10]Which saw a renewed rise in tensions in the last quarter of 2022 after nearly nine months of easing.

[11]China is indeed a « heavyweight » in terms of demand for raw materials. In 2021, China accounted for nearly 21% of global imports of agricultural raw materials, 32% for minerals and metals, and 16% for fuels, according to UNCTAD data.

[12]In this regard, a highly concise and comprehensive Treasury-Eco report providesinsight into recent developments in this sector, its many vulnerabilities, and how developers in China are financed and operate.

[13]Rescheduling of developers’ domestic debt, facilitation of mergers and acquisitions between developers, financial support for the most systemic developers, incentives for public actors to acquire land through auctions to facilitate their sales, etc.

[14]These measures are aimed in particular at regulating and limiting developers’ debt. On January 6, 2023, Beijing seemed willing to relax the debt ceiling, probably by excluding debts raised to acquire assets from the calculation of ratios or by granting grace periods to meet six-month debt targets.