Douglas W. Diamond, Philip H. Dybvig, and Ben Bernanke, 2022 Nobel Prize in Economics

The Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel, sometimes referred to as the « Nobel Prize in Economics, » was awarded on Monday, October 10, to Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig « for their research on banks and financial crises. »

These laureates have contributed to improving our understanding of the role of banks, their importance, and their vulnerabilities, particularly in the context of financial crises. Their work also addresses the regulation of the banking sector.

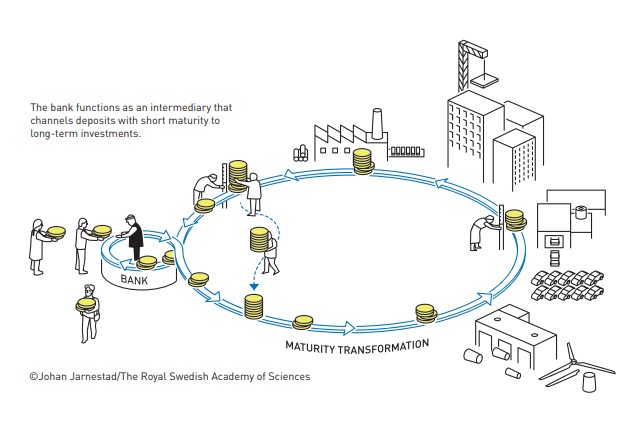

Douglas W. Diamond, 69, is a professor at the University of Chicago Booth School of Business. Philip H. Dybvig teaches at Washington University in St. Louis. Their landmark model, Bank Runs, Deposit Insurance, and Liquidity ( 1983), explains the role of maturity transformation banks: they collect savings from agents with financing capacity in order to grant medium- to long-term loans to finance investments.

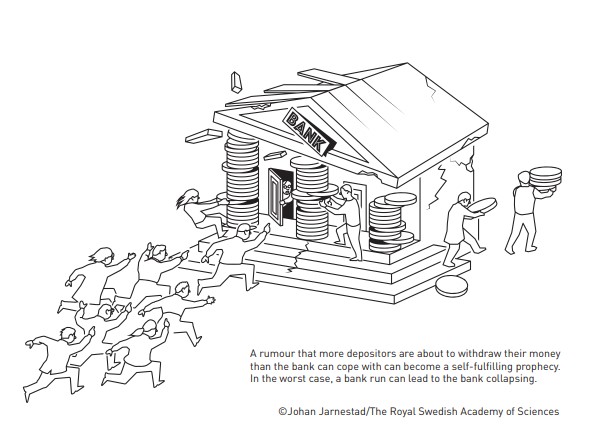

This raison d’être of banks allows for risk sharing between agents who wish to have access to their liquidity and invest at different maturities. However, it can be a source of fragility in the event of a financial crisis, particularly in the event of rumors of economic difficulties or a bank run at another bank, which can become self-fulfilling and generate a « run on the bank, » more commonly known as a « bank run. » . » This can create a chain reaction of liquidity and solvency crises in the banking sector. The authors recommend the implementation of deposit guarantee mechanisms. It should be noted that their article did not take money creation into account.

Ben Bernanke, former chairman of the US Federal Reserve (Fed) between 2006 and 2014, had precisely analyzed the importance of bank runs in the severity of the 1929 crisis, along with a loss of information on savers and the inability to quickly rebuild investment capacity for economic agents. Ben Bernanke is also being recognized for putting these lessons into practice in the monetary policy pursued by the FED during the 2008 crisis. He lowered interest rates to 0% and pursued a policy of quantitative easing, which at the time was criticized by some who feared the risks of inflation.