Summary

- The Turkish lira suffered a significant loss in value in early June. In light of certain comments, it would be tempting to see this as a sign of a new crisis stemming from recent election results. However, the explanation appears to be more subtle.

- The fall in the lira comes against a backdrop of the Turkish authorities easing exchange control measures. Probably artificially maintained at too high a level, given the country’s economic fundamentals, this decline would appear to be a corrective measure.

- The fall of the lira is also linked to the depletion of foreign exchange reserves, the result of several years of « unorthodox » monetary policy, and to increased external vulnerability in a context of high inflation.

- Signs of a change of course have been multiplying since early June. The next measures (particularly those concerning the conduct of monetary policy) will be closely scrutinized to assess whether or not Turkey is embarking on a path of profound macroeconomic rebalancing. In any case, the Turkish lira is likely to remain highly volatile and subject to downward pressure in the short term.

Between June 6 and June 13, 2023, the Turkish lira lost 9.1% of its value against the USD and 9.6% against the euro. This latest sharp fall in the Turkish currency is causing concern and provoking numerous reactions: it is seen as a consequence of the recent election results and/or a sign of a new economic crisis or, at the very least, a new currency crisis (as in 2018 and 2021).

However, it seems that this sudden movement in the lira is the result of a set of specific economic and financial mechanisms. Macroeconomic imbalances are undeniably deep in Turkey, but the recent fall in the lira does not seem to herald a new period of severe economic instability, as was the case in 2018-2019.

This note uses three graphs to review these factors in order to better understand and interpret the situation in Turkey and grasp the main issues at stake.

Fall of the lira: the central role of the relaxation of exchange control measures

For several months, the Turkish authorities, including the Central Bank (CBRT) and the regulator (BDDK), have stepped up measures to support the Turkish lira (TRY), which has been subject to high volatility. The aim was to prevent further depreciation of the TRY from fueling already high inflation, which could lead to a decline in private consumption and/or increase companies’ import bills. This objective seemed all the more necessary as it would support economic activity while fitting in with the electoral calendar (high-stakes legislative and presidential elections between May 14 and 28, 2023).

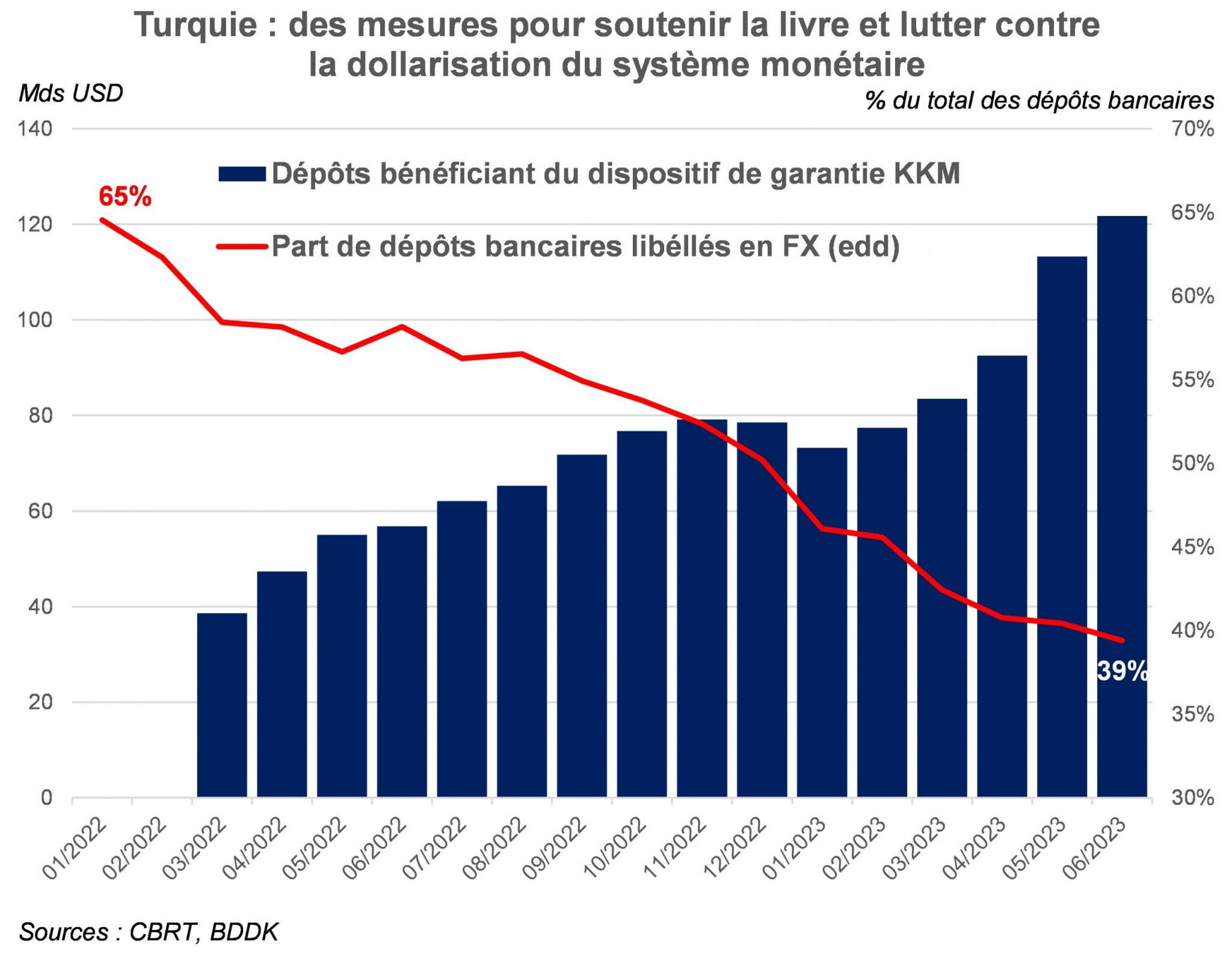

One of the most emblematic measures concerns the KKM guarantee system, introduced in March 2022 (see chart above). The aim of this system is to encourage depositors to convert their foreign currency (FX) deposits into Turkish lira (TRY) deposits, while benefiting from a public guarantee system that covers the exchange rate risk. By implementing this system, the authorities hoped to reverse the trend toward dollarization of deposits, a phenomenon that generally reflects increased mistrust of the domestic currency among depositors. Before the introduction of this mechanism, FX-denominated bank deposits peaked at 65% of total deposits. In early June 2023, thanks to successive measures taken by the authorities and depositors’ enthusiasm for the KKM guarantee (equivalent to USD 120 billion), the share of FX deposits fell sharply to 39% of total deposits.

The set of exchange control measures limited the loss in value of the TRY during the first few months of the year. From June 5, 2023, the authorities announced their intention to gradually relax these measures. It was following these announcements that the TRY fell sharply in June. Without these control measures, the depreciation of the TRY would have been more pronounced at the beginning of the year, and the TRY was therefore artificially trading at levels that were too high given its fundamentals[4]. The sharp depreciation in June came after the measures were relaxed and helped to correct this discrepancy.

Fall of the pound: inevitable given the depletion of foreign exchange reserves

After several months, even years, of « unorthodox » monetary policy to support economic growth through bank credit, at the cost of growing imbalances, the electoral calendar probably explains the timing of the relaxation of the measures mentioned above. However, this is not a sufficient explanation. This easing is also linked to the slowdown of a system that has accumulated multiple weaknesses.

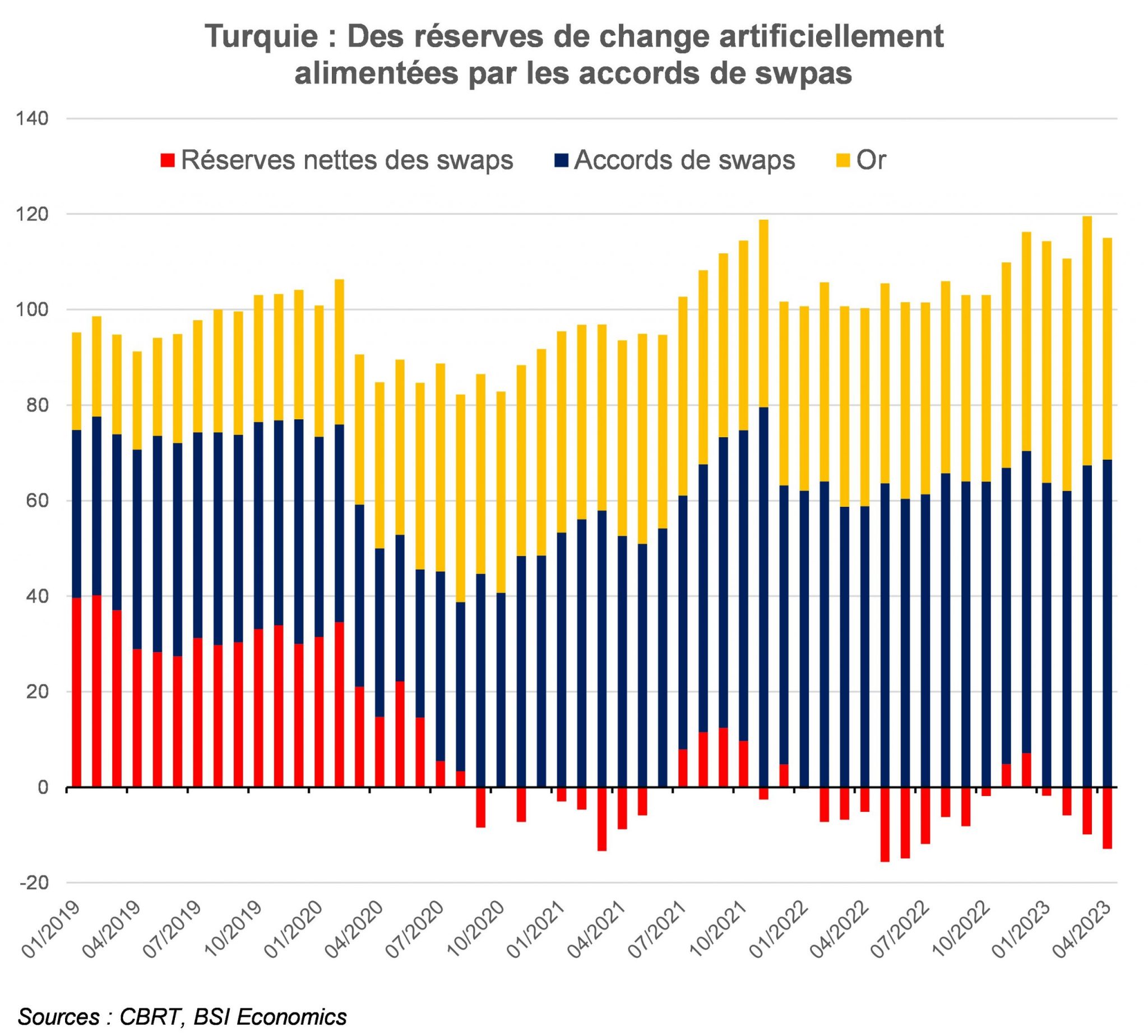

For many years, foreign exchange reserves have been under severe strain. They were divided by 1.6 between April 2023 and April 2015 (excluding gold reserves), both to support the TRY on the foreign exchange market and to sterilize theCBRT ‘s monetary interventions, especially since interest rates fell at the end of 2021 while inflation was skyrocketing.

The level of foreign exchange reserves is also artificially « boosted » by swap agreementsbetween the CBRT and Turkish commercial banks or with other central banks (Qatar, China, and the United Arab Emirates, for example, but not the United States). These agreements certainly enable the CBRT to build up foreign exchange reserves, but these reserves cannot necessarily be mobilized to intervene in the foreign exchange market. Once these amounts are deducted, it appears that net foreign exchange reserves would be negative in April 2023 or, in any case, close to zero (see chart above).

The timing may seem « political, » but it is above all « economic. » Running out of steam, the CBRT probably no longer has the means to draw on its last resources by « burning » its reserves. At the end of 2022, non-gold reserves covered only 56% of foreign currency debt maturing within one year. This is a very low ratio, which is worrying given Turkey’s tight refinancing conditions and deteriorating economic fundamentals.

Fall of the lira: tensions likely to persist, but increasingly strong signs of a change of course

In recent years, « unorthodox » monetary policy has certainly helped to meet some of the economic growth targets, but at the cost of the central bank’s independence. The resulting loss of credibility has been highly damaging, leading to uncontrolled inflation, capital outflows, and persistent pressure on the TRY. In June 2023, the appointment of a new finance minister and central bank governor, both figures known for their economic « rationality » or « orthodoxy,« sent a positive signal. Given the current slowdown in the Turkish economy, strengthening economic fundamentals and reducing imbalances could thus form the authorities’ new roadmap.

The first step will be to raise interest rates. This seems to be in line with the expectations of Turkish banks. The spread between the current rate on the Turkish interbank market for 3-month transactions and the reference rate in Turkey (the one-week repo) is generally used as a proxy. The wider this spread becomes: i) the more likely it is that the key rate will be raised in the short term, or ii) the more the credibility of the Central Bank is called into question, as the interest rate channel is not playing its role. The chart above shows that this spread (the area colored red on the chart) has been widening steadily since mid-2022. In the past, when this spread was similarly wide, the CBRT tended to raise its rates (within a period ranging from less than one month to six months).

Raising interest rates is one of the most eagerly awaited short-term measures to curb inflation on the one hand and hopefully bring about a recovery in real interest rates on the other (currently close to -30%). A return to positive real interest rates would make Turkey more attractive to foreign investors. Given Turkey’s substantial external financing needs (9.4% of GDP in 2023, 7% in 2024), the ability to achieve positive real rates to attract capital is a significant factor.

Positive signals but a long way to go before a sustained strengthening of the lira can be envisaged

Monetary policy decisions will be closely scrutinized in the coming months to see whether or not the authorities change course. Without concrete confirmation of the recent favorable signals, the lira would once again enter a period of severe turbulence. Otherwise, a gradual correction of imbalances would gradually ease pressure on the Turkish lira.

However, given the imbalances (highly negative real interest rates, refinancing risk on external debt, chronic current account deficit, deterioration in the public debt profile with numerous guarantees), it seems very optimistic to expect a recovery of the lira in the short term.

Furthermore, tighter financing conditions are likely to weigh on economic growth. In this context, vigilance will be required to monitor the potential repercussions of a rise in interest rates (corporate debt, the real estate market in particular, and the solvency of the banking system).

[1]With a spectacular fall in the currency of nearly 7% against the USD on Wednesday, June 7 alone.

[2]Regular interventions by the banking system in the foreign exchange market, increase in the foreign currency reserve requirement ratio, restriction or even prohibition of short selling, obligation for exporters to convert 40% of their FX earnings into TRY, lighter regulatory constraints for banks with a share of TRY deposits exceeding 60% of the total, etc.

[3]+49.3% on average over the January-May 2023 period on an annual basis.

[4]There are many reasons for this, which are discussed in other sections of the article: very high inflation, increasing external vulnerabilities, drying up of FX liquidity, etc.

[5]A classic method of currency support by the banking system, whereby funds released from the sale of FX-denominated assets are used to purchase assets denominated in the domestic currency, which automatically supports its exchange rate.

[6]Over the first five months of the year, sterilized amounts reached the equivalent of USD 4.8 billion, up +120% compared to the same period in 2022.

[7]This concept was discussed at length in a previous BSI Economics article by Floris Laly in 2019.

[8]In any case, it was perceived as such by the markets, as evidenced by the decline in the 5-year sovereign CDS premium of -168 bps between June1 and June 13, 2023.