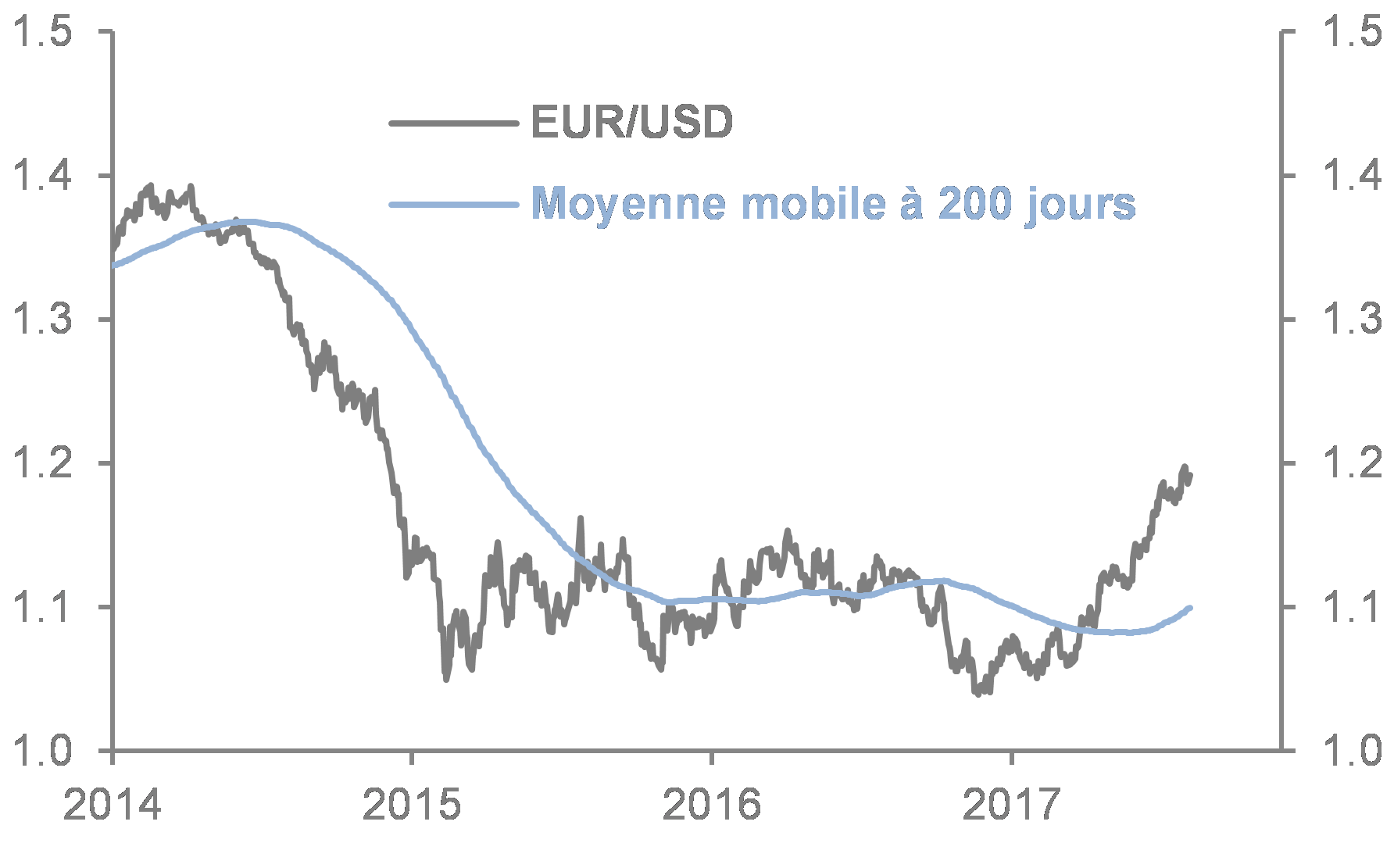

As of September1, 2017, the euro had appreciated by 12% against the U.S. dollar since April 2017.

According to estimates by the Kiel Institute, a 10% appreciation of the euro could affect economic activity and inflation in the eurozone by 0.2 points in the first year. This is an additional risk that would compound weak wage inflation and a slower transmission of the acceleration in activity to consumer price increases. As a result, the ECB could prolong its monetary easing by extending asset purchases from 3 to 6 months in 2018 and revising its inflation forecasts downwards by 0.1 percentage points for 2017.

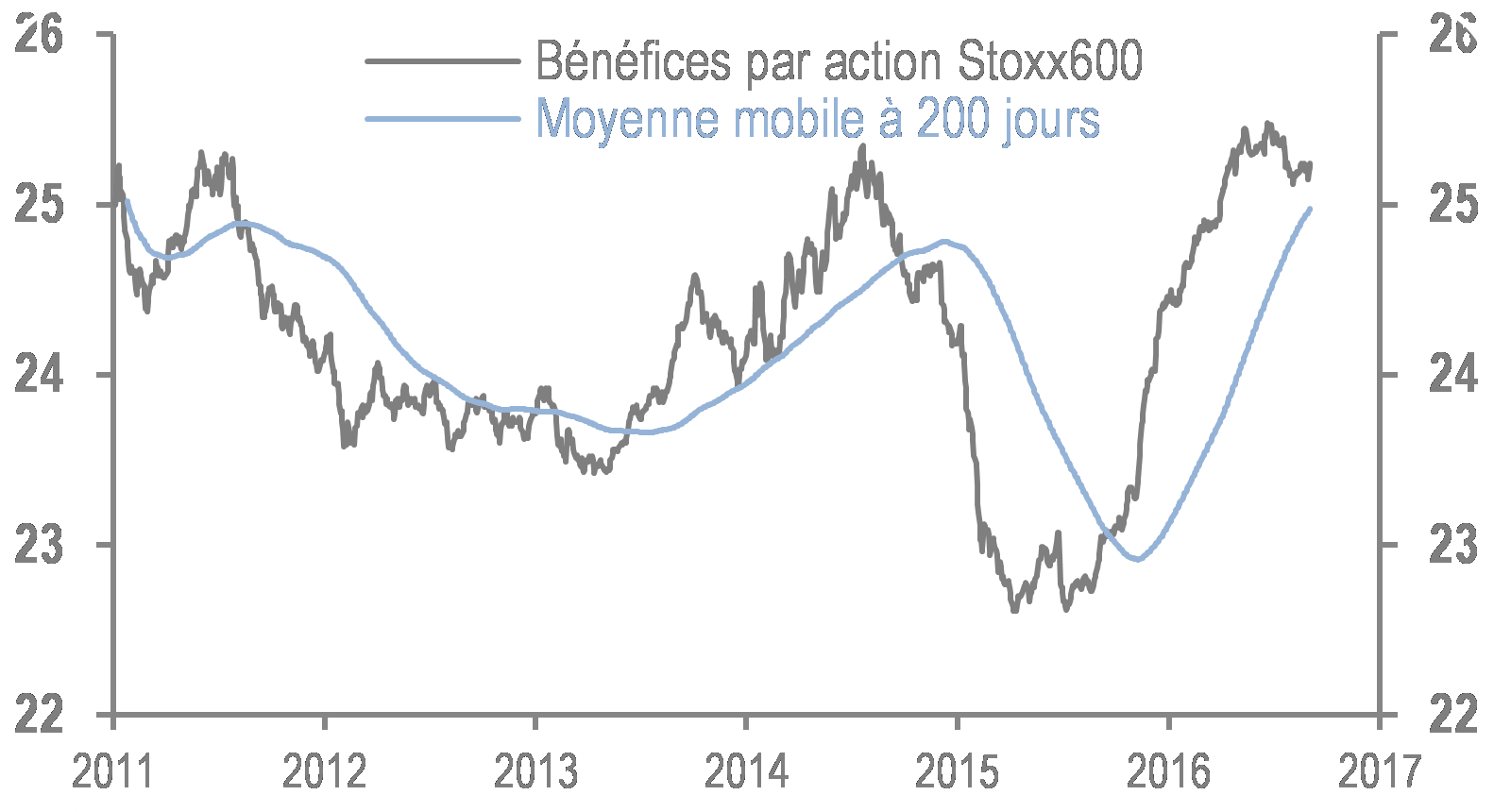

Asa second effect of the euro’s appreciation, earnings growth for companies in the Stoxx 600 index could be revised down by 2 points. Admittedly, earnings growth will remain strong in 2017 (14%) and 2018 (8%), while European market valuations are still lower than some expensive markets (price/earnings ratio for 2017 at 15.5), which would support buying flows on European markets. Nevertheless, a downward revision of earnings could accelerate certain tactical repositioning, particularly by investors who are currently overweight in European equities and who could reposition themselves to neutral. This would be a way to have cash available in case of positive surprises in the US, such as solutions to the debt ceiling and federal budget issues that would facilitate negotiations on the tax cuts expected since last November.

Nevertheless, the economic environment is favorable in the eurozone. Growth in the second quarter reached 0.6% and is expected to continue in the third quarter, with leading indicators supported by order books on the rise and confidence indices reaching historic highs since the last financial crisis. The institutional stability of the eurozone, facilitated by the recent French elections and measured by Franco-German relations, is reassuring investors. Finally, the latest advances in reforming the French labor market confirm the optimism, with more social dialogue and measures that support the activity of small and medium-sized enterprises.

On the French stock market, the CAC40 index is valued lower than the European Stoxx 600 index (P/E ratio of 14.7 vs. 15.5) due to less dynamic earnings growth (6.3% in 2017) but shows sustained dividend growth of 3.5% and sales growth prospects of 4.4% compared with 3.4% for the European average – resulting in the CAC 40 Index outperforming the Stoxx 600 Index by 1.1 points to 6.4% since the beginning of the year.

Sales in the French index are also more exposed to trade outside Europe, which accounts for 72% of sales compared with 47% for the Stoxx 600. Finally, sector exposure is divided between banking (11% of the CAC 40), industry (11%), energy (10%) and construction (9%), which—due to sector weighting—makes the French market less sensitive to a potential tightening of financial conditions than the Italian or Spanish markets, where banks account for 28% and 37% of the index, respectively, even though finance accounts for 26% of CAC 40 earnings.

In the first half of 2017, profits rose by 23%, revenue by 6.9%, the operating margin increased by 1.1 points year-on-year to 12.5%, and the debt-to-equity ratio fell from 25% to 24%. Overall, French companies’ profits reached €50 billion in the first half of 2017, compared with €75 billion for the whole of 2016, confirming the strong economic figures, continuing favorable financial conditions, and upward profit revisions despite the recent appreciation of the euro.