Summary:

– The absence of a new leader casts uncertainty over the post-Bouteflika era.

– Without a genuine competition policy and an industrial sector capable of meeting local demand, the country is struggling to combat inflationary pressures.

– Declining oil revenues and rising operating expenses are weighing on the budget balance.

Since 1999, President Abdelaziz Bouteflika has set out a roadmap: diversifying sources of revenue and developing the local economy. Three five-year plans [1] have been implemented, the latest of which is worth USD 286 billion [2], in order to upgrade the domestic economy.

Algeria is a rich country (with just over $200 billion in foreign exchange reserves and a state fund [3] containing $65 billion in excess hydrocarbon revenues), and thanks to these considerable resources, it has been able to prevent the emergence or formation of an « Algerian Spring » linked to living conditions (decline in purchasing power and difficulties in accessing housing).

In this contribution, we will discuss four types of risk: political risk, the credibility of monetary policy, fiscal policy, and the economy’s dependence on its trade balance.

The presidential coalition makes the political outlook uncertain.

Despite a high abstention rate (over 70% in Algiers), the two elections in 2012 were won by the presidential coalition composed of the historic National Liberation Front (FLN) and the National Democratic Rally (RND). The first, legislative, in May 2012, gave this coalition 198 seats out of a total of 388. The second, local, in November 2012, gave it just over 990 municipalities out of 1,541. Despite the coalition’s supremacy, uncertainty about the post-Bouteflika era has not been alleviated.

In May 2012, President Bouteflika indicated that his « generation was finished » and that the 2014 presidential election would mark the end of his third term. However, the proliferation of corruption scandals linked to the hydrocarbon sector and the resignation of several important political figures have made it difficult for a new Algerian leader to emerge. Although there is a risk of political instability in 2014, the likelihood of the military returning to power is virtually nil given the country’s history of reconstruction since the end of the Black Decade [4].

Nevertheless, this situation has a negative impact on the economic and social environment. The president no longer makes major economic decisions and leaves it to his prime minister to make repeated declarations of intent to combat the structural difficulties of the Algerian economy, such as the informal economy, which accounts for 45% of national income.

The government’s failure to act on governance issues is damaging the business climate, resulting in:

– a slowdown in foreign investment: Algeria attracted only $2.6 billion in 2011, compared with $2.8 billion in 2008.

– a negative impact on national industrial policy: uncertainty about possible changes in business regulations is preventing partnerships between local and international manufacturers from developing.

– Moreover, we can see that after making significant progress, the World Bank’s governance indicators for Algeria deteriorated slightly in 2011.

Sources: World Bank, Chemseddine KEDDI, BS Initiative.

Unemployment and inflation rates poorly controlled

Over the past 10 years, the unemployment rate has fallen significantly, from 29.5% in 2000 to 10% in 2011. Numerous programs to revive the economy have generated significant job creation in sectors such as construction. However, the unemployment rate has been stagnant for four years now and is becoming a concern among young people under the age of 30. According to the latest ILO figures from 2008, the unemployment rate among those under 30 stood at 37%, and according to figures from the National Statistics Office, the unemployment rate among those under 25 is 21.5%.

Inflationary pressures (consumption and public sector wage increases) have persisted despite the intervention of the Bank of Algeria in May 2012. Protectionist measures aimed at promoting local production have exacerbated price increases. Imports have certainly fallen, but domestic production is still unable to absorb a significant share of domestic demand.

The inflation rate therefore reached its highest level since 2000: 8.4% at the end of 2012. The situation is becoming worrying, and the Governor of the Bank of Algeria admitted at the beginning of 2013 that he was powerless to reduce it significantly.

Sources: IMF, Chemseddine KEDDI, BS Initiative.

A growing non-hydrocarbon deficit.

Revenues from hydrocarbons are « budgeted » according to a reference price that is well below the actual market price. This reference price is a 10-year moving average of the price per barrel and allows for budget management that is less dependent on hydrocarbons. Since 2007, the price used to establish the state budget has been USD 37 per barrel. The difference between the budgeted price and the actual price per barrel of crude oil is used to fund the Budget Revenue Regulation Fund (FRR) [7].

Despite the establishment of the FRR, hydrocarbon revenues still accounted for 70% of total revenues in 2011, compared with only 66% in 2010. To reduce this dependence, the country has undertaken numerous reforms since 1999 to increase the share of non-hydrocarbon revenues, which represent approximately 29% of total revenues on average. These measures include efforts to tackle the informal economy (45% of national income) and tax evasion. However, faced with high levels of spending and a deteriorating trade balance (falling hydrocarbon prices), the country experienced its first budget deficit in 2009: -5.4% of GDP.

Sources: Bank of Algeria, National websites, Chemseddine KEDDI, BS Initiative.

By increasing operating expenditures at the expense of investment expenditures, hydrocarbon revenues are no longer sufficient to cover all expenditures and thus avoid a fourth negative balance for 2012, estimated at -2.9% of GDP. Expenditures related to compensation and subsidies have tripled since 1999 and represent, on average, 30% of total expenditures.

A current account heavily dependent on the trade balance

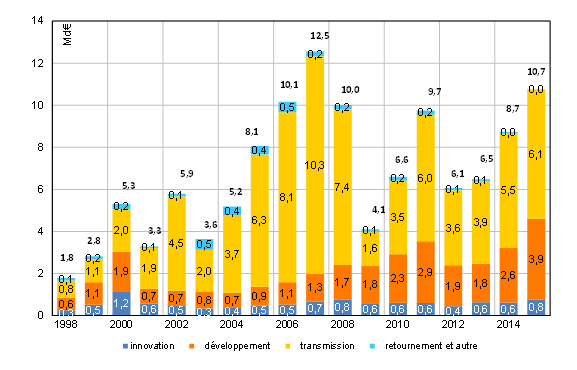

After reaching a record surplus in 2006, driven by a rise in oil prices, the current account fell to its lowest level in 2009: 0.3% of GDP. Algeria, a country dependent on its hydrocarbon export revenues, suffered from the bursting of the oil price bubble, which fell sharply to USD 60 per barrel in 2009.

Thanks to exports (which increased in 2011 after falling by half in 2009), Algeria managed to significantly improve its current account in 2011, which rose from $0.4 billion in 2009 to more than $18 billion in 2011. High oil and gas prices have helped to strengthen the balance of payments.

Sources: IMF, Bank of Algeria, Chemseddine KEDDI, BS Initiative.

Algeria does not yet have a diversified economy, with hydrocarbons accounting for more than 98% of exports. Its main trading partners are Europe and the United States. The latter are also the main customers for petroleum products and gas, which means that foreign income is linked to the economic performance of these two regions.

Algeria imports a lot of food products, capital goods, and machinery. In other words, despite a positive current account supported by a trade surplus, the country consumes and produces little or nothing, which explains the low share of non-hydrocarbon exports in value added.

Conclusion

The political status quo, which is preventing the emergence of a new Algerian leader and raising the possibility of a fourth term for the current president, does not give rise to fears of a political crisis in the short or medium term. However, if this uncertainty persists, it could threaten the confidence of both local and international investors, leading to a further deterioration in the business climate. This situation could have repercussions on the country’s economic fundamentals, which are currently solid.

Completed at the end of March 2013.

Notes:

[1] A five-year plan is a government planning document setting out objectives to be achieved over a five-year period.

[2] The first plan was for USD 6.9 billion and the second for USD 155 billion.

[3] Revenue Regulation Fund.

[4] Ten years of civil war that began in the early 1990s.

[5] According to the local press.

[6] The BoA undertook to reduce the liquidity in circulation through two measures concerning the withdrawal of liquidity and an increase in the reserve requirement ratio. The liquidity withdrawal, which was capped at EUR 10 billion, was increased to EUR 12.5 billion. The reserve requirement ratio was raised from 9% to 11%, which means that Algerian banks will have to deposit 11% of deposits from the private sector (households and businesses) with the Bank of Algeria.

[7] The total outstanding amount of the FRR is estimated at USD 65 billion.