The EONIA and EURIBOR indices are frequently discussed in economic and financial newspapers. What do they represent? What are the similarities and differences between these two indices?

Similarities:

EONIA and EURIBOR are two benchmark indices on the euro interbank market, i.e. the market where banks lend each other euro liquidity. More specifically, these indices relate to the market where banks lend to each other without underlying collateral (known as « unsecured » loans). The interest rates reported by these two indices are calculated based on a survey of banks that are representative of their activity in these markets in the euro area [1]. An average of the rates reported by these banks is then calculated to obtain the EONIA or EURIBOR.

Differences:

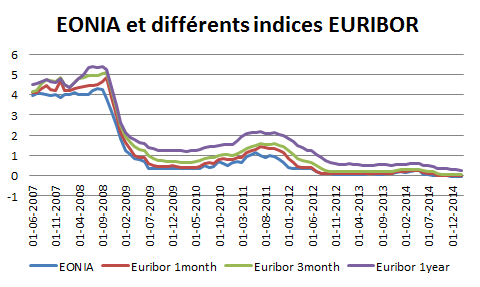

The main difference between these two indices is the maturity involved. EONIA only concerns the overnight loan market: the maturity is therefore one day. EURIBOR indices cover a range of longer maturities: from one week to one year. There are therefore 15 different EURIBOR rates.

Source: Macrobond, BSI Economics

Another difference is that the EONIA rate is calculated on the basis of actual rates: it is an average of the rates offered by the banks in the panel surveyed before the market closes, weighted by amount. For this reason, it is published at 6:30 p.m. each business day. The EURIBOR, on the other hand, is based on declarations. More specifically, each bank in the representative panel must answer the following question: « At what rate do you think a first-class bank would lend to another bank without collateral? » An average is calculated from the rates given by the banks, removing the 15% most extreme rates. The final rate obtained is considered the « best rate for the best banks, » which gives the EURIBOR its status as a « risk-free rate » in a normal context [2].

J.P.

Notes:

[1] The panel varies, currently comprising 25 banks for EURIBOR (see here).

[2] Since the crisis, perceptions have changed, given that even the largest banks, which are usually risk-free, have become riskier (see this document).

For further information:

European Banking Federation, Eonia joint statement

European Banking Federation, Euribor-EBF response to the European Commission Consultation Document on the Regulation of Indices

EBF to separate Euribor, Eonia rate fixing panels (May 2013)

Julien Pinter, Charles Boissel, The Eurozone deposit rates’ puzzle: Choosing the right benchmark, Economics Letters, Volume 148, November 2016, Pages 33-36. (http://www.sciencedirect.com/science/article/pii/S0165176516303536)