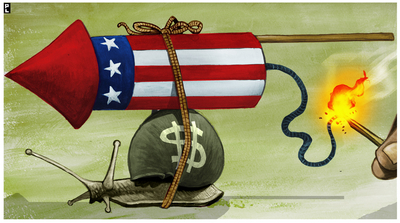

United States: Recession in 4D

The risk of recession in the United States can be anticipated in four ways:

· The slowdown in economic activity that precedes its contraction. Industrial activity indicators contracted in February: wholesale inventories fell by 0.5%, while industrial orders contracted by 1.7% and new orders for durable goods by 3%. The slowdown is also evident in final real private demand, estimated at 1.5% at the end of 2015, compared with 4% at the beginning of 2015. More recently, the Atlanta Fed revised its growth expectations for the first quarter of 2016 from 2.6% in mid-February to 0.1% in mid-April.

· The spread of this slowdown to the economy as a whole. The fall in energy prices has permanently reduced the profitability of the energy sector, whose production index has fallen by almost 10% year-on-year. The overall US industrial production index has fallen from 3.8% to -1.6%. However, this sector accounts for only 12% of value added. The more significant services sector is slowing down, but only relatively, as leading indicators of activity remain in expansion territory (ISM non-manufacturing at 54.5 and PMI services at 51.3), marking a divergence from leading indicators for industry. More broadly, the activity indices provided by the various central banks recovered in March (FED Philadelphia Activity Index from -3 to +12, FED Dallas Activity Index from -31 to -13, and FED Richmond Activity Index from -4 to +22).

· The significance of the decline in activity. A correction of more than 1.5% in employment, household spending, household income, production, and retail sales is historically a source of recession. Employment has been growing steadily since 2014, with payrolls up 2%. Real household spending remains strong (+2.8% year-on-year), as does income growth (+4%). Finally, while retail sales are up 1.7% year-on-year, only industrial production is down, at -1.6%.

· The duration of this decline. According to the NBER definition, a recession requires six months of economic contraction (two quarters). The third quarter of 2015 and the fourth quarter of 2015 posted real growth of 2% and 1.4% respectively. The Fed anticipates annual growth of 2.2% in 2016.