Summary:

– French government borrowing conditions are historically favorable, with a 10-year borrowing rate of around 1.2% at the beginning of September 2014

– Changes in interest rate spreads are being passed on to the rates charged on loans to non-financial corporations (NFCs), facilitating access to credit and benefiting the entire French productive sector

– Fears of a rise in sovereign rates pose a real risk to the investment capacity of NFCs

Interest rate spreads in the eurozone, i.e., the difference between sovereign rates (the spread between rates and the German bund), have become significant since the sovereign debt crisis in 2010. Since then, divergences have emerged between the financing rates of core countries ( Germany, France) and southern countries (Italy, Spain, Portugal, Greece) due to increased investor concerns about the level of public debt relative to the wealth of these countries. The crisis in Europe has led to a sharp rise in sovereign rates in southern countries, even though French rates have remained low despite an increase in the spread between German and French rates. But what could be the impact of a further tightening of spreads on the financing conditions of non-financial companies?

1 – A fall in lending rates eases financing conditions for non-financial corporations

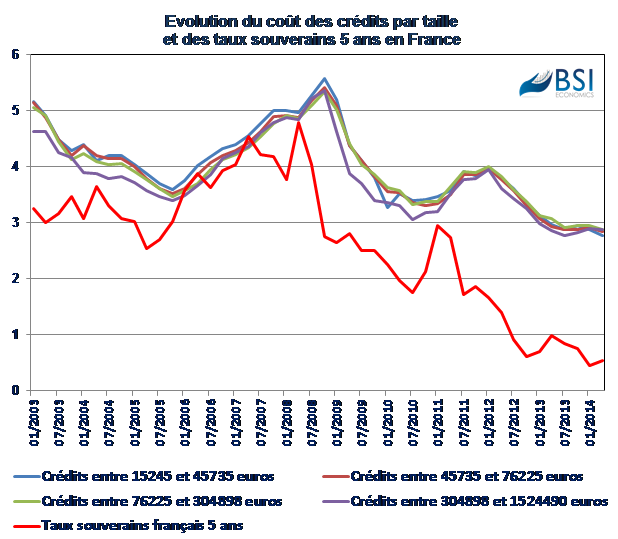

According to a study by the Banque de France[1], rate spreads have a significant impact on the financing conditions of non-financial corporations (NFCs). The transmission of spread levels to lending rates is relatively weak in the short term, but the authors argue that in the long term, a 100-basis-point increase in sovereign rates is fully passed on to lending rates. For example, the cost of credit rose between mid-2010 and the end of 2011, before falling in line with (1) the decline in French sovereign rates and (2) the tightening of French and German rate spreads since the end of 2012.

This observation would suggest that the narrowing of sovereign spreads currently observed in the euro area would facilitate an easing of financing conditions for NFCs. The growth rate of outstanding loans to NFCs increased, reaching a high of 1.8% in July 2014 after an average growth rate of 0.5% between September 2012 and March 2014.

2 – A general easing across all types of credit

The growth in outstanding loans to non-financial corporations extends to loans of all sizes. According to figures from the Banque de France, the costs of all loans to non-financial actors[3] appear to be affected downward by the level of sovereign rates.

These figures are supported by studies conducted at the beginning of the year by the Banque de France[4]which noted (1) an increase in loans granted in the first quarter of 2014 and (2) continued high levels of demand for and granting of loans in the second half of the year for cash flow and investment loans granted to micro-enterprises, SMEs, and mid-cap companies in France. A decline in the overall cost of financing has already been observed.

Conclusion

Coupled with renewed momentum in the stock markets and the development of new sources of financing for SMEs and mid-cap companies, such asInitial Bond Offerings (IBOs), financing conditions for French non-financial corporations are expected to improve, particularly through lower sovereign rates, which would keep borrowing costs low.

However, although conditions are favorable for credit growth, concerns about French sovereign rates and the economic environment could hamper the recovery in SNF investment.

Notes:

[1]Jean Barthélemy and Magali Marx, « The impact of changes in sovereign rates on financing conditions in the French, Spanish, and Italian economies, » Bulletin de la Banque de France No. 188,2nd semester2012.

[2]Bond issue for SMEs and mid-cap companies

References

– Jean Barthélemy and Magali Marx, « The impact of changes in sovereign rates on financing conditions in the French, Spanish, and Italian economies, » Banque de France Bulletin No. 188, 2nd half of 2012

– « Quarterly survey of businesses on their access to credit in France, » Banque de France,1st half of 2014

– « Quarterly survey of businesses on their access to credit in France, » Banque de France,second half of 2014