Crowdfunding: the birth of a new industry in the global financial intermediation landscape – Part 3 –

Summary:

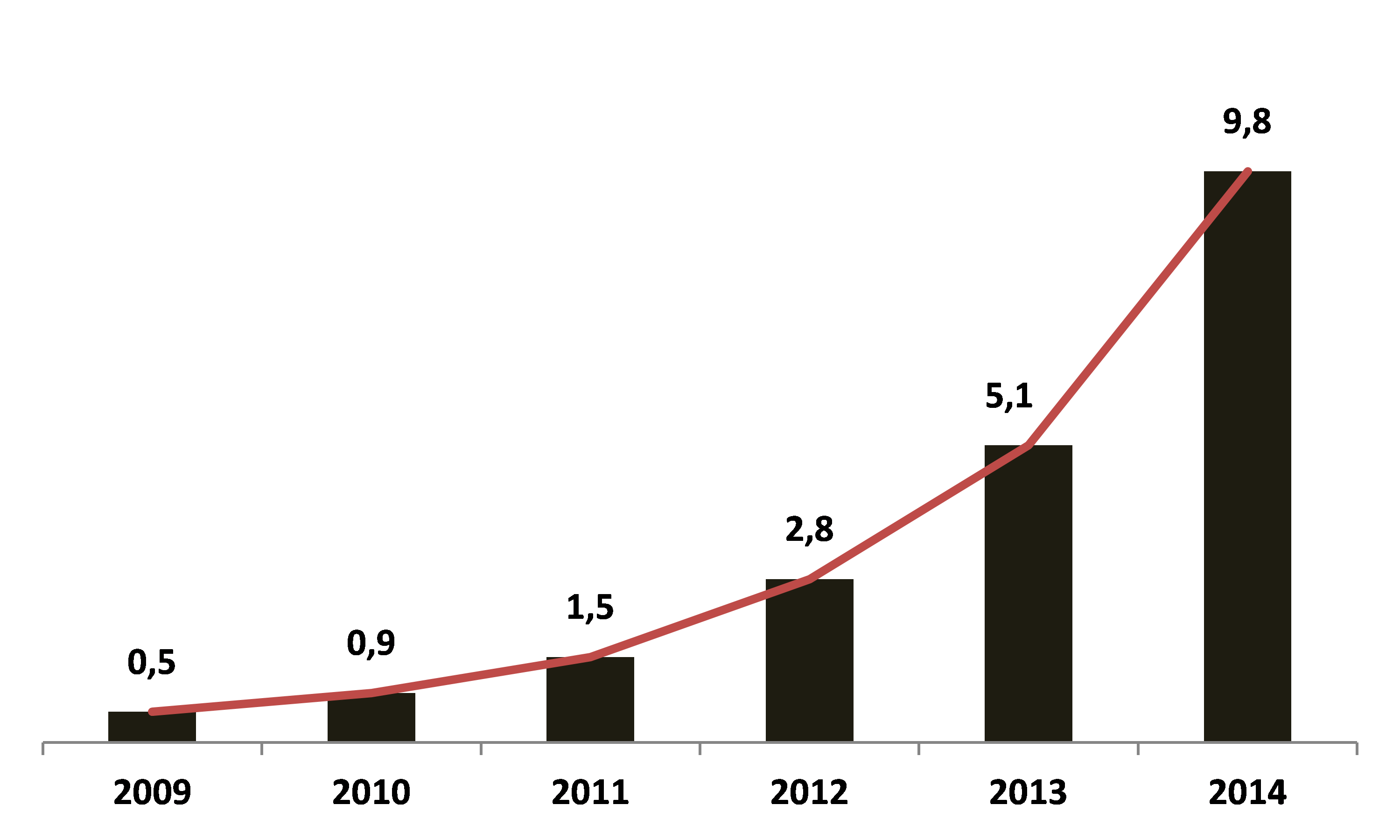

– Crowdfunding is a booming industry that raised more than $5 billion worldwide in 2013, nearly two-thirds of which was in the United States, and is expected to reach $10 billion by the end of 2014.

– In France, this market is growing rapidly, exceeding €150 million raised in 2014, compared to less than €10 million before 2011.

– This young industry is taking shape and carving out a place for itself in the financing landscape, alongside banks and traditional players in personal and business financing.

– France is one of the most advanced countries, both in terms of regulation and the ecosystem that has developed in recent years, and has all the assets to become a key player in global crowdfunding in the future.

Since 2010, the global crowdfunding industry has been experiencing hypergrowth. This new financing tool provides access to financing for private projects, replacing bank financing with participatory financing. Like all young industries, the sector is experiencing rapid growth in the number of crowdfunding players and users (backers and project leaders), which is helping to drive the industry forward.

1 – Global growth of crowdfunding

Globally, the industry has grown from $530 million[1]to over $5.1 billion by the end of 2013. Forecasts for 2014 predict that the market will reach $10 billion.

Evolution of amounts raised by crowdfunding worldwide (in billions of dollars)

Sources: Statista, Massolution, BSI Economics

The United States accounted for nearly 60% of the amounts raised worldwide in 2012. However, specific national regulations prevent this market from being the most dynamic in the world. The United Kingdom is seeing the fastest growth. With €350 million raised in 2012, the market reached €2.3 billion in 2014. This growth is driven by business financing. The amounts raised throughequity crowdfunding increased 22-fold between 2012 and 2014, reaching €111 million in 2014.[2]. The amounts raised by P2P business lending platforms increased more than twelvefold, reaching nearly €1 billion in 2014. Finally,invoice trading, which can be likened to factoring[3]through crowdfunding, has grown 7.5-fold in the industry, reaching €528 million in 2014. Institutional investors such as funds and family offices, as well as high-net-worth individuals, now have access to a new asset class consisting of short-term corporate debt. With more than €3 billion raised by the crowdfunding industry across the Channel, it is by far the most mature in Europe and the world.

2 – Growth of crowdfunding in France

French crowdfunding, with the highest growth rate in the world, has established itself as the leading market in continental Europe. According to the latest barometer conducted by Compinnov for the association Financement Participatif France (FPF), the French market has seen the amounts raised double in one year, from €78.3 million in 2013 to €152 million in 2014.

As in the rest of the world, this young industry is characterized by a proliferation of platforms. According to François Desroziers[4], in 2011 » crowdfunding was limited to Wiseed inequity, Babyloan in microcredit, and the three main donation-based platforms, Ulule, KissKissBankBank, and MyMajorCompany. »

The economic research institute Xerfi[5]counted 80 active platforms in France in mid-2014, more than 75% of which had been in existence for less than three years.

Creation/launch of crowdfunding platforms in France

Sources: Xerfi, BSI Economics

According to Xerfi, the first failures[6]of platforms are beginning to be observed. In the crowdfunding sector, margins are low given the role of intermediary, and therefore volumes must be high in order to achieve sufficient profitability.

3 – Strong political will to make France a stronghold of crowdfunding

The French market has also benefited from strong political support, which has enabled its rapid development. Political speeches, such as that given by Arnaud Montebourg at the crowdfunding festival in 2014, focused on directing French savings towards the real economy. This commitment was reflected at the Entrepreneurship Conference in the establishment of a legal framework to enable the development of participatory finance. The government has thus demonstrated its willingness to better recognize the risk-taking involved in long-term investment. This led to a law passed in September 2014 that recognized crowdfunding activities by platforms defined as investment service providers or crowdfunding advisors. François Desroziers confirms that « with this law, the government has been able to support[7]the platforms in the face of reluctance, or at least mistrust, from the banking sector. »

4 – Market structure

All over the world, there has been a sharp increase in the number of platforms active in crowdfunding. However, the European Commission anticipates a consolidation of theequity crowdfunding and lending markets in the medium term, particularly for interest-bearing loans. Conversely, the donation and social lending markets could see, if not an increase in the number of players, then a specialization that would reduce their scope of action but lead to a monopoly in each sector. François Desroziers confirms this analysis and believes that when the industry matures, the market will see a « concentration of players according to different business lines and different promises » and envisages « an ecosystem combining large platforms that are leaders in their segment and small specialized platforms. »

Furthermore, as observed across the Atlantic, structuring will involve the internationalization of platforms. In Europe, this phenomenon may be hampered by regulatory differences between countries and slowed down by specific national financing arrangements. Nevertheless, given the activity and amounts involved, the internationalization of platforms will be necessary to ensure their viability and financial soundness.

Finally, the arrival of global players such as Google, Alibaba, and JingDong[8], could accelerate the internationalization of platforms and disrupt the current global crowdfunding landscape.

5 – Reaction from traditional sectors

The future of the industry also depends on how banks react to the arrival of these new players, particularly in France, where banks have a virtual monopoly on both corporate financing and personal loans.

Currently in France, banks are entering the crowdfunding market through partnerships. For example, Wiseed, the French leader inequity crowdfunding, entered into a partnership with Crédit Coopératif at the beginning of the year to refer companies to Wiseed when they need capital, thereby expanding their investor base. Similarly, partnerships between banks and crowdlending platforms are becoming increasingly common for major lending platforms such as Unilend and Prêt d’Union. Finally, in the area of solidarity lending, Spear has included banks in its financing scheme from the outset. According to them, the services offered by banks and crowdfunding platforms are not « perfectly substitutable. » They add that « the issue of the experience of a growing number of users with regard to their savings should lead banks to position themselves either by communicating or by integrating innovation into their operating methods. »

Wiseed has also announced its intention to raise a private equity fund. It remains to be seen how the private equity industry will position itself and react to the arrival of these new capital investors. The impact of crowdfunding could potentially divert individuals, who currently represent one of the main sources of private equity with more than €1 billion invested each year in French private equity funds, away from the private equity industry.[9].

6 – Market penetration andcommunication/lobbying effect

The industry’s growth potential will also depend on market penetration. Today, the number of funded projects is multiplying, as is the number of contributors. User loyalty is essential to the sustainability of the crowdfunding model.

In France, the latest 2014 barometer published by FPF reports 1.3 million funders for 84,880 funded projects, 30% of which were funded in 2014. A survey by the Think institute[10]attempted to assess the potential for market penetration. On the financing supply side, they estimate that 7% of the French population has already invested, lent, or donated money via crowdfunding. They also estimate that the number of potential funders in France could reach 24 million people in the short to medium term. On the financing demand side, they conclude that the French population has strong potential in terms of business creation. They estimate that 2.1 million business creation projects could come to fruition within two years. Of this windfall, 60% of future business leaders say they are interested in crowdfunding as a source of financing for their projects. One-third of entrepreneurs already in business say they are considering crowdfunding as a source of financing.

These figures show how important it is for French crowdfunding to educate the public in order to help French people make drastic changes in how they manage their savings. They will need to be supported in this change and also protected or warned of the risks inherent in investing and lending. This is because the French remain largely passive and risk-averse. In this regard, the crowdfunding industry has stepped up its efforts to communicate more effectively about its activities through associations such as FPF, but also by creating news sites dedicated to French crowdfunding. The State and the AMF[11]have also been involved in this movement by publishing guides aimed at a very wide audience that may be interested in crowdfunding. The State has also created a crowdfunding observatory hosted by BPIFrance.

7 – The power of the crowd and the long-term viability of models

Beyond building loyalty among a large audience of users (financiers or project leaders), the industry will have to confirm its model. Until now, financing and financial intermediation have been the domain of experts. Their skills and experience gave them legitimacy in financing choices. Crowdfunding relies on the predictive power of the crowd and its ability to choose the right projects and not finance the wrong ones. The initial results of academic studies are rather encouraging for this young industry.

Conclusion

The crowdfunding industry is booming in France, as it is in the rest of the world. National, European, and international regulations will be essential in determining national advantages and enabling sustainable growth, and will determine the place of crowdfunding in the economy. Crowdfunding could become a real alternative for households looking to invest, as well as for institutional investors seeking returns and diversification. France has all the assets it needs to position itself as a key player in European and global crowdfunding.

References:

– Interview with François Desroziers conducted for BSI Economics by Pierre-Michel Becquet on October 25, 2014

– 2014 Crowdfunding Barometer in France, Financement Participatif France, March 2015

– Barometer of Crowdfunding in France for thefirst half of 2014, Financement Participatif France, September 2014

– 2013 Crowdfunding Barometer in France, Financement Participatif France, March 2014

– « Crowdfunding in France, » Precepta Groupe Xerfi, September 2014

– « Social and Solidarity Economy: Current Challenges for a Booming Sector, » BSI Economics, October 2014

– « First overview of the creative industries: At the heart of France’s influence and competitiveness, » EY, November 2013

– « MovingMainstream: The European Alternative Finance Benchmarking Report, » University of Cambridge, EY, February 2015

– « Crowdfunding Innovative Ventures in Europe: The Financial Ecosystem and Regulatory Landscape, » European Commission, February 2015

– « The French, their entrepreneurs, and crowdfunding, » survey conducted by the Think Institute for Lendopolis and the Higher Council of the Order of Chartered Accountants, January 2015

Sources:

[1] Source: Statista

[2] Source: MovingMainstream, University of Cambridge EY, February 2015

[3 Factoring involves anticipating the collection of a future receivable by outsourcing the collection to a third party.

[4] Deputy CEO of SPEAR. Read his interviewfor BSI Economics published in part 1of the crowdfunding report.

[5] Source: « Crowdfunding in France » published by Xerfi, an independent publisher of sector-specific economic studies.

[6] Liquidation or receivership

[7] Order No. 2014-559 of May 30, 2014, and Decree No. 2014-1053 of September 16, 2014

[8] Chinese internet giant

[9] Source: Activity of French private equity players in 2013

[10] Source: The French, their entrepreneurs, and crowdfunding

[11] Financial Markets Authority