Abstract :

– 70% of corporate financing is provided by bank loans.

– The new Basel III banking regulations could restrict access to credit… at the risk of compromising the financing of the French economy.

– « Responsible » securitization could partially offset the adverse effects of this prudential reform without compromising financial stability.

– Insurers, seeking returns in the current low interest rate environment, naturally appear to be significant potential investors.

This article follows on from a previous article presenting the main aspects of Solvency II and its impact on insurers and on the financing of the economy.

The Solvency II prudential reform is part of a broader set of new supranational financial regulations (Basel III, EMIR, MiFID II, etc.) aimed at strengthening financial stability. It must therefore be understood within a more comprehensive approach. In France, banks remain the preferred source of financing for micro-enterprises, SMEs, and mid-cap companies. As a result, the financing of the private economy is, by its very nature, highly dependent on the willingness of banks to lend.

However, the new Basel III regulatory requirements aim to strengthen the financial soundness of banks and thus promote financial stability by increasing the amount of capital they must hold against their commitments. With capital remaining constant, they thus restrict banks’ ability to grant loans, which could prove disastrous for the financing of the French economy. There appears to be a dilemma between financial stability and corporate financing, both of which are essential to the proper functioning of the economy. One solution to this problem proposed by some experts would be, as is the case in other developed countries, greater banking disintermediation based mainly on securitization. The idea, which is currently the subject of much debate, would be to transfer the risks borne by banks on loans to other investors, typically insurers. Indeed, the latter, as risk professionals, have enormous investment capacity (they hold nearly €2 trillion in investments) and are facing a sharp decline in the return on their assets.

Securitization: a weapon against the crisis?

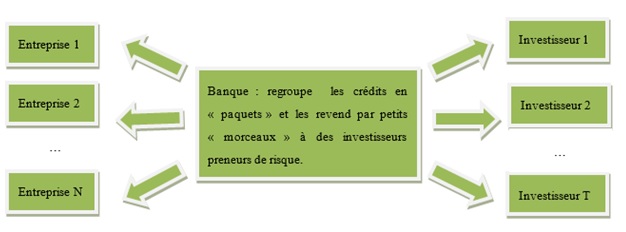

The mechanism for securitizing loans granted to businesses (or individuals), which would enable banks to free up capital to provide more financing to non-financial companies, is broadly as follows:

Business leaders are more in favor of financing SMEs/mid-cap companies through credit rather than through an initial public offering or capital increase. This is because they often fear that issuing shares to new investors will lead to a loss of control and excessive transparency and administrative obligations.

Insurance companies currently have virtually no small or medium-sized business loans in their asset portfolios. In order to diversify their investments and increase their returns in the current low interest rate environment (10-year OATs are currently trading at around 1%), they are likely to be potential investors. For example, insurers have already publicly expressed their interest in investing in such securitization funds. Moreover, this desire to finance small businesses has already materialized in the form of strong participation by insurers in the Novo and Nova funds launched by the Caisse des Dépôts et Consignations. For example, the Novo funds, which consist of bond loans at relatively attractive interest rates (between 4% and 6%), have enabled €461 million to be invested in sixteen companies since their launch in 2013. By next year, the total budget is expected to reach €1.015 billion, according to the initial targets.

In addition, insurers could take a greater interest in European real estate loans through securitization mechanisms, which would automatically enable banks to provide more financing to companies. According to a recent study conducted by The Economist Intelligence Unit for Blackrock, based on interviews with executives from global insurance organizations, even though many challenges remain, insurers are expected to increase their investments in real estate securities.

Furthermore, « high-quality » securitizations (senior tranches) are penalized fairly lightly in Solvency II, as the shocks applied to this type of investment are similar to those of a BBB bond (for a 10-year duration).

However, it is imperative to rigorously regulate such financial arrangements in order to avoid repeating the mistakes that led to the 2008 financial crisis, known as the « subprime crisis. » That is why, in order to restore confidence in these products, secure investments, and maintain long-term financial stability, it seems essential to develop « responsible » securitization that meets the following criteria:

– Alignment of interests and criminal liability (obligation of means) of all stakeholders: all parties involved (excluding supervisory bodies and the Banque de France) in the financial arrangement have a strong financial interest in the financial outcome of each transaction. In particular, the bank, which remains the sole point of contact for borrowers and grants the loans, should take a minimum stake of around 30% in each transaction.

– Sale of loans regulated and adapted to the risks incurred.

– Strengthening of financial and criminal penalties for fraud or offenses related to these securitization transactions.

– Simplicity. Indeed, overly complex financial products can lead to buyers misunderstanding the underlying risks.

– Prohibition on creating complex financial products (squared securitization, etc.) on this type of underlying asset.

– Serious and rigorous rating of these products, remunerated by the levying of a tax (no direct financial link with the rating agency). For example, the Banque de France, which has expertise in rating micro-enterprises, SMEs, and mid-cap companies, could share its knowledge in this area with all stakeholders by being responsible for rating these securitized products. In addition, it would be appropriate for it to open the FIBEN (Fichier bancaire des entreprises) database to investors so that they can properly understand the potential risks of loss.

– Strengthening the powers granted to the regulator. The Autorité des Marchés Financiers (AMF) could be responsible for the approval, monitoring, and control of these products.

– Securities trading platform within a regulated market.

– Clear and transparent communication to investors. A regular dashboard on the evolution of the portfolio would provide investors with the most complete information possible, enabling them to assess the risks involved in sufficient detail.

The « responsible » securitization of loans granted to businesses (or individuals) could thus lighten the balance sheets of banks. As a result, with capital and financial strength (Basel III vision) equivalent to today’s levels, the granting of financing, which is beneficial to the French economy through the distribution of credit, would be facilitated. Responsible securitization currently appears to be a real solution to the low level of investment by companies, which has a negative impact on their profit margins and therefore their future ability to invest, without which they cannot survive in the long term.

The purchase of « responsible, » « high-quality » securitized credits by insurers is perfectly in line with the investment diversification approach advocated by the Solvency II Directive. In addition, it would enable them to combat the continuing decline in financial returns, which could potentially jeopardize their solvency (life insurers) in the near future. The concept of securitization could also be a source of improved solvency for insurers (non-life). Indeed, securitization applied to the liabilities of insurers (non-life) would enable them to transfer certain insurance risks to investors through the design of ILS (Insurance Linked Securities). ILS have the advantage of being weakly correlated with financial markets, which makes them a source of diversification (and therefore reduces the probability of overall losses in the event of a financial crisis) for investors (pension funds, hedge funds, family offices, etc.). These insurance risk transfer mechanisms are currently undergoing significant development but remain limited mainly to catastrophic risks (hurricanes, storms, earthquakes, floods, etc.).

Responsible securitization, without weakening the financial system, therefore offers promising prospects for financing the economy. It would facilitate a way out of the crisis and the return of much-hoped-for growth.

Conclusion

The new Basel III prudential rules that will soon apply to banks appear to be much more dangerous than the Solvency II Directive for the financing of the economy. This reform aims to drastically increase the solvency requirements for banks. However, banks are currently the preferred partners of micro-enterprises, SMEs, and mid-cap companies for securing financing through debt. This is why, in order to limit the undesirable effects of Basel III on the financing of the economy, we have recently seen a strong political will in France and Europe, from the European Central Bank (purchases of asset-backed securities) and the regulator (easing of capital constraints) to revive securitization.

Securitization involves transferring risk, linked for example to corporate or real estate loans, from banks to investors such as insurers. It therefore has the advantage of partially decoupling lending from new prudential banking regulations. Responsible securitization of SME/mid-cap (or individual) loans therefore appears to be a weapon against the crisis and a solid bulwark against the supposed harmful effects of Basel III on corporate financing, without jeopardizing financial stability.

Given the current low interest rate environment, insurance companies are looking for returns higher than those offered by sovereign bonds.

In addition, they are communicating their desire to increase their investments in businesses and have nearly €2 trillion in investments at their disposal. This is why insurers appear to be important potential investors for these « responsible » structured products.

Bibliography:

Numerous press articles published by L’Argus de l’Assurance

Annual reports of the FFSA

Various publications by the Banque de France and the ACPR

EIOPA

« Solvency II, securitization, and financing of the French economy (1/2), » Romaric Chalendard (January 2015), BSI Economics.

« Private equity activity in 2013, » AFIC

« The consequences of Solvency II on corporate financing, » Anne Guillaumat de Blignieres and Jean-Pierre Milanesi (February 2014), Les éditions des JOURNAUX OFFICIELS