The last few weeks have seen a lot of debate in the US about the « R-star, » which is the neutral real interest rate for the US economy. The output gap (actual GDP minus potential GDP) is inversely correlated with the interest rate gap (actual rate minus neutral real rate). If the output gap is smaller than expected, inflationary pressure will be lower and the interest rate gap, implicitly the number of rate hikes by the Fed, will also be reduced (Fickle-Wicksell and Laubach-Williams model). Ultimately, these factors will limit the appreciation of the US dollar.

Comments from FOMC members were more measured on the evolution of potential GDP, which would limit inflationary potential in the medium term, without however proposing a formal level for the real neutral interest rate. Evans, President of the Chicago Fed, emphasized the usefulness of setting a core inflation target above 2% to avoid the need for transparency on the « R-star. » The markets’ dependence on central bankers’ announcements is leading the latter to renew their credibility criteria, no longer based simply on the trade-off between transparency and opacity, but also on the fundamental role of their mandate to free themselves from an excessive need for transparency. Communication drives the US dollar. The dollar may already have appreciated too much relative to the gradual rate hikes envisaged by the Fed. Dependence on macroeconomic data is not only cyclical but structural, hence the debates surrounding R*.

Another debate surrounds the GRF2S and its four possible scenarios: Goldilocks, Reflation, Fat & Flat, and Stagflation. (1) A Goldilocks scenario would lead to an upturn in activity without a rise in bond yields, causing equity markets to appreciate. Emerging market assets, cyclical stocks, and more volatile stocks would outperform. (2) A Reflation scenario would also see improved activity, but with higher bond yields, improved earnings and therefore rising equity markets. Cyclicals and banks would outperform defensive stocks, while European and Japanese markets would outperform the US market. (3) A Fat & Flat scenario would continue with moderate growth, sluggish earnings, and bond yields at their lowest. Emerging markets would hold steady, with the US market outperforming. Sector-wise, banks and cyclicals would underperform defensives. (4) A Stagflation scenario would lead to a sharp rise in inflation and yields, but without a rebound in activity. Commodities would gain ground, with emerging markets underperforming developed markets.

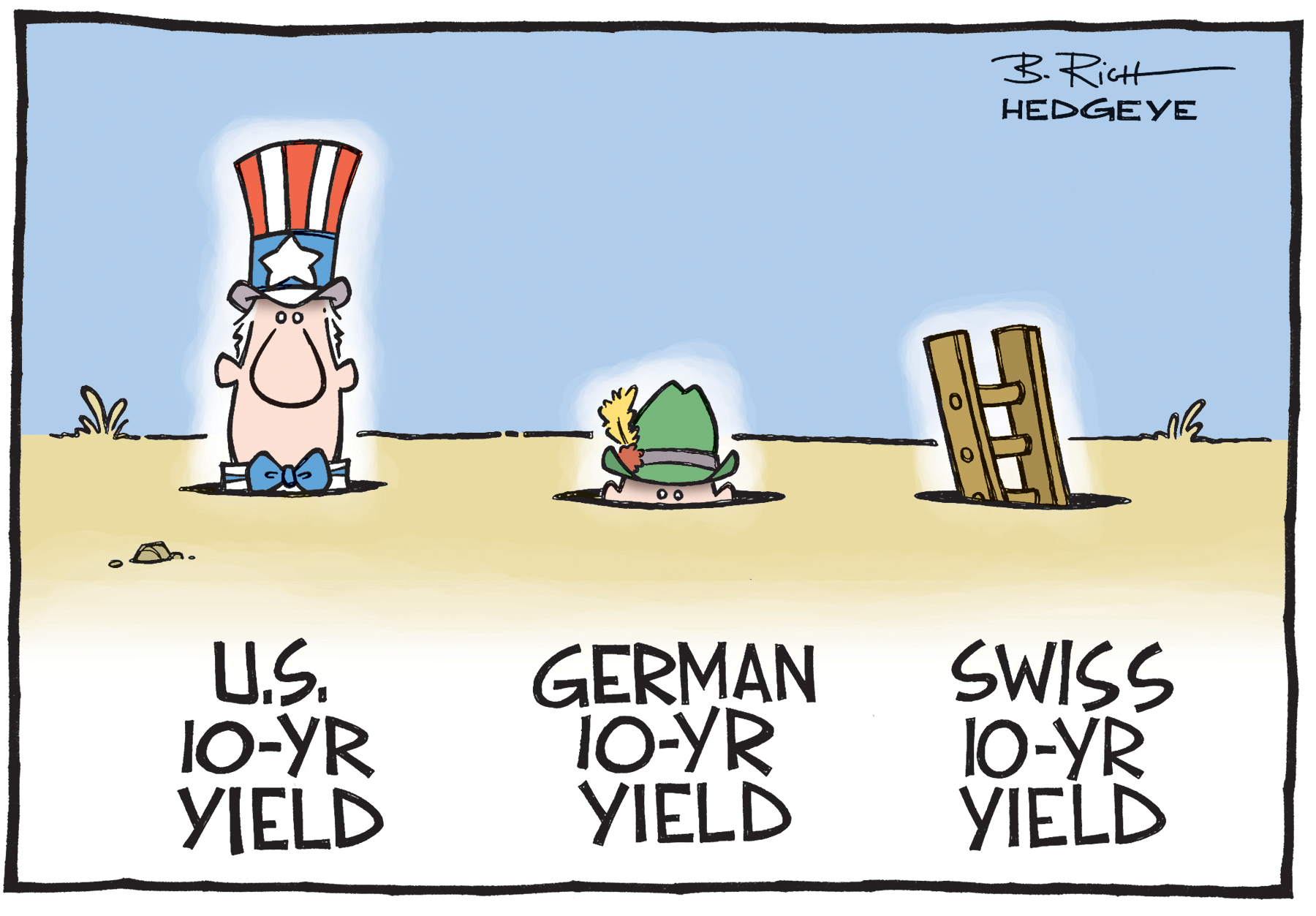

While several US bank reports are focusing on a Fat & Flat scenario to describe the current situation, more interesting are those discussing tactical portfolio moves in response to low interest rates. These moves are (1) geographical: (a) low rates favor stocks with stronger fundamentals and therefore favor the US market, which has outperformed other developed markets; (b) emerging markets have benefited from low rates in developed markets by offering better yield differentials; (2) sectoral: banks’ net margins have contracted, leading to under-allocation in financial indices, while those exposed to consumption have outperformed; (3) weak supply, particularly in the sovereign and high-rated corporate segments in Europe, has contributed to the contraction in rates. However, the decline in bond yields was also part of a trend of weaker long-term dividend expectations in light of weaker economic activity. Three strategies reinforced this relationship: (1) strategies targeting growth stocks (solid fundamentals) rather than value stocks (recovery in asset value after a sharp correction), (2) strategies targeting cyclical stocks rather than defensive stocks, and (3) strategies targeting the least volatile stocks. In short, strategies favoring defensive stocks, which are less volatile in the market and have stronger fundamentals. Failing to buy Bunds at the right time, failing to strengthen positions in Gilts before Brexit, and failing to position for a significant appreciation of the US dollar.