In the United States, the 3-month Libor rose in line with an increase in Fed Fund rates – but for regulatory reasons

In anticipation of an imminent rise in Fed Fund rates, the 3-month Libor rate rose by 20 points, equivalent to the level seen during the last Fed Fund rate hike in December 2015. Initially, the anticipated pricing of the 3-month Libor rate on the rise in Fed Fund rates seemed to be an explanatory factor. However, the rise is not the result of economic or financial conditions, but of a new regulatory framework for the US money market, which has had the effect of tightening monetary conditions on the 3-month Libor. In November, the US Securities and Exchange Commission (SEC) will require US money market funds to disclose the variable net asset value (NAV) of their assets.If these funds have less than 30% of assets that can be liquidated within five days, the SEC could levy a 2% fee as part of its financial stability policy. Previously, these money market funds were only required to comply with a constant net asset value rule valued at one dollar. This new regulation has led funds to postpone their demand for money market funds for commercial paper and bank certificates of deposit (Prime Money Market Funds) in favor of diversified money market funds that include commercial paper, certificates of deposit, and Treasury bills. It should be noted that more than 18% of Prime Market Funds come from France, compared with 13% from the United States, 13% from Canada, 11% from Japan, and 5% from the United Kingdom. The rise in the 3-month Libor rate to 0.85% (+20bp) led to a decline in international demand for dollar-denominated debt. At the same time, real US interest rates fell following a downward revision of inflation expectations for the US economy. These two effects point to a bearish environment for the US dollar.

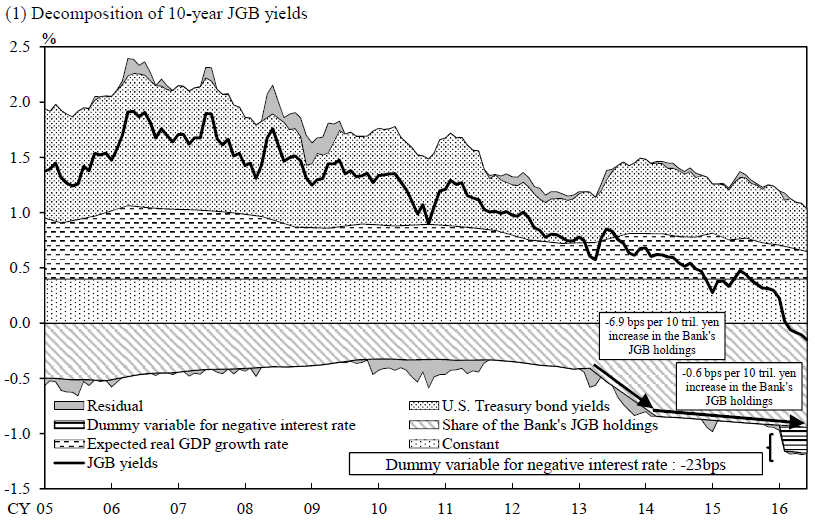

The Bank of Japan measures the effect of negative interest rates and justifies its yield curve control policy

The Bank of Japan has provided an interesting document to justify the effects of negative interest rates and its new Yield Curve Control monetary policy. Negative rates have thus contributed to a 24-basis-point correction in Japanese sovereign bond yields, as shown in the chart below. The negative contribution of negative rates would be: (1) equivalent in absolute terms to the positive contribution of yields on 10-year US sovereign debt, (2) five times greater than the BoJ’s market share in the Japanese sovereign debt market – although this does not prevent the latter factor from explaining a 60-basis-point decline in the 10-year yield due to the BoJ’s cumulative and regular purchases. Only expectations of real GDP growth have a greater effect on the 10-year yield (34bp).

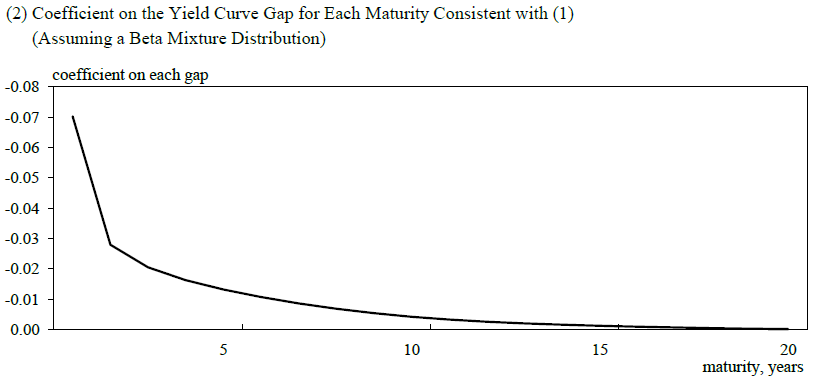

The natural yield curve can be used to measure the impact of a decline in real interest rates on the output gap. A new regression shows that this relationship can be explained by 10-year US sovereign bond yields, year-on-year inflation excluding food prices, and the ratio of available jobs to total job seekers. The conclusion is that the coefficient on the output gap is seven times greater for short maturities than for medium and long maturities. The Japanese economy would therefore be significantly more sensitive to 1-year and 2-year rates than to 10-year rates, which would justify yield curve control on and beyond 10-year bonds (with a target yield of around 0%).