Summary:

– Italy unexpectedly slipped back into recession in the second quarter of 2014, having only just returned to growth in the fourth quarter of 2013.

– The decline in Italy’s GDP in the first quarter could have been seen as a mere blip, especially given the presence of a « truck effect, » which had a negative impact on activity.

– The decline in Italy’s GDP in the first quarter of 2014 (-0.1%) surprised most analysts due to the recovery in the main economic surveys.

– While the gap between business surveys and activity appears to be gradually narrowing, Italy will not escape another year of recession in 2014 (-2.4% in 2012 and -1.8% in 2013), given the negative growth recorded (-0.2% at the end of the second quarter) and the low level of surveys.

Italy has entered recession once again.[1]in the second quarter of 2014 (-0.2%, after -0.1% in the first quarter), just as it had returned to growth in the fourth quarter of 2013 (+0.1%) after nine quarters of recession. This new decline in Italy’s GDP is unexpected (+0.2% according to the August Consensus Forecasts ) given the improvement in the business climate observed in the first half of 2014. Taking into account the negative carryover effects, the Italian economy is likely to be in recession again this year.

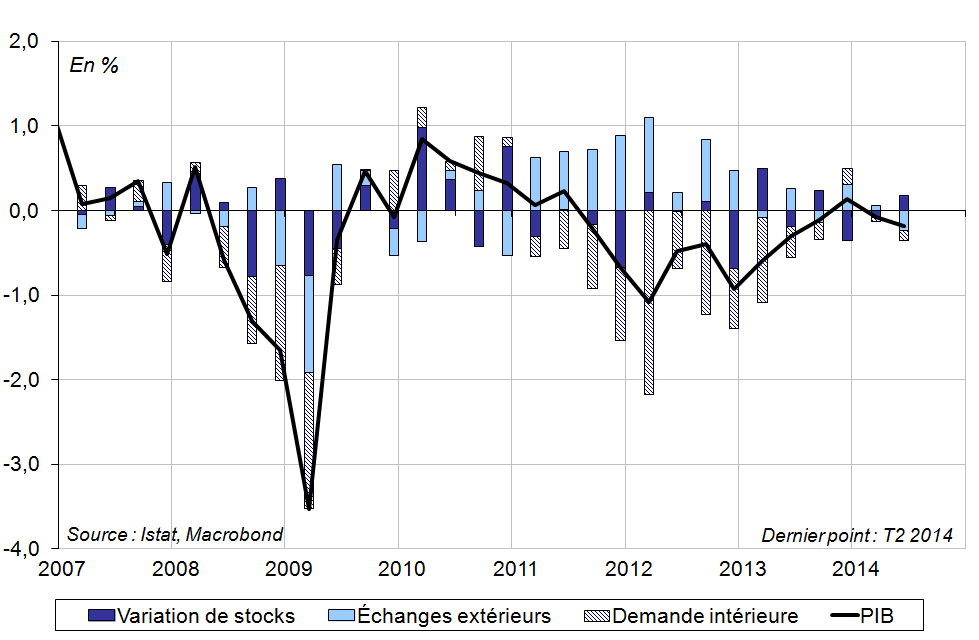

Seasonally and working day-adjusted activity declined by 0.2% in the second quarter of 2014, after already falling in the first quarter of 2014 (-0.1%). Private consumption rose slightly for the second consecutive quarter (+0.1%), while investment contracted sharply (-0.9%) due to a further marked decline in the construction sector (-0.9%) and a sharp drop in investment in equipment (-1.5%). After falling by 7.7% in the first quarter, investment in transport equipment rebounded by 1.5% in the second quarter. Foreign trade made a negative contribution to activity (-0.9%), due to an increase in imports (+1.0%) and stable exports (Figure 1).

Chart 1: Italy’s GDP and its components

Sources: Istat, Macrobond, BSI Economics

With a further decline in activity in the second quarter, the fall in Italy’s GDP in the first quarter of 2014 can no longer be identified as a mere blip.

In thefirst quarter of 2014, Italy fell victim to the « truck effect. »

The decline in Italy’s GDP in the first quarter of 2014 could have been seen as a mere blip, especially given the presence of a « truck effect, » which had a negative impact on economic activity. The Euro 6 standard, which came into force on January1, 2014 for trucks, introduced common requirements for emissions from motor vehicles and their specific spare parts, leading to an increase in the price of trucks (particularly diesel trucks). It will apply to other vehicles from September1, 2015, and is likely to have a similar impact on passenger car registrations.

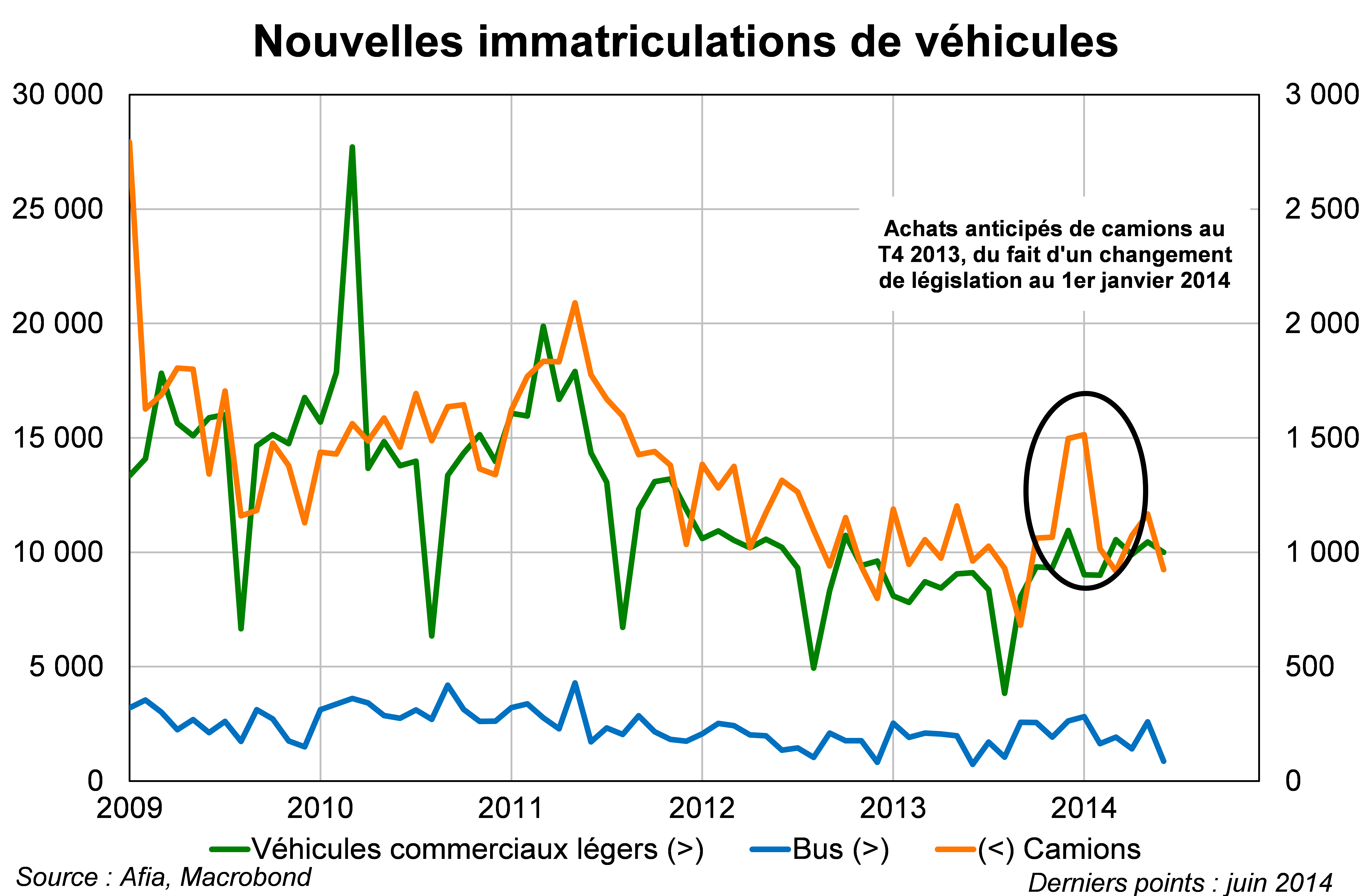

Investment in transport equipment, which accounted for 1.4% of GDP in 2012, contributed to a 0.11 percentage point decline in GDP. Although this series is particularly volatile, the magnitude of these variations is exceptional and seems to describe anticipated investment behavior. In Italy, as in France, there was a sharp rise in truck registrations in the fourth quarter of 2013, followed by a marked backlash in the first quarter (see Chart 2). This atypical development tends to confirm the existence of a positive « truck effect » in the fourth quarter of 2013 and a negative one in the first quarter of 2014.

Assuming zero growth in investment in transport equipment since the third quarter of 2013, the « truck effect » would have increased fourth-quarter GDP by 0.26% and decreased first-quarter GDP by 0.13%.

Figure 2: New commercial vehicle registrations

Sources: Afia, Macrobond, BSI Economics

However, this cyclical effect alone cannot mask the disconnect between business surveys and activity since the beginning of the year.

Second explanation: The gap between economic surveys and actual economic activity is beginning to narrow

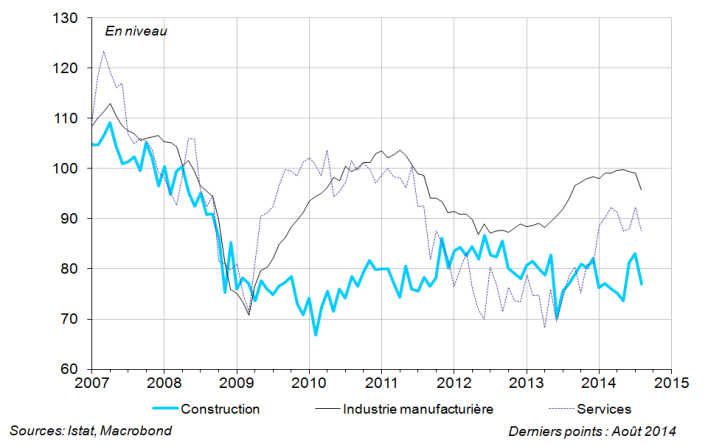

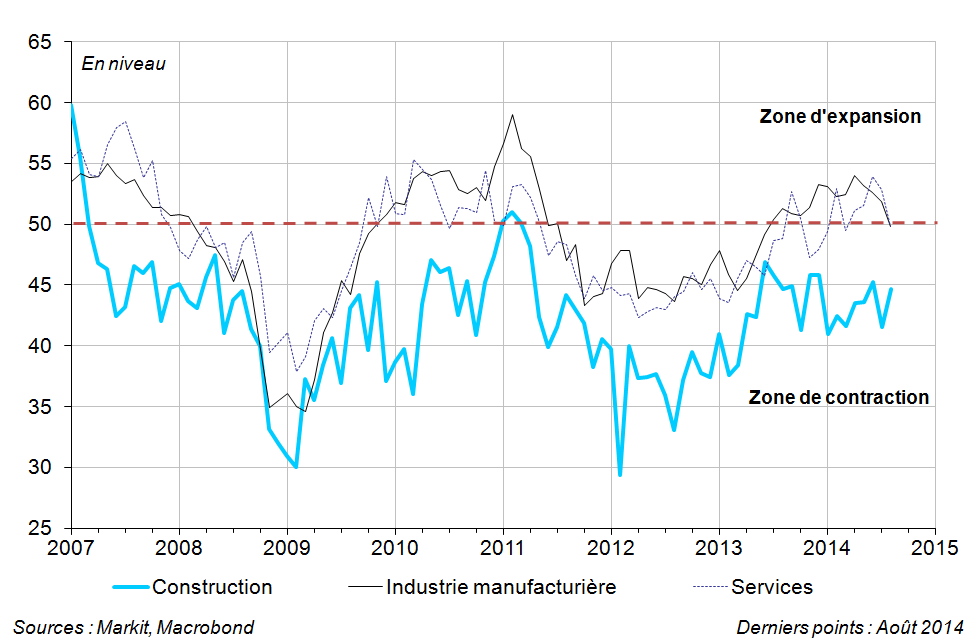

The decline in Italy’s GDP in the first quarter of 2014 (-0.1%) surprised most analysts, who had been hoping for a gradual return to growth after the end of the recession in the fourth quarter of 2013, particularly given the upturn in the main economic surveys (Istat, European Commission, PMI). In fact, in the first half of 2014, the various Istat business climate indices had begun to recover. The manufacturing index, which has the highest predictive power due to its knock-on effect on the economy, had almost returned to its long-term average (100) in the second quarter (Chart 3). Markit’s PMI indices also gradually recovered during the first two quarters, suggesting a slight acceleration in activity over the period.

However, this improvement in business confidence did not materialize in the activity data for the first half of the year. While a gap had widened between the level of business surveys and activity in the first half of the year, it began to narrow in July, with surveys now pointing to a downturn. According to PMI surveys, the upturn now appears to be over, with the manufacturing index even returning to contraction territory in September for the first time in 13 months. Indices for other sectors offer little cause for optimism, with services and construction also in negative territory. The outlook is hardly more encouraging in national surveys, as the various indicators are now moving further and further away from their long-term average and closer to their levels in 2012-2013, years of sharp contractions in activity.

Figure 3: Istat business climate surveys

Sources: Istat, Macrobond, BSI Economics

Chart 4: PMI surveys

Sources: Istat, Macrobond, BSI Economics

Conclusion

In three years, Italy has experienced eleven quarters of recession out of a possible twelve, and its GDP in volume terms is 9% lower than before the crisis. Italy’s return to recession in the second quarter of 2014 is an unpleasant surprise given the marked improvement in the business climate over the period. While the gap between economic surveys and actual activity appears to be gradually narrowing, Italy will not escape another year of recession in 2014 (-2.4% in 2012 and -1.8% in 2013) given the negative growth achieved

(-0.2% at the end of the second quarter) and the low level of surveys.

This observation is all the more difficult for Italians to accept given that the 2014 budget law marked a pause in the fiscal adjustment process and that the Renzi government has made a return to growth one of its priorities, with the implementation of concrete measures to boost purchasing power[2].

(Written in September 2014)

Notes

[1] The term recession refers to a contraction in economic activity lasting at least two consecutive quarters.

[2] The « Le bon tournant » plan presented by Mr. Renzi on March 12, 2014, included an average reduction of €100 in monthly contributions on the pay slips of those earning less than €25,000 per year, representing a net increase in income of €1,000 per year for monthly salaries of less than €1,500 per month. This measure came into effect in May 2014 and is estimated by the Italian government to cost a total of €10 billion.