DISCLAIMER: The person is speaking in a personal capacity and does not represent the institution that employs them.

Summary:

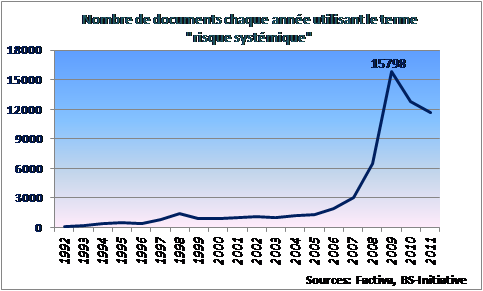

– Since the 2008 crisis, economists have been touting « systemic risk » as the be-all and end-all of contemporary financial economics.

– The first challenge of systemic risk is to agree on its definition, which is multi-faceted by nature.

– The second challenge is to measure it and make predictions about its future evolution, which still requires a great deal of effort given the indicators currently available.

– The third challenge is to successfully regulate it, which is difficult given the current pace of financial innovation, which is constantly creating new vulnerabilities: « this time is different »!

The 2008 crisis saw the emergence in public debate of the concept of « systemic risk, » which has since been brandished by economists as the be-all and end-all of contemporary financial economics (see Figure 1), i.e., the starting point for any effort to understand recent economic phenomena and the ultimate goal of all new banking and financial regulations. But what about this concept, which is certainly omnipresent but very difficult to define? The debate is far from over on the three challenges posed by systemic risk, namely its definition, measurement, and regulation.

Defining systemic risk

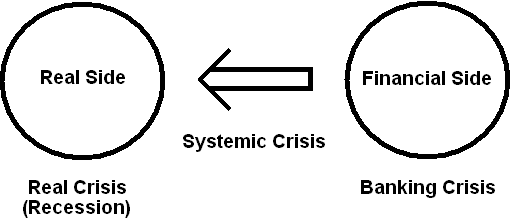

The « systemic » crises that require the full attention of European and international regulators are those that originate in the financial sphere and have a significant impact on the real economy, far from any notion of the neutrality of monetary and financial variables (Figure 1).The systemic banking crisis spreads to the real economy as a whole through two main channels: (i) the credit channel, or « credit crunch, « which directly reduces the supply of credit, and (ii) the price channel, or « fire sales, « which fuels downward spirals in asset prices and reduces the lending or borrowing capacity of market participants (see previous article here).

Although there is no commonly accepted definition, systemic risk can be defined as « the risk that financial instability will become so severe that it impedes the proper functioning of the financial system to the extent that it negatively impacts growth and welfare » (ECB, 2010).

Figure 1: Definition of a systemic crisis

Source: Duprey, 2013 and BS-initiative

Identifying the different dimensions of systemic risk

According to Caruna (2010), one of the executive directors of the Bank for International Settlements, systemic risk reflects:

- Common exposures to the main risk factors;

- The procyclicality inherent in the financial system;

- Interconnections between financial institutions.

This triptych aims to highlight, on the one hand, the procyclical nature of financial imbalances reflecting macroeconomic cycles (leverage cycle: Geanakoplos, 2009; procyclicality of leverage and liquidity: Adrian and Shin, 2010), and, on the other hand, the contagion mechanism at work behind simultaneous or cascading defaults, namely identical risk-taking and diversification strategies (Wagner, 2010) on the part of different agents (« commonality ») or reciprocal exposure (interbank loans, credit default swaps, repurchase agreements, etc.) in the event of difficulties for one of them.

However, a more restrictive definition of systemic risk focuses on points 2 and 3, i.e., the accumulation and transmission of internal imbalances within the system, while point 1 is sometimes considered to reflect a systematic risk, namely, common exposure to an exogenous shock. In this case, the regulator can only act on the individual resilience of financial institutions and not on the occurrence of the shock itself.

The different aspects of systemic risk (see Table 1) can be grouped into two main dimensions: (i) the stability of the system at each point in time, whether the shock is endogenous (systemic in the restrictive sense) or exogenous (systematic), and (ii) the stability of the system over time, i.e., the possible amplification of the initial shock (procyclicality).

Table 1: Taxonomy of systemic risk

|

Phase: |

Increase in risks |

Materialization |

Risk diffusion |

|||

|

Dimension: |

Cross-section |

Temporal |

Temporal |

Cross-section |

||

|

Predictive power: |

Nowcasting |

Forecasting |

Nowcasting |

Nowcasting |

||

|

Risk source: |

Exogenous (Systematic) |

Endogenous |

|

|

Endogenous |

Endogenous |

|

Type of measurement: |

Exposure |

Contribution |

Early warning |

Early warning |

Contagion to the real economy |

Contagion between institutions |

|

Examples of measures (see references at the end of the article): |

MES DIP SRISK CoVaR |

Delta-CoVaR BSI |

Signal theory (credit growth gap and potential level) |

Threshold models |

CISS VAR DSGE |

BSI Network PCA |

Source: Duprey, 2013

A new concept of risk

A financial institution can be considered systemic (G-SIBs, or Global Systemically Important Banks) based on a combination of factors (see Table 2), mainly:

- size, which reflects (among other things) the bank’s dominant position and the magnitude of the shock (Drehmann and Tarashev 2011);

- interconnectedness, which reflects the institution’s centrality in the network based on the size of its links (interbank market, OTC derivatives) or its involvement in different segments/jurisdictions;

- substitutability, which reflects the degree of homogeneity and competition in a market segment;

- complexity, which reflects the uncertainty associated with the resolution of a distressed institution and the possibility of panic (flight to quality) in the event of difficulties in controlling risks (Caballero and Simsek, 2009).

Systemic risk is by definition an externality, meaning that each financial institution manages its own risk without considering the impact of its decisions on the risk at the level of the system as a whole. Thus, the stronger the interdependencies, the greater the externality. Consequently, in 2007, a fairly localized shock to part of the US mortgage market was able to trigger the recession we are familiar with.

Even if size remains the main factor in systemic risk, the resilience of the system can be undermined by a small component if it is sufficiently complex and interconnected with the system. As a result, certain institutions that do not affect the global financial system may be systemic at a more local level, hence the definition of domestically systemically important banks (D-SIBs).

The challenge posed by systemic risk is therefore to propose a comprehensive approach to risks, which must be investigated in as much detail as possible.

Table 2: Risk factors used to identify systemic financial institutions

|

Category |

Weighting |

|

Cross-jurisdictional activity |

20 |

|

Size |

20 |

|

Interconnection |

20 |

|

Substitutability/institutional infrastructure |

20 |

|

Complexity |

20 |

Measuring systemic risk: a challenge

Systemic risk can be measured as the residual difference between overall risk and the sum of individual risks, i.e., the portion of risk that is not internalized in the behavior of financial intermediaries. The main measures of systemic risk can be grouped according to the dimension of risk studied (see Table 1), namely:

- of exposure to a systematic shock;

- of contribution to the fragility of the system;

- chain effects via contagion to other entities.

However, while it is relatively easy to measure a systemic risk as it materializes, i.e., to make real-time forecasts or « now-casting, « the predictive (« forecasting ») nature of most measures is very weak or even non-existent, given the tools currently available.The temporal dimension of systemic risk therefore lends itself only to historical analysis, which aims to deduce recommendations for greater future resilience from past vulnerabilities.Obviously, this is difficult to reconcile with the current pace of financial innovation (particularly the regulatory arbitrage enabled by certain derivatives) and the unprecedented nature of each new crisis, because « this time is different »!

Efforts are therefore now focused on developingearly warning indicators to identify rising vulnerabilities and thus signal to the regulator the most appropriate time to activate macroprudential tools to prevent systemic risk from materializing. Ideally, regulators would like to test the effectiveness of signals of rising systemic risk, i.e., distinguish between situations where systemic risk is increasing without being detected (type 1 error) and situations where indicators signal a risk that is not actually present (type 2 error).

Conclusion: towards a new, more « systemic » regulation

The success of macroprudential regulations in reducing both the costs associated with systemic crises and their probability of occurrence depends on our ability to better understand the different facets of systemic risk. Significant progress is being made, notably with the introduction of capital surcharges for systemic institutions (BCBS, 2013) corresponding to the cross-sectional dimension of systemic risk, and the development of countercyclical capital buffers (CGFS, 2012) aimed at strengthening regulation during periods of expansion and allowing more room for maneuver in times of crisis, which refers to the temporal dimension of systemic risk.

References:

– Adrian, T. and Shin, H. S. (2010). Liquidity and Leverage, Journal of Financial Intermediation, 19, 418-437.

– Arnould, G. (2013). How does a systemic crisis start? BS initiative

– Basel Committee on Banking Supervision (2013). Global systemically important banks: updated assessment methodology and the higher loss absorbency requirement, BCBS Paper, 255.

– Caballero, R. and Simsek, A. (2009). Complexity and Financial Panics, NBER Working paper, 14997.

– Caruana, J. (2010). Macroprudential policy: working towards a new consensus. Speech at the High Level meeting on the Emerging Framework for Financial Regulation and Monetary Policy, April 23.

– Committee on the Global Financial System (2012). Operationalizing the selection and application of macroprudential instruments. CGFS Publications No. 48.

– Drehmann, M. and Tarashev, N. (2011). Systemic Importance: Some Simple Indicators, BIS Quarterly Review, 1103.

– European Central Bank (2010). Financial Stability Review. June 2010, pp. 138-146.

– Geanakoplos, J. (2009). Solving the Present Crisis and Managing the Leverage Cycle, testimony by the Financial Crisis Inquiry Commission.

– Wagner, W. (2010). Diversification at financial institutions and systemic crises, Journal of Financial Intermediation, 3, 373-386.

Selective bibliography of systemic risk indicators:

Signaling theory and threshold models:

– Committee on the Global Financial System (2012). Operationalizing the selection and application of macroprudential instruments. CGFS Publications No. 48.

– Lo Duca, M., Peltonen, T. (2013). Assessing systemic risks and predicting systemic events, Journal of Banking and Finance, 37(7), 2183-2195.

CoVaR:

– Cao, Z. (2013). Mult-CoVaR and Shapley value: A systemic risk measure. Working Paper.

– Adrian, T., Brunnermeier, M.K. (2008). CoVaR. Federal Reserve Bank of New York Staff Reports No. 348.

Marginal expected Shortfall (MES) and SRISK

– Acharya, V.V., Pedersen, L.H., Philippon, T., Richardson, M. (2010). Measuring systemic risk. Working Paper.

– Acharya, V., Engle, R. and Richardson, M. (2012). Capital Shortfall: A New Approach to Ranking and Regulating Systemic Risks. American Economic Review, 102(3), 59-64.

Distress Insurance Premium (DIP):

– Huang, X., Zhou, H., and Zhu, H. (2009). A framework for assessing the systemic risk of major financial institutions. Journal of Banking and Finance, 33(11), pp. 2036-2049.

Banking Stability Index (BSI)

– Segoviano, M., Goodhart, C. (2009). Banking stability measures. IMF Working Paper No. 09/4.

Composite Indicator of Systemic Stress (CISS):

– Hollo, D., Kremer, M. and Lo Duca, M. (2012). CISS – a composite indicator of systemic stress in the financial system. ECB Working Paper No.1426.

Principal Component Analysis (PCA):

– Billio, M., Getmansky, M., Lo, A. and Pelizzon, L. (2010). Measuring Systemic Risk in the Finance and Insurance Sectors. NBER Working Paper No. 16223.

Network:

– Cont, R., Moussa, A. and Santos, E.B. (2010). Network Structure and Systemic Risk in Banking Systems. Working paper.