BSI Economics Consensus conducts a survey among a panel of economists working in France, internationally, and for public, private, institutional, and academic organizations. The consensus asks these specialists about economic and financial issues to identify the challenges for the coming months.

We would like to thank all the economists, strategists, and academics who have participated in the Consensus since its launch: Marie Owens Thomsen (Chief Economist, CA-Indosuez Wealth Management), Adrien Pichoud (Chief Economist, SYZ Asset Management), Sébastien Barbé (Head of Emerging Markets Strategy, Crédit Agricole CIB), Didier Borowski (Head of Macroeconomics, Amundi Asset Management), Philippe Waechter (Natixis A.M.), Julien Marcilly (Chief Economist, Coface), Olivier Chelma (Chief Economist, Afep), Christopher Dembik (Head of Economic Research, Saxo Bank), Julien Moussavi (Head of Economic Research, Beyond Ratings), Arthur Jurus (Economist and Strategist, Mirabaud Asset Management), Anna Sienkiewicz (Economist, Crédit Agricole S.A.), Paul Chollet (Economist, Crédit Mutuel Arkéa) Jézabel Couppey-Soubeyran (Paris 1 Panthéon-Sorbonne University), Mathilde Viennot (Chief Economist at FFA), Martine Carre-Tallon (Professor, Paris Dauphine University, PSL), Sabrina El Kasmi, Victor Lequillerier (Economists, BPIfrance), Julien Acalin (John Hopkins University), Mourtaza Asad-Syed (Investment Director, Yomoni), Charles Bonati (DFCG). As well as economists from the following institutions whose names cannot be disclosed: AFSE, AMF, AXA AM, BNP Paribas, Caisse des Dépôts, CEPII, CERDI, China Economy Podcast, Coe Rexecode, European Commission, Direction Générale du Trésor, Engie, Euler Hermes, Groupe Alpha, IEDOM, Natixis, OECD, Oxford Economics, Peterson Institute for International Economics, Science Po Toulouse, Société Générale, TAC Economics, TSE, and Xerfi.

The opinions expressed by the professionals surveyed are personal and do not reflect those of their institutions. The result presented by this consensus is based on an aggregation of the views of each expert: the view presented does not represent the convictions of each expert taken separately.

BSI Economics Consensus December 2017:

Consensus concerns

This latest Consensus for 2017 is in line with the previous issue: convictions are weak, while few events are likely to occur. Economists remain cautious about an acceleration in US economic activity, which would imply more than three rate hikes by the Fed next year, and about a EUR/USD exchange rate above 1.20 in early 2018. Furthermore, opinions remain divided on possible tensions in the Chinese banking system and on the resilience of emerging market currencies over the next six months. Finally, and more surprisingly, 50% of experts anticipate a Bitcoin price that will remain above USD 10,000. This is a cautious but nevertheless significant belief in the disruptive nature of cryptocurrencies.

1 – CONSENSUS ON THE MARGINS OF THE FED AND MAJOR FINANCIAL INSTITUTIONS:

The US economy improved in the second half of the year. Economic activity accelerated, leading the US Federal Reserve (Fed) to revise its forecasts upward to 2.5% for 2017 and 2018, while the labor market strengthened, helped by an unemployment rate close to 4%. Finally, the adoption of the tax relief bill is maintaining business confidence and household optimism about their future situation. Despite this favorable environment, the consensus remains cautious. Only one in three economists considers the 2.5% economic growth target for 2018 to be realistic. Above all, the scenario of a faster normalization of the Fed’s key interest rate—i.e., more than three 25-basis-point hikes—would have a low probability of occurring for 55% of the panel. Optimism therefore remains more subdued than the Fed’s outlook for economic activity (less than 2.5% growth), more moderate than that of the major financial institutions (four rate hikes are anticipated by the major US banks), but in line with the financial markets, as the probabilities derived from futures indicate two rate hikes for 2018.

2 – NOTHING SEEMS TO BE ABLE TO STOP THE RECOVERY IN THE EURO ZONE:

The eurozone posted year-on-year growth of 2.6% in the third quarter of 2017, its highest level since the first quarter of 2011. The European Central Bank’s (ECB) recent decisions to reduce net asset purchases had been widely anticipated by the consensus in the previous quarter. While it is now clear that the ECB will begin normalizing its monetary policy in 2018, inflation is still struggling. In this regard, more than a third of the economists surveyed believe that inflation will not slow down in the first half of 2018. However, the energy components of inflation could cause inflation to fall slightly over the same period. With regard to the euro, nearly 80% of respondents (medium to high probability) believe that the single currency could cross the symbolic threshold of USD 1.20 in the first quarter of 2018. Such an appreciation would have a strong impact on asset allocation for more than one in two respondents. It would also be a constraining factor for the ECB’s monetary policy. There is no clear consensus on the political risk weighing on Italy as the general elections approach in March 2018. Nearly one-third of respondents believe that this risk should not weigh excessively on sovereign bond yields across the eurozone, and that the impact on the global economy and asset allocation would be limited if it did. Finally, this positive outlook for the eurozone suggests that European equity earnings growth could be revised upwards in 2018: while there is no strong conviction here, 83% of respondents consider this event to be at least moderately likely, and only 12% believe it will have a low impact on asset allocation.

3 – INCREASED VIGILANCE IN EMERGING MARKETS:

Although Chinese growth performed fairly well in 2017, it is not based solely on solid fundamentals, particularly given that the banking system is exposed to tighter financial conditions, while fiscal leeway appears to be more limited than it seemed. To this end, only 13% of economists in this Consensus consider the probability of renewed tensions in the banking system in 2018 to be low. Such an event would have a significant impact on global growth for nearly 60% of those surveyed. While the majority of economists in the previous Consensus agreed on the resilience of emerging market currencies for 2017, there is no clear consensus on the subject for the first half of 2018. Interest rate hikes in the United States could indeed trigger capital outflows in the form of portfolio investments in emerging economies during 2018. Oil-producing countries will also need to remain vigilant, and not just with regard to their exchange rates. Indeed, the economists surveyed do not seem to expect the targets for reducing oil production to be met, which would lead to a potential rise in prices (only 25% consider this scenario to be highly likely).

2017 oil price scenario

Throughout 2017, economists were surveyed each quarter on the evolution of the price of a barrel of Brent crude. While the two adverse scenarios (Brent below USD 40 and Brent between USD 70 and USD 80) were clearly not popular, the overall trend remains bullish. In fact, only 15-25% of respondents believed that the price of Brent would fluctuate between $60 and $70 at the end of 2017 during the first three quarters of 2017, but now more than half believe this will be the case. At the same time, the least optimistic scenarios for the price of Brent crude oil received the fewest votes. In total, nearly two-thirds of respondents believe that the price of Brent crude will end the year between $60 and $80, compared with just over a third who believe it will be between $50 and $60. In 2018, the evolution of oil prices will clearly depend on the efforts of OPEC (Organization of Petroleum Exporting Countries) member countries to reduce production, following the November 2017 agreement.

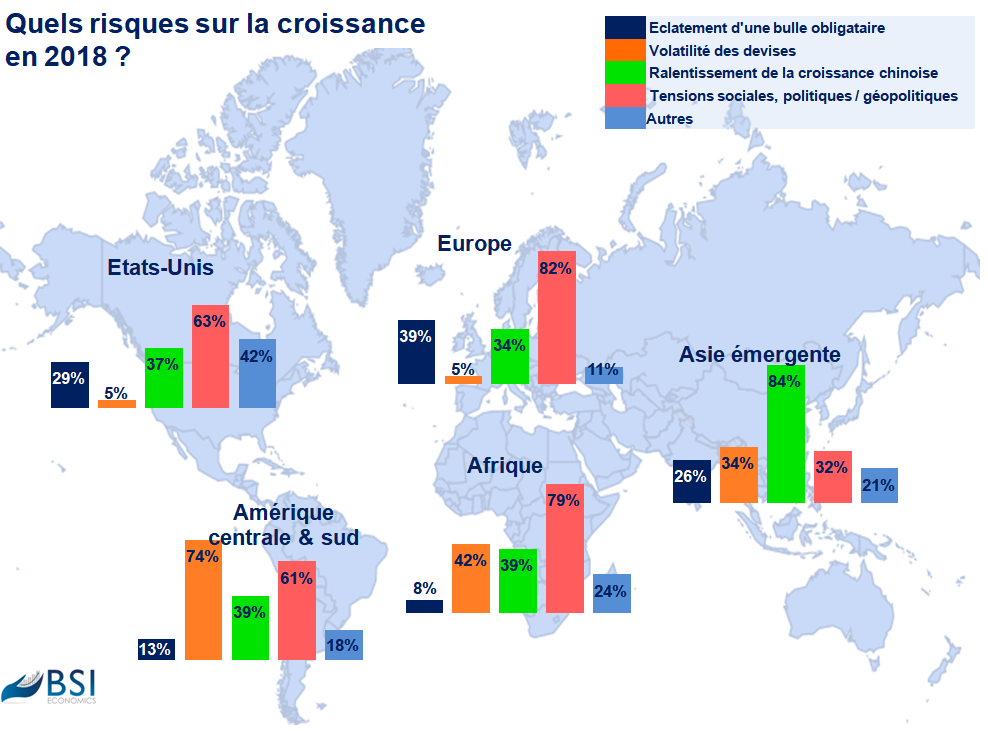

What are the risks in 2018?

This mapping of risks to growth in 2018 shows that no region is likely to be spared in 2018 and that all will be affected to a greater or lesser extent by different types of risk. With the Fed reducing the size of its balance sheet and the ECB now seemingly closer to normalizing its monetary policy, a bond bubble could burst, particularly in Europe (according to 39% of economists surveyed) but not necessarily in the rest of the world. While growth in the United States and Europe is likely to be impacted by the slowdown in Chinese growth (35.5% on average in both regions), it is the various forms of socio-political and geopolitical tensions that are causing concern. These tensions pose a risk to growth in the United States for 63% of those surveyed (unpredictability of the current administration’s diplomatic response, particularly on North Korea and Iran) and 82% in Europe (independence movements in Catalonia, general elections in Italy, lack of a coalition in the German Parliament, Brexit in the United Kingdom, tensions between Poland and the European Union, etc.).

In emerging countries, the risk of a slowdown in Chinese growth would have a clear impact both through foreign investment and, above all, on imports from the « Middle Kingdom. » Such a situation would affect all emerging regions, particularly emerging Asia (84% compared to 39% in other regions). Currency volatility would also be a significant issue there, unlike in Europe and the United States, according to economists, with a peak of 74% in South America (compared to 42% in Africa and 34% in emerging Asia). The prospect of interest rate hikes by the Fed raises fears of downward pressure on emerging market currencies. In addition, countries that are highly dependent on commodity exports are likely to continue to face difficulties in accumulating foreign exchange reserves if commodity prices remain low. This would limit their ability to intervene in the foreign exchange market to support their currencies, which is also the case for countries that need to ensure the sustainability of their pegs. Socio-political and geopolitical tensions appear to be less of a concern in emerging Asia, but more so in Central and South America (61%), where corruption scandals, particularly in Brazil, tend to have a negative impact on growth. This is also the case in Africa (79%): presidential succession in South Africa, tensions in Kenya, conflict in the Central African Republic, and/or the risk of terrorism (Nigeria and Burkina Faso, for example).