Summary:

– Financing growth in Europe remains difficult today.

– Led by the Commission, the Capital Markets Union seeks to develop financial markets in order to diversify sources of financing.

– Few safeguards and regulations are currently planned to stabilize markets that are, after all, volatile.

Proposed by Jean-Claude Juncker, President of the European Commission, and championed by Jonathan Hill (Commissioner for Financial Services), the establishment of a Capital Markets Union (CMU) seeks to strengthen growth and financial stability by improving capital allocation and risk sharing within the European Union (EU).

The stated objective, announced when the project was presented in February 2015, is to have it in place by 2019. A consultation phase took place between February and April 2015, with the aim of presenting a draft law at the end of 2015. This project, which addresses the financing structure of the European Union, is a long-term undertaking. Although the CMU is still in the planning stages, many questions are already being asked about the form it will take in the future.

1 – Fragmentation and the major influence of banks within the EU

Financial integration in the European Union, and equally in the eurozone, has stalled. Financial institutions are tending to reduce their external positions within and outside the EU and to retreat to their national markets ( Bouvatier and Delatte, 2015), mainly due to their fragility and their tendency to buy national sovereign debt[1]. However, such a retreat makes European economies more vulnerable to asymmetric shocks, which, in the context of the eurozone, weakens monetary union (see theories of optimal currency areas).

In addition, the European Union’s financing structure is largely dominated by the banking sector, with 74% of the economy’s financing coming from bank loans (Goldstein and Véron, 2011). However, recent crises have damaged the balance sheets of European banks, causing a contraction in the loans they grant and reducing their ability to finance economic recovery. In the United States, one of the reasons cited for the stronger recovery is the lower dependence on bank credit (24% in 2011, see Goldstein and Véron, 2011) and the greater resilience of financial markets as a source of financing.

As a result, the credit market is highly fragmented within the EU. The rates at which small and medium-sized enterprises (SMEs) can borrow vary greatly from one country to another (Figure 1).

Chart 1: Spread with Germany of credit rates granted to SMEs

Source: Al-Eyd.A and Berkmen.P, 2015

Such divergence in credit conditions increases the likelihood of asymmetric shocks and hinders the return to growth in the most fragile countries (Greece, Portugal, Spain, Italy, etc.).

Sluggish bank financing of growth and stalled integration are the two initial observations that led to the launch of the Capital Markets Union (CMU) project. The latter has two objectives: to improve the functioning of financial markets and to establish better risk sharing in order to strengthen their resilience.

2 – Improving the functioning of financial markets by strengthening supply and demand

The CMU seeks to broaden access to capital markets to new players, such as SMEs and infrastructure projects, in order to diversify sources of financing. To create an attractive single market, legislative convergence is necessary (legal framework for corporate bankruptcy, convergence of tax rates, reduction of the tax advantage of debt over equity, etc.), but this can only be achieved in the long term and will be the subject of tough negotiations (Hache, 2015). In order for a greater number of players to have access to the debt market, barriers to entry need to be lowered by reducing financial reporting or rating requirements for SMEs. However, only a small number of SMEs will be able to issue debt on the capital market, while the rest will remain dependent on banks, and it is the securitization market that is being targeted to facilitate their financing. Capital markets are very little used in Europe, especially when compared to the United States (Chart 2).

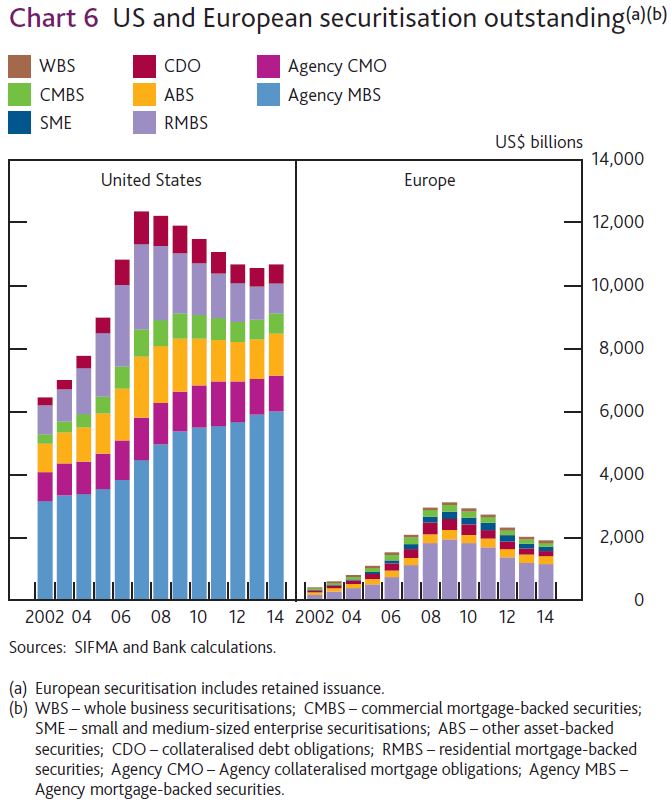

Chart 2: Outstanding securitized instruments in the United States and Europe

The CMU is therefore seeking to revive « good » securitization by easing capital requirements for banks under Basel III (under discussion). But reviving this market is far from easy. In the United States, nearly 50% of the securitization market is accounted for by the government agencies Fannie Mae and Freddie Mac[2](Chart 2, « Agency MBS »). In addition, the ABS purchase program conducted by the ECB since the start of the quantitative easing program with the aim of reviving this market has not produced the expected results, as ABS issuance declined in May 2015 and the ECB reduced the amount purchased under quantitative easing to €6 billion (compared with €10 billion in previous months). Without public support, these markets are therefore not viable in the short term (Hache, 2015).

Another challenge is to strengthen the supply of financing by attracting new players to the financial markets. Again, compared with the United States (Chart 3), EU households participate very little in financial markets, and most of their assets are in the form of bank deposits.

Figure 3: Composition of household financial portfolios

However, encouraging household participation in financial markets is not without risk and cannot be achieved without an appropriate system of guarantees (Véron, 2015), and such a change in practices can only be achieved in the long term. Furthermore, depriving banks of a fraction of their deposits will only increase their dependence on the debt market and risk weakening them.

Other players such as pension funds and insurers can be mobilized in the long term, but the former do not yet have the necessary scale in a continent where the funded pension system is not yet dominant. The latter are very limited by Solvency II in their ability to purchase financial securities, and while reforms are being discussed to remove these barriers, in the short term insurance companies have little room for maneuver. In the short term, the EMU will therefore have to call on investment banks to keep these capital markets alive, thereby strengthening the banks’ influence in financing the economy, contrary to the initial problem of excessive dependence on bank financing (Hache, 2015). We are already seeing renewed competition between investment banks in the growing management of bond issues undertaken by non-financial companies to finance themselves.

3 – Better risk sharing for greater financial stability

By facilitating and diversifying access to finance for EU companies, the CMU seeks to improve capital allocation and strengthen the resilience of the economy and its fragility in the face of banking crises. In addition, by broadening the range of players in this capital market, risk allocation should be optimized and risk dispersion should reduce the impact of a major shock. The corollary of widespread risk sharing and household participation in capital markets is that households, suffering greater losses, adjust their consumption more sharply. In addition, pension funds could also suffer significant losses (as in the case of ENRON in 2001), with disastrous consequences for retirees. As securitization has shown, better risk distribution does not mean that risk disappears. For the CMU to be credible to these new players, guarantees and safeguards must be put in place.

By seeking to reduce the weight of banks in the financing of the economy, it is shadow banking[3](which refers to any banking activity not carried out by a bank, such as maturity transformation or liquidity management) is favored by this UMC project, through securitization or liquidity on the repo market[4]market (Gabor and Vestergaard, 2015). However, no details have yet been provided regarding the regulations to be put in place to support the strengthening of these markets, most of which are currently unregulated (Anderson et al., 2015).

Conclusion

The Capital Markets Union is based on a proven diagnosis of sluggish European financial integration, fragile growth financing, and an underdeveloped capital market in Europe, leaving room for improvement.

However, although the CMU is still only a project in the consultation phase, very few details have been provided regarding the safeguards and regulations needed to ensure the stability of these markets.

Notes:

[1] The reason for this debt purchase is both in response to bailout plans or guarantees provided by governments, and a desire to avoid exposure to other poorly rated sovereign debt. It should also be taken into account that governments have issued a lot of debt, so banks automatically hold more of it.

[2] By pooling mortgage loans and real estate loans and securitizing them, these two agencies enable the existence of a secondary market. These agencies were hit very hard by the subprime crisis and were bailed out to the tune of $155 billion. They have since been nationalized but continue to offer the same services.

[3] Comprising securitization vehicles, money market funds, broker-dealers, etc.

[4] Repos, or repurchase agreements, are financial transactions in which securities are exchanged for liquidity (at a discount) for a predetermined limited period of time. This financial tool is mainly used as a source of short-term liquidity.

References:

Anderson.N et al., 2015, “A European Capital Markets Union: implications for growth and stability”, Financial Stability Paper No. 33 – February 2015,

Bouvatier.V and Delatte.A-L, 2014, “Eurozone bank integration: EU versus non-EU banks”, Vox

Gabor.D and Vestergaard.J, 2015, “The systemic issues buried deep in the market infrastructure plans”, FEPS Policy Brief

Goldstein M. and Véron N., 2011, “Too Big to Fail: The Transatlantic Debate”, Working Paper Series Peterson Institute, WP 11-2, January 2011, No. 11-2. Available at SSRN: http://ssrn.com/abstract=1746982 or http://dx.doi.org/10.2139/ssrn.1746982

Hache.F, 2015, “Capital Markets Union in 5 questions”, Finance Watch

Al-Eyd.AetBerkmen.P, 2015, “Fragmentation and Monetary Policy in the Euro Area”, WP/13/208

Véron.N, 2015, “Capital Market Union A vision for the long term”, Bruegel policy contribution