BSI Economics Consensus consults a panel of economists working in France and internationally within public, private, institutional, and academic structures. Consensus surveys these specialists on economic and financial risks to identify the challenges for the coming months.

This half-yearly edition of the 2019 Consensus reveals information on the following four macroeconomic and financial points:

-

The main issues monitored by specialists;

-

The prevailing macroeconomic and financial scenario;

-

Key events affecting economic growth and asset prices over the next few years;

-

The most widely held beliefs and the most hotly debated issues.

In this latest issue of 2019, the BSI Economics Consensus surveyed 42 economists, 34% of whom work in Economic Analysis and Country Risk, 30% in Strategy, and 36% in academia. The questionnaires were completed between December 9 and 15, 2019.In this final issue of 2019, BSI Economics surveyed 42 economists, 34% of whom work in Economic Analysis and Country Risk, 30% in Strategy, and 36% in academia. The questionnaires were completed between December 9 and 15, 2019.

Main economic and financial concerns

1 – Global trade in a zone of turbulence

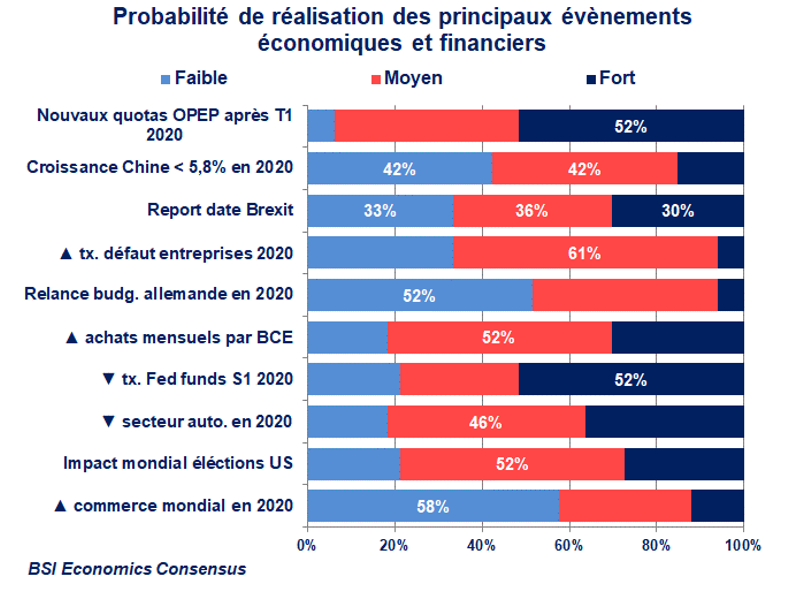

The International Monetary Fund’s (IMF) optimism about a rebound in global trade in 2020 (an event that would have a strong impact on global growth, according to 52% of Consensus economists) is not shared by Consensus economists. In fact, 58% of them believe that the probability of such a rebound is low, which would result in another year of deceleration (rather than contraction).

A further slowdown in global growth could be linked in particular to one of the major events of 2020: the US presidential elections in November. US protectionist policy is unlikely to change, as it is of strategic interest to incumbent President Donald Trump, who will be running for a second term. As such, these elections are seen as having a medium probability of occurring by a narrow majority (55%) of the Consensus, with only 18% believing that this event will have little impact on the global economy (12% for a low impact on asset allocation).

Global trade dynamics would nevertheless have an impact on the automotive sector. Trade tensions have hurt this sector, which contracted in 2019 in several countries (Germany, Japan, China), although other factors also explain this decline (notably the adoption of new environmental standards). No clear consensus has emerged on this issue at this stage.

2 – Advanced economies: secular stagnation on credit?

2019 saw a reversal of the situation on the US monetary policy front. More than half of the economists surveyed expect the Fed to continue easing monetary policy in the first half of 2020. While the impact on the global economy is likely to be relative, 64% of the panel believe that asset allocation will be significantly affected.

In Europe, the issue of Brexit is still on the agenda for 2020. Indeed, after multiple postponements and despite the strengthening of Boris Johnson’s majority in mid-December, the consensus is not strong, which could translate into widespread fatigue on this issue among observers and market players. Brexit is likely to go ahead, but the technical resolutions could take several years. Still in Europe, the potential rise in corporate default rates does not seem to overly concern respondents, even though more than two-thirds of them assess the probability of such a scenario occurring as medium to high, with a definite impact on the global economy (82% believe the impact would be medium to high).

In the eurozone, Christine Lagarde’s arrival at the helm of the ECB and her desire to launch a strategic review to redefine monetary policy in the eurozone seem to be fueling debates about the politicization of the Frankfurt-based institution. 82% of economists surveyed consider it likely (moderate to high) that the ECB will increase its monthly asset purchases as part of its continued QE program in 2020. The impact is expected to be significant on asset allocation for nearly one in two respondents. However, while monetary policy is expected to continue to fuel the financial markets, the panel does not seem convinced by the announcements of fiscal stimulus in Germany.

3- Vigilance on China and oil prices

The scenario of a sharper-than-expected slowdown in Chinese growth does not convince the Consensus: 15% of economists surveyed consider the probability of real GDP growth below 5.8% in 2020 to be low. Such a slowdown will necessarily have a significant impact on global growth and is widely agreed upon (64%). These results should be viewed in the context of China’s significant policy support measures to ensure a controlled slowdown and attempt to offset the negative effects of the trade war (increased public spending, greater efforts to finance infrastructure, lower reserve requirements, etc.). However, with less room for maneuver than in the past, particularly when it comes to preserving financial stability, vigilance is called for, and Chinese growth will remain a topic of concern in future Consensus surveys.

Despite the efforts made in 2019 by the members of the Organization of Petroleum Exporting Countries (OPEC), the price of Brent crude remained lower on average than in 2018 (USD 64 vs. USD 71). As in 2019, sluggish global demand and strong production in the United States are expected to keep downward pressure on oil prices in 2020. This situation would prompt OPEC+ to extend its production quotas beyond the first quarter of 2020, according to 52% of the Consensus.

What are the risks in 2020?

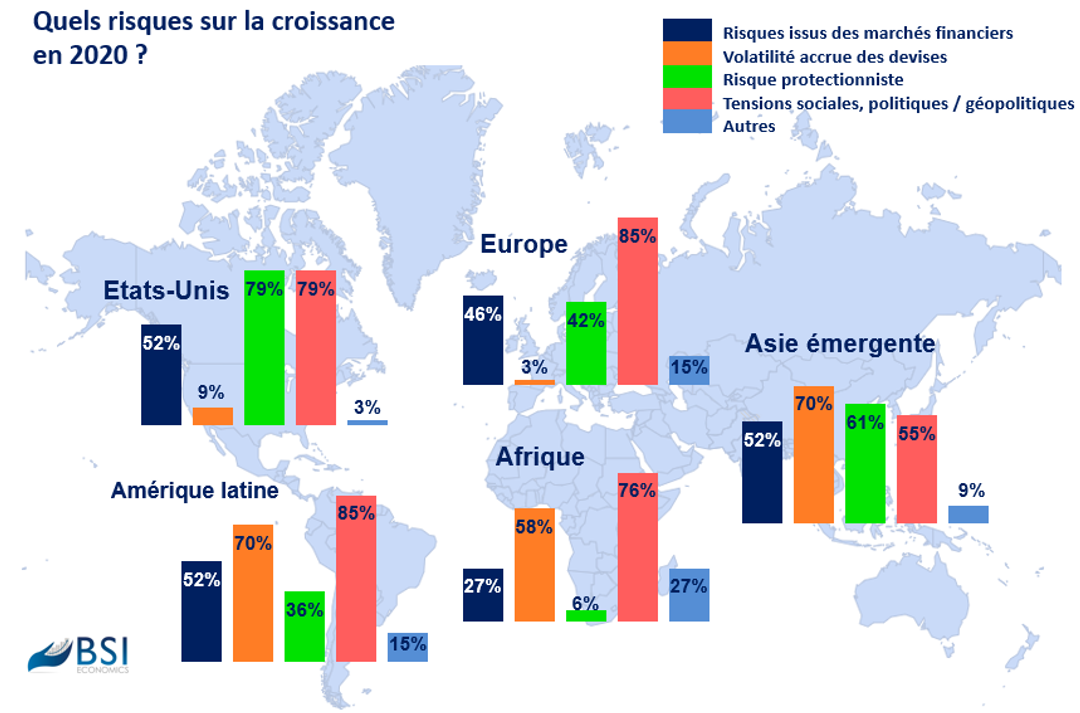

Consensus after consensus, social, political, and geopolitical tensions remain one of the main concerns for global growth. In Europe, Brexit remains at the heart of the uncertainty. The strengthening of Boris Johnson’s majority following the December 12 general election now makes Brexit very likely. However, the terms of the exit remain undetermined, leaving doubt hanging over the European Union’s trading partners. In the United States, a presidential election year would go hand in hand with significant political risk, according to 79% of respondents. Already high in 2019, this risk would remain high in Latin America for 85% of the panel. The deterioration in the social climate (Chile, Ecuador, Bolivia) had a negative impact on currencies across the continent at the end of 2019. In Argentina, the new president will have to convince and reassure investors about the country’s ability to avoid default. In Africa, the political situation in Algeria, high social risk, and security risks in the Sahel region lead 76% of economists to consider growth prospects potentially vulnerable to political risk. In Asia, a slight majority (55%) see this risk as a potential obstacle to growth. However, several countries are suffering from a deteriorating political climate (Hong Kong, Iran, Iraq, Lebanon).

Consensus economists consider protectionist risk to be significant in 2020, but less so than in 2019. This result can be explained by the latest agreement in principle between the United States and China, which includes a postponement oftariffincreases on nearly $160 billion worth of products imported from China. However, several issues remain subject to a high degree of uncertainty (intellectual property protection, technology transfer). The risk of protectionism is seen as most likely in the United States (79% of respondents) and Asia (61%), and less so in Europe (42%), despite recent US threats to impose surcharges on French products in response to the GAFA tax.

The Fed’s accommodative monetary policy argues for a reduction in the risk of emerging market currency volatility, which would nevertheless remaina significant risk in 2020 (Asia: 70%, Latin America: 70% and Africa: 58%). In Latin America, the political climate and the extent of the decline in Chinese demand will be two key factors in determining this volatility. In Africa, the South African rand will be most susceptible to downward pressure (especially if it loses its investment grade status), and the ECO project in West Africa is already fueling uncertainty.

More accommodative monetary policies help to support economic activity, but such policies can also undermine financial stability. This is a risk that would affect all regions outside Africa. This is particularly the case in China and more generally in Asia (according to 52% of respondents), where private debt is already high, a situation that has attracted the attention of the IMF.