On August 20, BSI Economics organized a meeting to discuss economic developments in emerging countries. The meeting brought together a trading room manager from a French institutional organization, a manager from an American strategy consulting firm, an economic manager from a French institutional organization, and an economic head from a Swiss private bank.

The discussions focused on three major themes:

1) Chinese economic activity. In China, the depreciation of the renminbi is in line with the slowdown in activity and the contraction of the current account balance. The reduction in tradable volumes (floating) on certain developed bond markets, the decline in the volatility of Chinese sovereign bonds, coupled with the integration of part of the Chinese bond universe (government bonds) into bond indices, will structurally contribute to a shift of flows towards the emerging class and thus to a tightening of credit spreads.

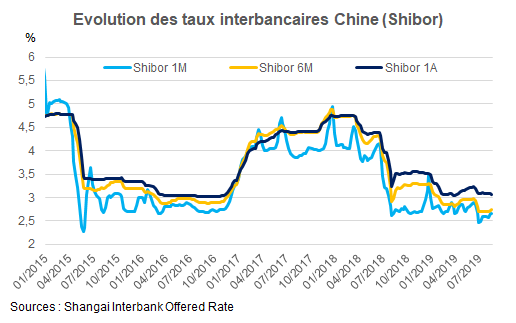

2)Financial stability. Uncertainty surrounds the potential appreciation of the USD despite the expected cuts in US interest rates. Central banks’ room for maneuver is becoming limited, but interventions by the US Treasury remain possible. The risk of financial instability in China appears to be reduced at this stage, despite the recent bailouts of two banks by the People’s Bank of China (PBoC). These bailouts had no systemic implications and only led to a slight increase in SHIBOR* (interbank market) rates, in contrast to the episodes of stress that occurred in 2015 and 2017 (see chart below). If the Chinese authorities introduce new measures to support economic activity (likely in the second half of 2019), corporate and local government debt will once again need to be scrutinized. The aim will be to assess whether the recent improvements in financial stability will quickly be undone.

3) The risk of capital outflows in the event of a political shock. Geopoliticalrisk could be more significant for emerging markets than trade tensions. The risk of armed conflict between Iran and the US seems limited, as economic sanctions are already having a considerable impact. On the other hand, there is consensus on the risks associated with the protests in Hong Kong and, to a lesser extent, in Kashmir. Furthermore, the increase in the proportion of passive investments in emerging countries is likely to amplify the downward reaction of markets in the event of a major political shock.

*Excluding overnight SHIBOR rates