This half-yearly edition of the 2019 Consensus reveals information on the following four macroeconomic and financial points:

-

The main issues monitored by specialists;

-

The prevailing macroeconomic and financial scenario;

-

Key events affecting economic growth and asset prices over the next few years;

-

The most widely held beliefs and the points that are the subject of the most heated debate.

In this latest issue of 2018, the BSI Economics Consensus surveyed 44 economists, 25% of whom work in Economic Analysis and Country Risk, 39% in Strategy, and 36% in academia. The questionnaires were completed between May 29 and June 8, 2019.

1 – A bipolarization of the global economy at the expense of Europe

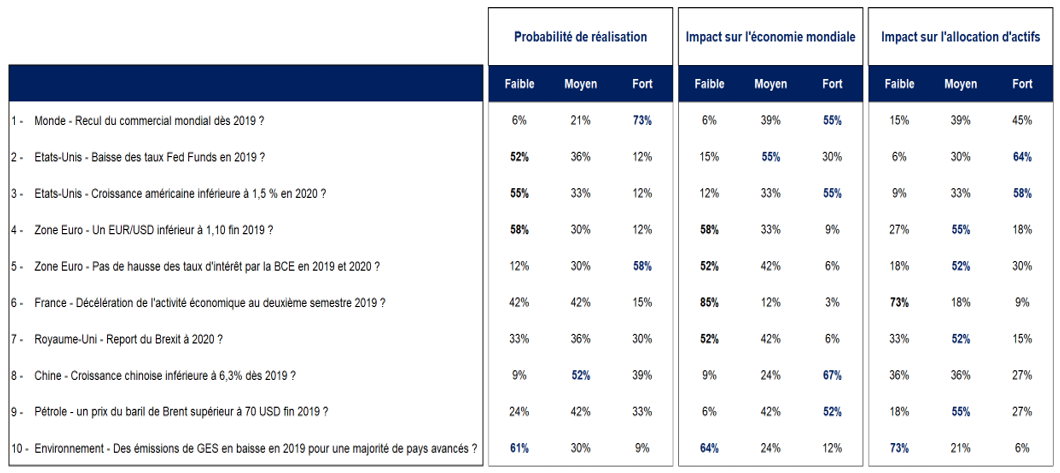

According to 98% of respondents, the decline in trade in goods would have an overall negative impact on the global economy. However, this decline is not perceived as a threat requiring intervention by the US Federal Reserve (Fed). In fact, a slight majority of the Consensus favors the scenario of no cut in key interest rates by the Fed and also assigns a low probability to a slowdown in the US economy in 2020 below 1.5%, which translates into no recession.

US economic fundamentals remain strong. US consumers are benefiting from low inflation, a robust labor market, and favorable refinancing and mortgage opportunities linked to lower mortgage rates. While private investment is slowing, the US trade balance is expected to continue improving from the first quarter, mainly due to a sharp decline in imports. The assumption underlying this outlook is that a trade agreement will be reached before tariffs are extended to consumer goods, which would nevertheless penalize US households, who could be affected by these tariffs.

In line with these expectations, few anticipate a stronger appreciation of the US dollar (only 12% of respondents consider the probability of the USD appreciating against the euro to be high). As a result, the EUR/USD exchange rate is likely to remain above 1.10 for the long term. The interest rate differential between the European Central Bank (ECB) and the Fed is expected to remain unchanged in the absence of any rate movements in 2019. Growth in the eurozone, which has been severely affected by threats to German industrial exports, should nevertheless benefit from the continued momentum of the French economy in the second half of 2019. Indeed, 42% of economists surveyed do not anticipate a slowdown in activity in France.

Finally, there is no strong conviction that Brexit will be postponed until 2020. This event seems to have become an exogenous variable that is difficult to predict and therefore not yet fully integrated into economic forecasts. However, 67% of the panel believe that it would have a significant, even strong, impact on asset allocation.

Specialists are focusing their attention on the United States rather than Europe. The impact of a EUR/USD exchange rate below 1.10, an increase in the ECB’s key interest rate, or a slowdown in European economic activity would not affect asset allocation. On the other hand, a change in interest rates or a more marked slowdown in the United States would contribute to changing the balance of asset prices. This is one of the main implications of the ongoing trade negotiations: economic and financial balances are giving way to a bipolarization between the United States and China, at the expense of Europe.

2 – Chinese slowdown against a backdrop of declining global trade

While US President Donald Trump is escalating the trade war by seeking to impose tariffs on Mexico in addition to those ratified a few months ago on China, nearly three-quarters of respondents (73%) believe that global trade growth could dry up as early as this year, even as the US economy begins to show signs of weakness (see previous section).

It is against this tense geopolitical backdrop that China’s economic slowdown continues. After higher-than-expected growth in the first quarter (6.4%), the latest economic indicators suggest that deceleration will once again become the norm in China for the rest of 2019. 81% of the panel surveyed believe that Chinese growth will be below 6.3%—as a reminder, the Chinese authorities’ growth target for 2019 has been set at between 6% and 6.5%. An expansionary fiscal policy and increased monetary policy support should enable the authorities to sustain economic activity and also limit the impact of US protectionist barriers. These measures should therefore enable the growth target to be met in 2019. Given the significant weight of the Middle Kingdom in the global economy, two-thirds of respondents agree that this economic slowdown will have a strong impact on the global economy, while the impact on asset allocation will be moderate.

While oil prices remain at the center of debate, there is no consensus at this stage on their overall trend between now and the end of 2019. However, a new agreement reached on July1 between members of the Organization of Petroleum Exporting Countries (OPEC) to extend production quotas into the second half of 2019 could trigger a further rise in prices. Environmental issues (reduction of GHG emissions in advanced countries) do not seem to concern the economists surveyed in the short term.

3 – What are the risks in 2019?

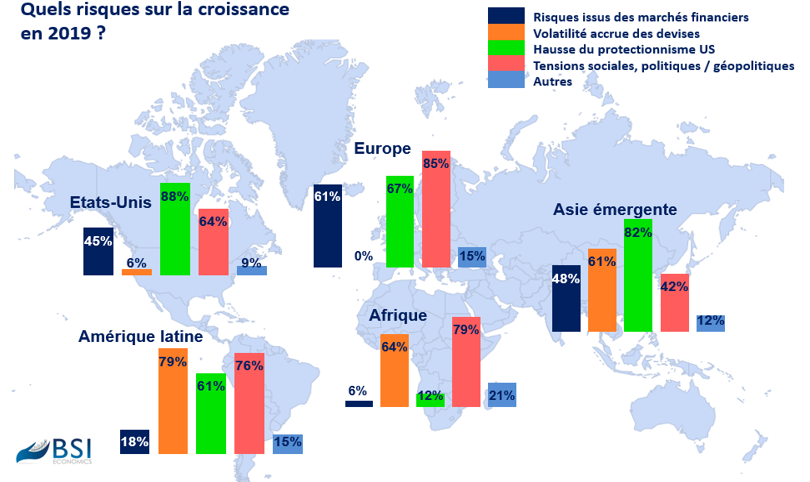

Political tensions are identified as the most significant risk to European economic growth in 2019, with a large majority (85% of respondents) agreeing. While the rise of Eurosceptic and populist parties was ultimately contained in the May 2019 European elections, the dispersion of votes offers little visibility at this stage on potential alliances within Parliament. The first half of 2019 saw numerous twists and turns in the Brexit saga. A new deadline has been set for October 31, 2019, and the prospect of a hard Brexit is gaining momentum with the resignation of former Prime Minister Theresa May. In the United States, political risk is on the rise compared to the previous Consensus (64% vs. 55% of respondents), with Donald Trump’s unpredictability contributing to sometimes tense relations with several countries (notably China, Turkey, Russia, and Iran). In Latin America, this risk also remains significant (76% of respondents), due to deep political crises (Venezuela, Nicaragua), the potential impact of fiscal reforms (Mexico, Brazil), and the elections to be held in October in Argentina. The resumption of conflict in Libya, the rise of terrorist risk in the Sahel, and elections in a deteriorating social climate (Algeria and even Tunisia) are all factors that lead 79% of the panel to consider political tensions to be significant in Africa.

One of the implications of political risk from the United States is increased trade risk with the rise of protectionism. Outside Africa, all regions would be affected, especially Europe (67%), emerging Asia (82%) and even more so the United States (88%), where American companies appear to be suffering from the tariffs imposed by the US administration and where the trade balance with China continues to deteriorate. The escalation of protectionist tensions with China appears to have begun, despite the trade truce.

After a sharp fall in the main emerging currencies against the USD in 2018, this risk is declining according to the panel and therefore appears to be less significant in 2019 (Asia: 61% vs. 79%; Latin America: 79% vs. 87%). The prospects for net capital inflows in line with the first half of the year and a status quo from the Fed in 2019 (or even a cut in interest rates) would help to limit this risk in emerging economies. However, the risk of currency volatility remains significant in Argentina (inflationary risk and sovereign risk), Turkey (external imbalances, geopolitical risk) and South Africa (risk of losing investment grade status).

Financial market risks are considered significant in Europe by 61% of respondents, but do not represent a majority view in other regions. Concerns are focused particularly on the Italian banking sector. However, this risk could increase in the second half of 2019.

contact@bsi-economics.org