Summary:

· Bitcoin is neither a currency nor a commodity, but rather a means of transaction and potentially a financial asset.

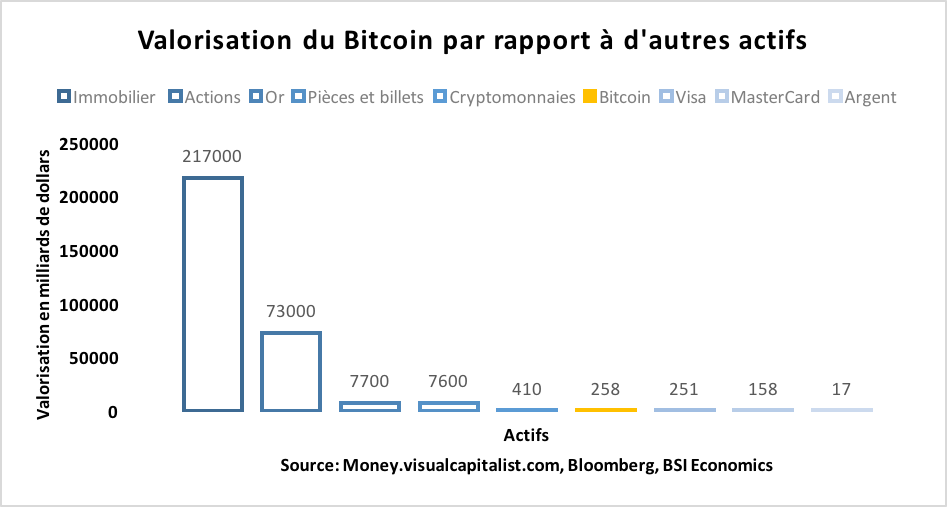

· Bitcoin is now valued at fifteen times more than the entire global silver stock, more than the American companies Visa and MasterCard (specializing in payment methods), and its valuation represents nearly 3.5% of the global gold stock, 3.5% of all coins and banknotes in circulation worldwide, 0.35% of the global stock market, and 0.1% of the global real estate market.

· Bitcoin’s valuation is skewed by the failure to take into account the replicability of the technology, the security issues inherent in the way bitcoins are stored, the environmental impact of producing and verifying bitcoin transactions, the political risk associated with cryptocurrency regulation, and the launch of competing and/or official cryptocurrencies by central banks.

· Bitcoin is a speculative bubble that is just waiting to implode. Caution is therefore advised, especially for novice investors.

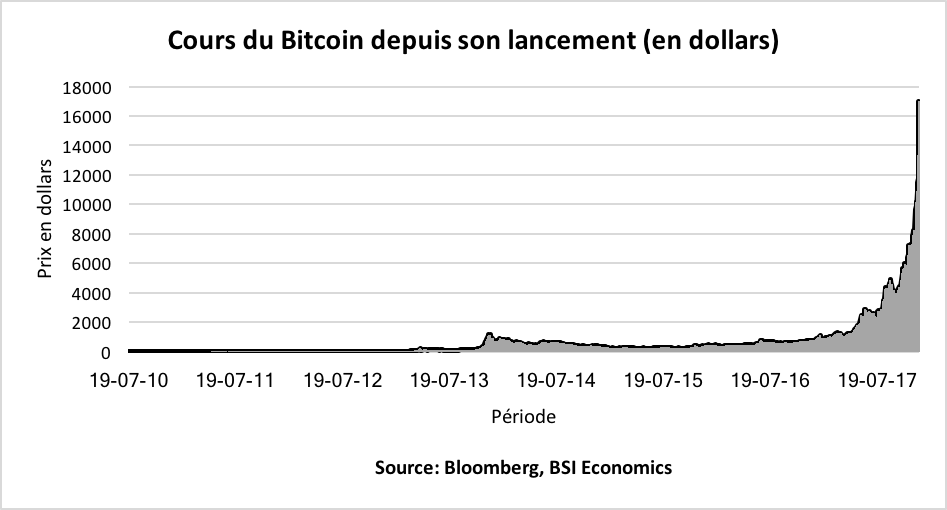

Day after day, the price of Bitcoin continues to break new records, crossing the $17,000 mark on Thursday, December 7, after a 134% increase in the last 30 days alone. The rise is even more staggering when you look at the price history. Bitcoin has appreciated by more than 170 million percent since its launch in January 2009, meaning that $1 invested at the outset would now be worth around $1.7 million.In other words, an initial investment of $600 would have turned any investor into a billionaire, effectively making them one of the world’s 2,000 richest people. But therein lies the problem: the promise of quick and easy riches fascinates and fuels the relentless rise in the price of Bitcoin, but for how long?

Bitcoin was created in 2009 by one or more people under the pseudonym Satoshi Nakamoto. It is a cryptocurrency, or digital currency managed by an algorithm that (1) does not depend on any state, (2) does not depend on any central bank, (3) is not regulated, and (4) is entirely dematerialized. More specifically, Bitcoin was designed as an electronic payment system based on cryptographic proof rather than trust, allowing any transaction between two parties without the presence of a trusted third party (usually a bank). The emergence of cryptocurrencies, and Bitcoin in particular, can be seen as a direct consequence of citizens’ loss of trust in the financial system on the one hand and in the state on the other. The problem is that Bitcoin’s strengths may also be its Achilles’ heel.

1- How can Bitcoin be valued?

The surge in the price of Bitcoin has not gone unnoticed, with discussions about its « fair value » now bringing together geeks, financial experts, and other novice small investors. While some, such as hedge fund manager Mark Yusko, see Bitcoin’s price reaching $400,000 in the coming years, others, such as Warren Buffet and Jean Tirole, believe that Bitcoin’s intrinsic value is close to $0.

In order to estimate the « fair value » of Bitcoin, we need to define what Bitcoin is. What we do know, thanks to Satoshi Nakamoto’s white paper, is that Bitcoin was originally designed as a means of electronic payment. But is it a currency? Is it a new kind of commodity? Is it a financial asset? And is it really a means of transaction?

The answer to the question of whether it is a currency is probably no. While currency is supposed to be the most liquid asset in an economy, Bitcoin is a highly illiquid asset with very large spreads between platforms (sometimes more than 20%).

Furthermore, according to the functionalist approach, currency fulfills three essential functions: (1) unit of account, (2) medium of exchange, and (3) store of value.

Does Bitcoin fulfill these functions? At first glance, Bitcoin does not fulfill the function of unit of account, at least today, due to its excessive volatility (110% annual volatility over the period 2010-2017), so much so that the economic value of Bitcoin is generally represented in dollars or euros, while the economic value of the goods and services that Bitcoin can be used to purchase is very rarely represented in Bitcoin. Secondly, Bitcoin does not fully fulfill the function of an intermediary in exchanges. A currency is only an intermediary in trade if it is accepted by everyone for the exchange of goods and services, but Bitcoin is relatively unaccepted as a means of payment around the world, although this could change in the future (Japanese law, for example, has recently recognized cryptocurrencies as legal forms of payment). Thirdly, Bitcoin does not fully fulfill the function of a store of value, again due to its excessive volatility (the maximum daily return observed was +67.71% and the minimum daily return observed was -45.17% over the period 2010-2017), with the purchasing power it allows to be transferred being extremely unstable over time.Finally, according to the essentialist approach, and more specifically according to the German historical approach, currency is based on state power, which gives it political power , whereas Bitcoin does not depend on any state and therefore has no political dimension.

To the question of whether it is a commodity, the answer is definitely no. Although many cryptocurrency experts define Bitcoin as comparable to a commodity, and more specifically to a precious metal such as gold—some calling Bitcoin « digital gold »—the comparison between the two seems extreme. Although Bitcoin is available in limited quantities (21 million bitcoins will be available by 2140, minus any bitcoins lost here and there or frozen due to coding errors), and an increase in mining difficulty is planned, just like gold and silver, whose quantity on Earth is also limited and whose mining difficulty increases over time, this scarcity of Bitcoin is not only programmed by humans themselves, but also fictitious since the code used to generate bitcoins is replicable, the code being open source. As a result, the amount of cryptocurrency in circulation is theoretically unlimited, meaning that the value of each cryptocurrency is based on the trust that each user places in it. Contrary to what Satoshi Nakamoto says, trust is therefore one of the key elements in the valuation of Bitcoin.

The answer to the question of whether it is a financial asset is more nuanced. A financial asset is an asset that derives its value from the contractual obligation it represents. Bitcoin, and cryptocurrencies in general, cannot currently be considered financial assets as they are neither officially recognized securities nor contracts (uncertain contractual obligation). However, cryptocurrencies are indeed negotiable and offer investors the possibility of capital gains in return for taking an initial risk (via the futures market, for example). In this respect, Bitcoin is similar to a financial asset.

The creation of Bitcoin futures contracts on the two Chicago futures markets (CBOE and CME) and on the Nasdaq could change the game by providing a regulated framework for Bitcoin and greater liquidity with the potential arrival of new institutional investors. This could indeed allow for better price discovery and reduce the volatility of Bitcoin prices in the medium term. However, as futures contracts are leveraged contracts, very short-term volatility could skyrocket in times of stress. When the CBOE launched Bitcoin futures contracts on Sunday, December 10, the price of Bitcoin soared by more than 20% on relatively low volumes (approximately $50 million in notional value) and a premium of $1,300 over the spot price[4] on average, indicating the difficulty for traders to arbitrate between the futures price and the spot price. It remains to be seen whether Bitcoin futures contracts will suffer the same fate as poultry futures contracts.

Looking at the current valuation of Bitcoin relative to assets such as real estate, stocks, gold, silver, and coins and banknotes in circulation around the world, we see that Bitcoin is now valued at fifteen times more than the entire global stock of silver, more than the American companies Visa and MasterCard (specializing in payment methods), and its valuation represents nearly 3.5% of the global gold stock, nearly 3.5% of all coins and banknotes in circulation worldwide (while all cryptocurrencies represent nearly 5.5%), nearly 0.35% of the global stock market, and 0.1% of the global real estate market (office real estate, residential real estate, industrial and agricultural land).

Based on the wildest estimates, namely $400,000 for one Bitcoin (Mark Yusko’s prediction), Bitcoin would be worth $6 trillion, a valuation very close to that of global gold reserves and coins and banknotes in circulation . There is no doubt that this valuation is biased.

2- Valuation bias: replicability, security, ecology, and political risk

The first obstacle to Bitcoin’s significant valuation is its replicability. Since Bitcoin’s source code is open to all, the algorithm that oversees Bitcoin mining is infinitely replicable. Thus, although the quantity of Bitcoins created is limited to 21 million units, the quantity of cryptocurrencies that can be produced is in fact unlimited. Furthermore, there are already thousands of alternatives to Bitcoin, such as Ethereum, IOTA, Ripple, Litecoin, Dash, Monero, Stellar Lumens, Populous, Qtum, and Stratis, to name but a few, and many cryptocurrencies have algorithms that are, in principle, more advanced than Bitcoin. In other words, Bitcoin appears to be overvalued in relation to its real potential, as investors tend to confuse Bitcoin with blockchain, when the true value of Bitcoin lies in the blockchain, which is anything but specific to Bitcoin.

The second obstacle to Bitcoin’s significant valuation is the lack of security faced by Bitcoin holders. Although the blockchain is highly secure and information is encrypted during each transaction, no one is immune to large-scale hacking or careless mistakes. A few days ago, NiceHash, a mining company based in Slovenia, whose main activity is to offer miners around the world the opportunity to mine Bitcoin (or other cryptocurrencies for Bitcoin) and keep their earnings (in bitcoins) in a digital wallet, had a bitter experience when more than 4,700 bitcoins worth $64 million were stolen. Similarly, last month, Parity, an online digital wallet for Ethereum holders, was hacked, resulting in a loss of $162 million. Finally, Bitcoin enthusiasts have not forgotten the misfortune of Japanese investors who, in 2014, saw 850,000 Bitcoins[7] disappear from the Mt. Gox exchange platform. This first risk has led many investors to transfer their bitcoins to a wallet stored on a computer or smartphone, or to a hardware wallet called a ledger (USB keys), replacing one risk with another. It is fairly easy to lose or have this type of equipment stolen (although online backups are possible), meaning that Bitcoin’s anonymity can quickly become a disadvantage.

The third obstacle to Bitcoin’s significant valuation is the ecological impact of its production. Can you be environmentally friendly and buy Bitcoin? Probably not. Digiconomist, a platform for analyzing the economic risks associated with cryptocurrencies, reveals that Bitcoin mining generates an annual electricity consumption of 32.5 TWh, which is equivalent to Denmark’s annual electricity consumption or 0.15% of global electricity consumption. Each transaction generates an estimated 240 KWh of electricity consumption, equivalent to the annual consumption of an A+ rated refrigerator. In addition, each transaction generates 118kg of CO2, equivalent to the CO2 emissions of a car traveling 1 km. Finally, a Bitcoin transaction consumes 3,000 times more energy than a credit card payment. In other words, cryptocurrency mining is not environmentally friendly.

The fourth obstacle to Bitcoin’s significant appreciation is political risk. Today, Bitcoin is unregulated and does not depend on any state or central bank. It seems unlikely that countries around the world will allow cryptocurrencies to spread without reacting. As for central banks, they could easily launch their own cryptocurrencies, which would be regulated and controlled while remaining dematerialized. Bitcoin therefore probably has cause for concern.

3- Speculative bubble and major shakeout ahead

By definition, any speculative bubble involves an unsustainable price increase generated by the purchase of an asset with the aim of reselling it at a higher price. But you only have to look at the Bitcoin price curve and listen to the conversations around you (in the media, on public transport, at work) to be convinced that this price increase is unsustainable. As the saying goes, trees don’t grow to the sky.

The behavior of investors around cryptocurrencies is reminiscent of the behavior of another generation of investors in the 1990s around technology stocks. At the time, the revolutionary technology was the Internet. Today, it is blockchain. The collective euphoria generated by the prospects of these two technologies is similar, with ICOs[9] replacing IPOs[10] and speculators seeking quick capital gains without paying too much attention to fundamentals.

Comparing these two periods in more detail, it appears that the euphoria generated by cryptocurrencies is actually even greater than the euphoria generated by technology stocks in the late 1990s. While the average annual return on technology stocks on the Nasdaq was 46% between 1996 and 2000, i.e., over the last four years before the dot-com bubble burst, the average annual return on Bitcoin has been 113% over the last four years, which is much higher than the average return observed during the internet bubble.

Amid this collective euphoria, the Bulgarian government has just realized that it was sitting on a veritable treasure trove, born out of the dismantling of a criminal network in Bulgaria and the seizure of more than 213,000 bitcoins estimated at $3.6 billion, enough to repay about 20% of the country’s debt.

Furthermore, it turns out that a thousand or so investors control 40% of the Bitcoin market (out of 30 million Bitcoin holders worldwide), which, it should be noted, is currently an unregulated market (meaning that the risk is minimal for potential price manipulators). This suggests that a corner—a massive accumulation of bitcoins with the aim of controlling supply and driving up its price—may be underway, similar to what the Hunt brothers did with silver in the 1980s. If this turns out to be the case, then the price of Bitcoin could plummet very sharply and suddenly overnight, as no corner in the history of modern finance has ever lasted very long without a resounding price drop.

Conclusion

The fair value of Bitcoin seems closer to $0 than $17,000, as the current price of Bitcoin on exchange platforms might suggest. This can be explained by a valuation bias and the failure to take into account the replicability of the technology, security issues inherent in the way Bitcoins are stored, the ecological impact of producing and verifying Bitcoin transactions, and the political risk associated with cryptocurrency regulation and the launch of competing and/or official cryptocurrencies by central banks. Furthermore,blockchain is the technology of the future, which is not necessarily the case for Bitcoin, which could turn out to be an empty shell.

Furthermore, there is no doubt that the Bitcoin bubble will implode, even if it is difficult to know the exact timing of the market reversal. As after the implosion of the internet bubble, the big clean-up should allow blockchain to develop in a much healthier and more constructive environment. However, this is likely to have a significant impact on the cryptocurrency ecosystem, with digital currency miners finding themselves heavily indebted due to their massive investments in state-of-the-art data centers (server farms), with revenues in free fall and therefore well below initial expectations, and assets (value of accumulated bitcoins) in sharp decline. Small investors, meanwhile, find themselves, as is too often the case, with massive losses (at least in percentage terms) on their cryptocurrency investments. Caution is therefore advised.

Floris Laly

References

Alain Beitone, Antoine Cazorla, Christine Dollo, Anne-Mary Drai, Dictionnaire des Sciences Economiques(Dictionary of Economic Sciences), Armand Colin, 2007.

Olga Kharif, The Bitcoin Whales: 1,000 People Who Own 40 Percent of the Market, Bloomberg , December 8, 2017

Charles P. Kindleberger, Manias, Panics, and Crashes, Wiley, 2005.

Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, White Paper

Quentin Périnel, Hackers steal $64 million in bitcoins, lefigaro .fr

Notes:

[1] As the price of Bitcoin is not the same on all trading platforms, this is an estimate.

[2] The creator(s) of Bitcoin, and therefore of the first blockchain, are believed to own one million bitcoins valued at $17 billion at the current price of $17,000 per BTC.

[3] However, it should be noted that private currencies have existed in the past, particularly in Scotland in the18th and19th centuries (Scottish Archive Network: http://www.scan.org.uk/knowledgebase/topics/moneyandbanking_topic.htm).

[4] The spot price is the price of Bitcoin on exchange platforms.

[5] Poultry futures contracts were abandoned in July 1993.

[6] A digital database in which all transactions since the launch of the cryptocurrency are recorded.

[7] Equivalent to $14.5 billion at the current exchange rate.

[8] Miners verify and validate all Bitcoin transactions worldwide.

[9] Initial Coin Offering or fundraising through the issuance of digital assets that can be exchanged for cryptocurrencies. Unlike IPOs, ICOs are not regulated.

[10] Initial Public Offering (IPO) or fundraising through the issuance of shares that can be exchanged for currencies.

[11] The Hunt brothers owned between 30% and 50% of the silver market just before its price imploded. In March 1980, the price of silver plummeted by 50% in just four days.