This article is a non-technical summary of the paper written by Julien Acalin (BSi Economics), Olivier Blanchard, and Paolo Mauro, available here.

News:

In the wake of the global financial crisis, public debt-to-GDP ratios have risen sharply in developed countries. While current levels appear sustainable, a new series of economic or financial shocks could undermine the sustainability of public debt. Recent experience in the eurozone has shown that (1) defaults are extremely costly in economic terms and that (2) the spiral between bond interest rates and high debt levels can rapidly deteriorate the dynamics of sovereign debt. Economic growth-indexed bonds can help mitigate these risks: by reducing interest payments when growth is low (and, conversely, increasing them when growth is high), they substantially reduce the debt-to-GDP ratio and the risk of debt levels exploding.

Introduction

The economic arguments in favor of growth-indexed bonds are clear and well documented in the literature (Shiller, 1993, and Borensztein and Mauro, 2004). By indexing interest payments to growth, they limit the increase in the debt ratio when economic growth is weak, reducing the likelihood that the debt will become unsustainable in the long term. These bonds thus reduce the default risk premium, improving the distribution of the debt-to-GDP ratio. However, as interest payments become more volatile, growth-indexed bonds may have to pay a premium to compensate investors for the risk associated with uncertainty about GDP growth. If this premium is too high, the benefits of reducing the risk of debt explosion (upper tail risk) may be more than offset by a faster increase in the debt ratio in the baseline scenario. A recent policy brief from the Peterson Institute for International Economics explores these issues quantitatively.

Lower risk of public debt explosion but a premium to pay

While indexed bonds reduce the risk of debt explosion, as interest payments are proportional to the country’s economic performance, they are nevertheless likely to carry a risk premium relativeto conventional bonds.

This premium depends on four factors:

– Default risk. If indexed bonds are issued in sufficient quantities to reduce the risk of default, this premium works in favor of indexed bonds. A lower risk of default implies a lower premium on public debt in general (whether indexed or not).

– Growth risk. As returns are more volatile and pro-cyclical for investors, they will demand a premium linked to uncertainty about growth. This risk can be reduced if bonds are issued by different countries, preferably with economic cycles that are not highly correlated, which would allow investors to diversify their asset portfolios.

– Novelty risk. Investors, who are unfamiliar with this new financial instrument, may demand a novelty premium due to the difficulty of pricing this asset or doubts about how it works. This risk may disappear quickly.

– Liquidity risk. The introduction of this instrument requires a large and diversified issuance scale. The evolution of novelty and liquidity premiums is difficult to predict, but the experience of inflation-indexed bonds in some developed countries suggests that they may decline rapidly and remain at low levels.

Simulations of the impact of indexed bonds on debt trajectories

This paragraph briefly presents some simulations for Spain, assuming that (a) the debt is unindexed or (b) the entire debt is indexed to economic growth. For more details on the methodology and data used, as well as results for other countries, please refer directly to the Peterson Institute policy brief (Blanchard, Mauro, and Acalin, 2016).

The starting point is the debt dynamics equation, where the change in the debt-to-GDP ratio is equal to:

Where: d is the stock of debt; r is the real effective interest rate on outstanding debt; g is the real growth rate; and s is the primary balance as a percentage of GDP.

The indexed bond pays an interest rateri equal to the economic growth rate plus a constant that equalizes its expected return to that of a conventional bond.

Initially, we assume that the risk premium is zero and that the primary balance is equal to the IMF forecast for each period. The message from this first, highly simplified series of simulations is clear: growth-indexed bonds reduce (or, in this case, eliminate) uncertainty about the future trajectory of public debt.

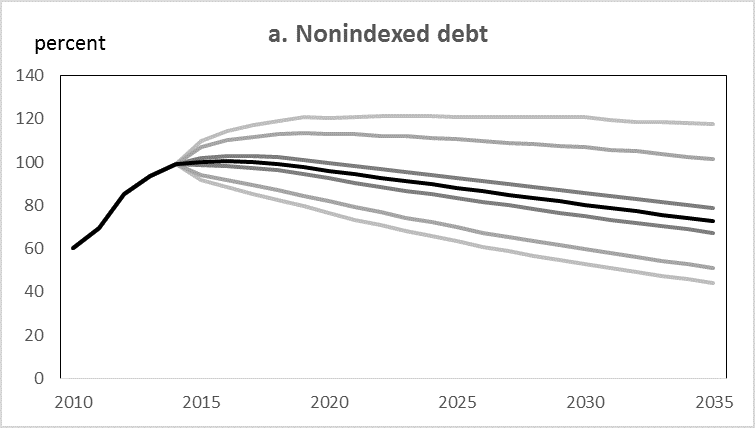

Figure 1 Debt-to-GDP ratio 2010-35 with non-indexed vs. indexed debt, non-stochastic primary surplus, Spain

Sources and notes: Authors’ calculations. The fan charts report the debt-to-GDP paths corresponding to the 1st, 5th, 35th, 50th (solid line), 65th, 95th, and 99th percentiles of the distribution.

We then introduce uncertainty into the primary balance, as well as a default premium. The results reinforce our previous conclusions: the probability that the debt-to-GDP ratio will exceed 140% in 2035 is 10% in the case of conventional bonds, compared with nearly 0% when the debt is indexed.

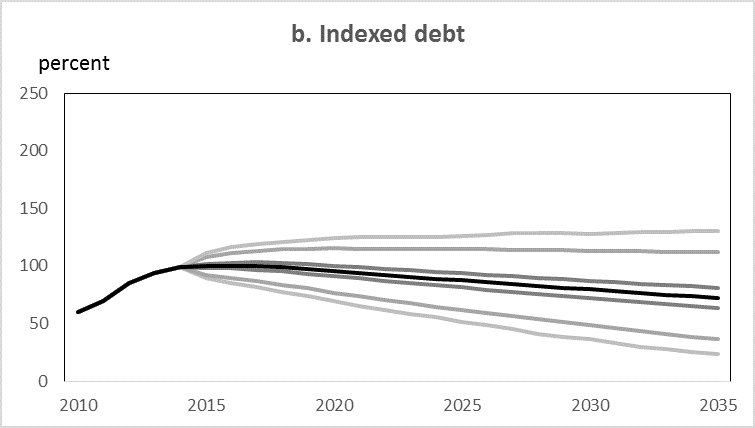

Figure 2: Debt-to-GDP ratio with non-indexed vs indexed debt, stochastic primary surplus, 2010-35, Spain

Sources and notes: Authors’ calculations. The fan charts report the debt-to-GDP paths corresponding to the 1st, 5th, 35th, 50th (solid line), 65th, 95th, and 99th percentiles of the distribution.

Finally, the above simulations ignore the impact of a premium linked to liquidity, the novelty of the instrument and uncertainty about growth. Following a review of the experience with inflation-indexed bonds and various discussions with investors, we believe it is reasonable to expect that once the novelty and liquidity premiums have stabilized, the sum of these premiums will be below 100 basis points.

Assuming that the sum of these three premiums is equal to 100 basis points over the period studied, the probability that the debt-to-GDP ratio will exceed 140% in 2035 falls from 0% to 7%. The gain is smaller, but still significant. However, the effect of the premium is non-linear: assuming that this sum is equal to 200 basis points, the probability of a debt ratio above 140% increases to 34%. The level of the risk premium therefore plays a crucial role.

Conclusion

However, simulations show that the risk premium would play a crucial role. We believe that there is a different equilibrium from the current situation, where this type of bond would be attractive to governments and investors.

Finally, the introduction of growth-indexed bonds could provide a partial insurance solution for the eurozone via the markets, or even a first step towards a possible fiscal union.

Bibliography

Barr, David, Oliver Bush, and Alex Pienkowski. 2014. GDP-linked bonds and sovereign default. Working Paper No. 484. London: Bank of England.

Blanchard, Olivier, Paolo Mauro, and Julien Acalin. 2016. The Case for Growth-Indexed Bonds in the Advanced Economies Today, Policy Brief No. 16-2. Peterson Institute for International Economics.

Borensztein, Eduardo, and Paolo Mauro. 2004. The Case for GDP-Indexed Bonds.Economic Policy, 38, April, 165–216.

Shiller, Robert J. 1993. Macro Markets: Creating Institutions for Managing Society’s Largest Economic Risks. Clarendon Press, Oxford.