On Wednesday, April 8, Switzerland broke new ground by launching a 10-year bond with a negative interest rate of -0.055%. This is a first for such a long maturity.

In recent years, several countries, such as France and Germany, and Portugal at the beginning of April 2015, have resorted to this type of negative-rate bond, but until now they have only been for short maturities of up to two years. This new Swiss bond was for a small amount (232.5 million Swiss francs), but the number of subscribers was quite high, with demand reaching 410.5 million Swiss francs, reflecting strong investor interest in the securities on offer. How can such success be explained?

Generally, a loan comes with a positive interest rate, guaranteeing the lender that they will recover the amount owed to them plus an additional amount proportional to the rate applied to the loan amount. It may therefore seem surprising that investors are interested in such a transaction, which consists of paying by lending. However, there are several factors that justify this type of transaction.

1 – The quality of the signature

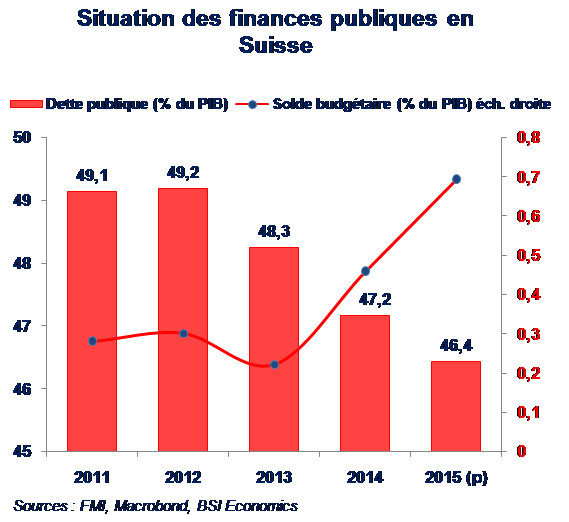

The more a country is known for its solvency, through its fiscal discipline (low public debt, controlled budget balance, ability to collect tax revenues) and its ability to honor its debt on time, the lower the probability that it will default on its debt. By purchasing securities issued by a country considered « robust, » investors can be sure of being repaid. In addition, banks and insurance companies must hold this type of bond with a high credit rating (considered to be risk-free, safe, and liquid assets) on their balance sheets in order to meet financial regulatory standards, whether under Basel III for banks or Solvency II for insurance companies. In the case of Switzerland, which is rated AAA by the rating agencies, it benefits from the highest possible credit rating, which makes the sovereign bonds it issues very attractive, effectively acting as a safe haven. To benefit from such security, investors are willing to pay, weighing up other investment opportunities (such as sovereign bonds from other countries). As there are few countries with such a high credit rating, Switzerland can afford to issue bonds at negative rates with longer maturities while still attracting investors who are concerned about security and/or meeting regulatory requirements.

2 – Investor strategy

The desire to diversify investments in order to spread risk may lead investors to want to acquire certain securities under certain conditions. The main investors in sovereign debt (insurance companies, banks, and investment funds) constantly engage in arbitrage in order to balance their securities portfolios according to the issuer (hence the importance of credit quality), maturity, the associated risk/return ratio, and the currency in which the securities are issued. As government bonds are often used as collateral in financial transactions, an investor may decide to acquire sovereign securities that will subsequently enable them to engage in financial transactions, the return on which will be higher than the return on investing the same cash in an account.

In the case of Switzerland, an investor may engage in several types of arbitrage and seek to acquire Swiss debt at a negative interest rate, either to reduce the risk of their portfolio (by holding bonds, which are less risky than equities and have a high credit rating) or to use them as collateral in financial transactions. As the April 8 issue is denominated in Swiss francs, it also offers the possibility of diversifying a portfolio in relation to other securities denominated in euros, dollars, or yen, for example.

3 – The possibility of capital gains

The value of a bond varies inversely with interest rates. An investor who has purchased debt with a negative interest rate will incur a financial loss (related to the payment of interest) if they still hold that debt when it matures. Thus, if interest rates fall before maturity, investors holding sovereign bonds will have the opportunity to resell them and thus realize a capital gain.

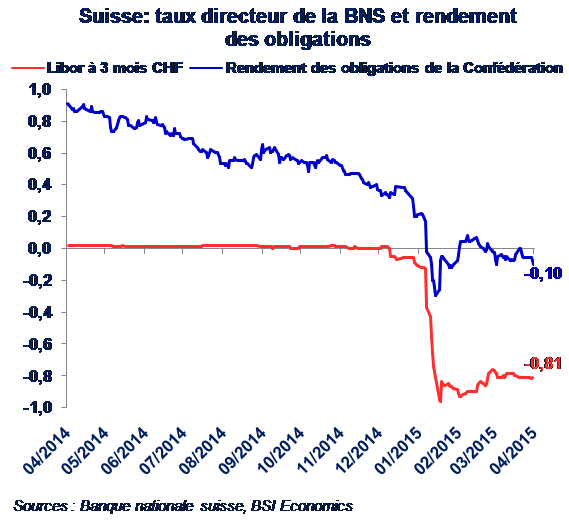

In the case of Switzerland, some investors may have taken the gamble of accepting a negative (and very low) interest rate in the hope of reselling this debt before maturity in 10 years’ time, as soon as there is a significant fall in interest rates. Given that the Swiss National Bank recently decided to suspend its floor rate for the Swiss franc (which led to a sharp appreciation of the exchange rate, thereby penalizing the real economy), the possibility of an imminent fall in interest rates to offset the negative effects of this measure cannot be ruled out. This situation could then prove beneficial to investors who have purchased Swiss sovereign bonds with negative yields.

4 – Playing on yield and real interest rates with price variations

Based on a negative nominal interest rate (the interest rate defined and agreed upon by the various parties at the time of the loan), an investor can bet that inflation will move into negative territory. By betting on a fall in the price index and a deflationary process, an investor can hope to recover a positive real interest rate (the nominal rate minus price variation), especially if the negative nominal rate is low. For investors, it is the real return that is sought. In the case of Switzerland, inflation has been negative since September 2014, with inflation at -0.87% in March 2015 and annual forecasts predicting deflation for the whole year at a rate higher than -0.055%, which is the nominal interest rate paid by an investor on the Swiss 10-year bond on April 8, 2015. This therefore ensures a positive real return for investors.

It is therefore the credit quality of a country relative to others and the various arbitrage opportunities that justify the issuance and purchase of negative-yield debt. The more important and significant these two factors are, the more investors will be inclined to purchase debt securities, even if they have to pay interest. The case of Switzerland best illustrates this type of situation, to such an extent that its decision to issue 10-year bonds, a maturity that is still unprecedented with a negative rate, attracted a significant number of investors.