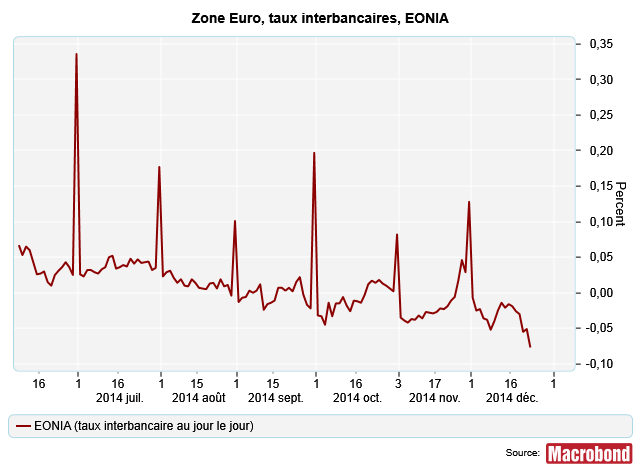

At the end of each month, a recurring phenomenon can be observed on the overnight interbank market (the market on which banks lend liquidity to each other for one day): interest rates rise sharply. This is reflected in the EONIA, which is an average of the rates charged on this market (chart below). Why do these movements occur?

These movements are in fact due to the constraints imposed by the central bank on banks in terms of managing their liquidity. More specifically, it is the reserve requirement system that is at issue here. Each month, banks must have a certain minimum amount of liquidity in their current account (the account they have at the central bank, just as you have an account at your commercial bank). This minimum amount is known as the reserve requirement.

The reserve requirement requirement relates to the average level of cash a bank has in its current account during the month. For example, the (imaginary) bank Société Paribas must have an average of €1,000 in its current account at the end of each day for the month of December. At the end of the month, some banks often find that they do not have enough cash in their current account to meet the reserve requirement. For example, Société Paribas may have had an average of only €990 in its current account at the end of each day. Banks in this situation will have no choice but to obtain cash, even at high prices, to meet regulatory requirements (under penalty of sanctions). They will therefore be willing to pay a relatively high price to other banks to borrow cash, compared to the price they were willing to pay at the beginning of the month. Their demand becomes « urgent » and they are willing to accept higher rates to meet the constraints, while at the same time other banks are less inclined to lend their cash.

The high rates on the interbank market at the end of the month can therefore be explained by the fact that banks that are « late » in building up their reserves will pay a high price to borrow cash from other banks, relatively higher than at the beginning of the month when the demand for cash to meet regulatory constraints is less urgent.

J.P.