In the news: Last week, Mario Draghi announced several new monetary policy measures. Among them was a cut in interest rates into negative territory. What are we talking about?

When we talk about the ECB’s « key interest rates, » we are referring to three rates:

– the marginal lending facility rate (1): this is the rate at which any bank can borrow cash from the ECB at the end of the day if it finds itself short of liquidity and is unable to borrow on more favorable terms on the interbank market [0]. This is the highest rate, currently set at 0.4%.

– The refinancing rate (2): this is the main policy rate, currently at 0.15%. It is the rate at which the central bank will « distribute » liquidity during its weekly open market operations. To put it simply, every week banks know that they can « borrow »[1] money from the ECB at this rate.

– The deposit rate (3): this is the rate at which cash deposited for 24 hours with the central bank in the banks’ « deposit » account is remunerated. This rate is now set at -0.10%.

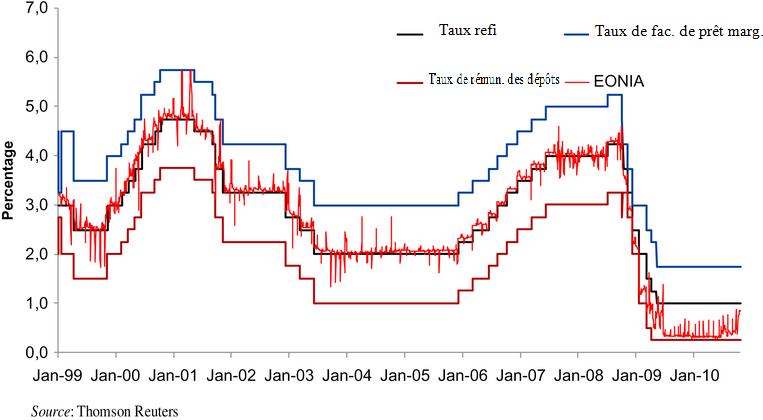

Why these three rates? Because they indirectly control AND limit fluctuations in the most important market interest rate: the EONIA [ 2], i.e. the rate at which eurozone banks agree to lend money to each other for one day at the end of each day, also known as the overnight rate on the interbank market. No bank will agree to lend to another bank at a rate lower than the deposit rate (3), and no bank will borrow from another bank at a rate higher than the marginal lending facility rate (1): the EONIA rate is therefore bounded by these two thresholds.

Under normal conditions, the EONIA rate is very close to the refi rate (see chart below). In the event of excess liquidity on the interbank market (below, following the ECB’s interventions after the collapse of Lehman Brothers in September 2008), the EONIA rate is close to the deposit rate because, to put it simply, all banks want to lend their excess liquidity.

The ECB’s « negative » rate is therefore the deposit rate. It is the minimum rate below which the EONIA cannot fall. It is also the minimum rate set by the ECB: it has made it clear that rates cannot fall any lower. And for good reason: below this rate, banks could be encouraged to hold their excess liquidity in the form of banknotes (see the article by one of our partners here on this subject (Captain Economics)), which would render the measure useless or even counterproductive.

J.Pinter

Twitter: ![]() JulienPinter_BSI

JulienPinter_BSI

Notes:

[0] which is rare for a large bank; this facility is generally reserved for banks in difficulty or banks lacking collateral

[1] Via repurchase agreements involving « good quality » securities under normal circumstances.

[2] European overnight index average

[3] Note that, for reasons of efficiency, commercial banks’ current accounts will also be subject to this -0.1% rate (the amount of cash exceeding the amount of required reserves). To put it simply, a commercial bank’s current account differs from its deposits in the same way that your current account differs from your savings account at your bank.