It is now official: at its latest press conference, the ECB committed to increasing the size of its balance sheet to close to the level it had reached in March 2012, i.e., €3 trillion by June 2016 [1].

Some, notably an article often reposted from the Wall Street Journal blog, have expressed doubts about the ECB’s technical ability to actually increase its balance sheet. This article argues that such doubts are difficult to justify and that, on the contrary, the ECB has everything it needs to achieve its goal.

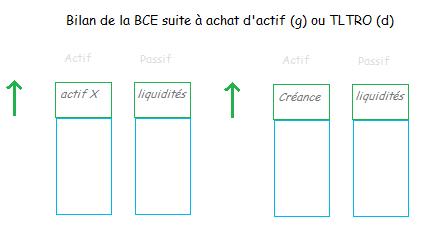

The ECB increases its balance sheet as it sees fit, with no technical constraints limiting its ability to do so. In this case, it has committed to increasing the size of its balance sheet using two tools: loans to banks and asset purchases. From an accounting perspective, each loan to banks increases the ECB’s assets under the « receivables » item; each purchase of securities increases the ECB’s assets under the « asset X » item[2]. The balance sheet therefore increases.

The reverse operation is synonymous with a decrease in the size of the balance sheet. When the ECB sells assets to banks or when banks repay their loans, the ECB’s balance sheet decreases.

First point: there is no risk of a significant unanticipated decline in the balance sheet between now and June 2016

As far as the ECB’s recent policy is concerned, no asset sales or repayments of new long-term loans (known as « TLTROs ») will take place between now and June 2016. The ECB has no intention of selling assets, which is clear to everyone. But what may have gone more unnoticed is that no bank in the eurozone will be able to repay the funds acquired through TLTRO loans before June 2016. The date for early repayments (voluntary or otherwise) is set for September 2016. This is an important detail.

Furthermore, no significant factors have changed since the announcement of the balance sheet expansion measure. The ECB knows that to reach its target, it will have to take into account factors that will naturally weigh down its balance sheet in the coming months (repayments of LTROs from December 2011 and March 2012, and lower borrowing in weekly refinancing operations), which will bring the total effort to more than €1 trillion de facto. This is not new, and was therefore already factored into its calculations at the time of the announcement.

Second point: the ECB has all the keys in hand to increase its balance sheet

The institution has technical flexibility with regard to both loans and asset purchases. With regard to TLTRO loans, it has technical flexibility in that, if there is insufficient appetite from banks, it can make these loans even more attractive and thus increase their volume. This is an option considered by many analysts (see F. Ducrozet of CA CIB for details here). With regard to asset purchases, it has technical flexibility in that it can broaden the range of assets it wishes to purchase (corporate bonds being a likely choice initially) if the depth of the markets in which it is positioned proves to be relatively insufficient.

Ultimately, the only constraints on the ECB’s ability to achieve this objective will be political constraints linked to conservative German positions. The ECB has all the keys in hand; it may simply need to allow itself to open other doors. There is no doubt that these doors will open if the credibility of the institution is at stake.

Julien Pinter

Notes:

[1] Here and throughout the rest of this article, for the sake of simplicity, we use the term ECB to refer to the Eurosystem (all central banks in the eurozone): the target relates to the aggregate balance sheet.

[2] Liabilities increase through the banks’ current accounts in both cases.