Berg, F., Koelbel, J.F., and Rigobon, R., 2022. Aggregate confusion: The divergence of ESG ratings.Review of Finance, 26(6), pp.1315-1344.

Abstract:

- ESG ratings are becoming increasingly important for companies and financial institutions, as they provide a comprehensible framework for assessing and integrating sustainability into decision-making.

- However, there are significant differences in the approaches used by different rating agencies, leading to widely divergent ratings or scores from one agency to another.

- Berg, Koelbel, and Rigobon identify the causes of these differences and offer recommendations, particularly in light of developing financial regulations on this subject. The European Commission has taken relatively significant steps to move toward greater transparency in these ratings.

Introductory remarks

ESG (Environmental, Social, and Governance) factors have become increasingly influential in the field of sustainable investment and corporate decision-making[1]. In their article entitled « Aggregate Confusion: the Divergence of ESG Ratings, » Berg, Koelbel, and Rigobon (2022)note that many institutional investors expect companies to manage ESG issues (Krueger et al., 2020) and monitor the ESG performance of their securities (Dyck et al., 2019). ESG ratings thus guide investment decisions and influence corporate behavior (Stackpole, 2023; ESMA, 2021). They provide investors with information about a company’s sustainability practices and help them align their investments with their values and long-term goals. In addition, they play a key role in promoting transparency and accountability, encouraging companies to improve their ESG performance in order to meet the evolving expectations of stakeholders.

ESG ratings have thus attracted growing interest and led to a dedicated academic literature. Their limitations are the subject of much technical and regulatory debate (Boffo and Patalano, 2020; Harvard Business Review, 2020; Posner, 2022). In this context, the authors identify a structural limitation to these ratings: they differ significantly from one rating agency to another, even though they are based on analyses of the same companies. In this paper, Berg, Koelbel, and Rigobon identify the reasons for these divergences (scope, measurement, and weighting of attributes) and provide a series of recommendations for regulators. The regulatory framework has certainly evolved in recent years to improve the disclosure of ESG factors. For example, the European Union (EU) has adopted regulations such as the Taxonomy, the Sustainable Finance Disclosure Regulation, and the Corporate Sustainability Reporting Directive, which have contributed to varying degrees to promoting the transparency and comparability of ESG ratings, standardizing indicators, and thus strengthening their role. However, the authors go further, proposing the harmonization of ESG disclosure and the establishment of a common « taxonomy. » For the authors, requiring rating agencies and companies to map their ESG data according to a common taxonomy would simplify comparisons, stimulate competition, and improve the comparability of ESG ratings.

ESG ratings: the subjective quantification of sustainability

The issue ofthelimitations of ESG ratings has attracted the interest of a wide range of stakeholders since its inception, but this concern has intensified recently due to the growing popularity of ESG ratings and the changing regulatory environment in the EU, the UK, and the US. Researchers have taken a particular interest in exploring the limitations of these approaches, contributing to the emergence of a dedicated scientific literature.

It should be noted that the academic community has already taken an interest in the relationship between sustainable and financial performance, requiring quantification. Three key meta-studies[3] are worth noting:

- Orlitzsky et al. (2003), which identifies 30 different measures of sustainable performance in 52 underlying academic studies;

- Margolis et al. (2009), identifying more than 100 measures in 182 underlying academic studies;

- Friede, Busch, and Bassen (2015), exploring 26 different concepts for measuring a company’s sustainability through 40 meta-studies on the subject, themselves covering 3,718 underlying academic studies;

Following this work, the lack of a common methodological framework for defining a company’s sustainable performance intrigued the academic community, giving rise to other important work on the subject, focused more specifically on ESG ratings conceptualized by rating agencies.

This literature highlights inconsistencies in ESG data and metrics and their communication by companies (Kotsantonis and Serafeim, 2019). It identifies a lack of consensus in the definition of ESG-related characteristics, attributes, and standards, which can lead some agencies to have opposing opinions on the same companies being evaluated (Billio et al., 2021). Christensen, Serafeim, and Sikochi (2022)also identify that greater disclosure of ESG information actually leads to greater divergence in ESG ratings.

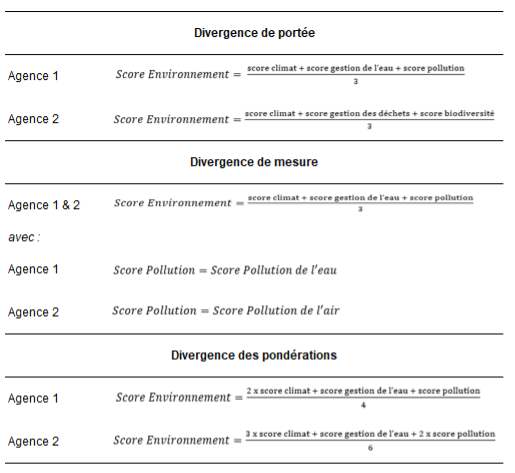

In this context, Berg, Koelbel, and Rigobon (2022)specifically identify the causes:

- Scope divergence: ratings are based on different sets of attributes.

- Measurement divergence: rating agencies use different indicators to assess the same attribute.

- Weighting divergence: rating agencies assign different weights to attributes in the final rating.

A schematic explanation of these different causes of divergence is provided in Figure 1.

This work is particularly interesting as it also contains specific recommendations for regulators to address this fundamental problem of ESG rating divergence. The authors highlight the potential benefits of harmonizing ESG disclosure in order to provide a reliable database of ESG ratings, as well as establishing a common « taxonomy » of ESG factors to facilitate the comparison and contrast of ratings. This recommendation echoes regulatory advances in the EU.

The essential role of regulators in addressing the issue of ESG rating divergence

Regulatory advances have been particularly key in the EU, which recognizes the importance of ESG information in investment decision-making and ensures that companies provide comprehensive and standardized data on their ESG performance.

In June 2023, the European Commission included in its new sustainable finance package a proposal for regulation specifically addressing the issue of transparency in the ESG rating methodologies of rating agencies[5].

In line with the recommendations of Berg, Koelbel, and Rigobon (2022), the impact of the European regulations mentioned in the introduction on ESG ratings is twofold:

- They contribute to the standardization and harmonization of ESG indicators, helping to reduce discrepancies between rating agencies. By providing clearer guidelines and disclosure requirements, the European Commission aims to enhance the consistency and reliability of ESG ratings, thereby facilitating more informed investment decisions.

- They meet the expectations of investors who are looking for transparent and reliable ESG information. Investors are increasingly relying on these ratings as a crucial part of their decision-making process. Regulatory developments in this area reinforce the importance of ESG factors in investment strategies and provide a framework to ensure that ESG ratings meet these needs.

Conclusion

Through the creation of ESG ratings, rating agencies offer part of the solution to the problem of the lack of a common approach and measures for corporate sustainability. The findings of Berg, Koelbel, and Rigobon suggest that there are still limitations to this solution and propose regulatory recommendations. Although it is still too early to know whether the Commission’s efforts will lead to the establishment of a standardized approach to sustainability through a common framework for assessing ESG factors, the Commission’s recent regulatory proposal to impose transparency in ESG ratings demonstrates the regulator’s interest in addressing this issue. Furthermore, the authors’ work, and the academic literature in which it is embedded, helps to better identify the limitations of ESG ratings and thus improve their relevance in a context where they play a predominant role.

[1]Investors representing more than $120 trillion in total assets have signed a commitment to integrate ESG information into their investment decisions (PRI, 2022).

[2]Notably through advances in the UK’sSustainability Disclosure Requirements (SDR)regulations and the SEC’s climate and ESG reporting requirements inthe United States.

[3]A meta-study is an analysis that synthesizes the results of multiple studies on a given topic to draw comprehensive and reliable conclusions. It allows data from several studies to be pooled and provides a more complete overview of a specific field.