Summary:

– Bitcoin appears to have the characteristics of what is known as a currency, but these intrinsic characteristics do not allow it to be classified as a conventional currency.

– Bitcoin evolves according to a mathematical algorithm, is capable of developing autonomously, and its quantity is capped at 21 million units in the long term (2040).

– Even though the price of Bitcoin has recently stabilized, it remains vulnerable to high volatility, and even though the Federal Reserve presented it as an alternative currency in 2013, the future of Bitcoin remains uncertain and may just be a passing fad.

– Beyond fiscal and regulatory issues, it is above all the competition from a currency that escapes the political control of states that worries them.

Although abstract in nature and often overused in everyday discourse, currency is a subject that affects everyone’s daily life. In this respect, Bitcoin is an innovative practical application of traditional monetary concepts. First appearing in 2009, Bitcoin was known and used mainly by geeks and the underground economy. After a long period of sluggishness and despite the existence of controversial elements regarding the monetary nature of Bitcoin, this has not prevented it from developing significantly over the last eighteen months to become the symbol of a new era marked by globalization, digital technology, and global crisis.

The characteristics, origin, and atypical evolution of Bitcoin have largely contributed to creating an aura of mystery around this decentralized digital currency inspired by libertarianism, which simultaneously echoes two major sources of anxiety in contemporary societies: information technology and finance. Although hypotheses can be made about the future of Bitcoin, the only certainty is that it represents a conceptual advance that financial and state institutions will increasingly want to control.

The nature of Bitcoin

Bitcoin is intended to be a currency, just like the euro or the dollar. It is therefore important to remember the three fundamental functions of a currency: (1) a unit of account, (2) a means of settling transactions, and finally (3) a store of value and a means of saving. Bitcoin can therefore be described as a currency because it fulfills these fundamental functions:

1 – It represents a unit of account, i.e., it can be used to value goods or services. For example, it is possible to determine that a pen is worth 2 bitcoins.

2 – It facilitates trade, i.e., it can be used to purchase goods and services. Instead of exchanging pears for apples, shoes for books, or a doctor’s visit for a car inspection, individuals seeking to trade use a monetary instrument as an intermediary.

3 – It serves as a store of value, meaning it can be stored for future use. Bitcoins can be held in a virtual wallet linked to an anonymous ID on the internet.

However, when it comes to the criteria that make up a currency, Bitcoin doesn’t quite fit the bill. Here’s why:

1 – A unit of account accepted by all. However, the sharp fluctuations in the price of Bitcoin in the past indicate the difficulty of determining a more or less stable value for it. Yet the stability of a currency, even relative stability, is a fundamental aspect of trust. Under these conditions, the high volatility (price fluctuations) associated with Bitcoin is not conducive to establishing a climate of confidence in it. Therefore, it is unlikely that anyone would accept their salary in Bitcoin if it could be worth half as much the next day. The same applies to suppliers of goods or services, for whom the risk of depreciation (loss of value) of their services in Bitcoin is particularly high, at least for the time being.

2 – A method of settling transactions. For the moment, and despite a clear increase in recent months, the number of businesses (e-commerce, hotels, restaurants, etc.) that accept this method of payment worldwide remains very low (20,000 commercial companies worldwide offer their customers the option of paying in bitcoin, and only 40,000 purchases of goods and services denominated in bitcoin are made each day around the world). Furthermore, the security issues inherent in this currency (hacking—not of the bitcoin system itself, but of the computers that enable bitcoins to circulate, etc.) make this possibility unworkable on a large scale. Finally, on a more trivial note, it currently seems complicated to go and buy a baguette this way.

3 – A store of value and savings tool. Even though it can be stored, the fact that it is impossible to physically set this money aside and that there is no way to make it grow other than through speculation prevents it from fulfilling this basic function of currency: it is impossible to deposit it with a financial institution in exchange for interest.

In addition, Bitcoin has intrinsic characteristics that differentiate it from traditional currencies. Bitcoin is a unique currency by nature:

1. The euro and the dollar are legal tender, which means that they are recognized by public authorities. This means that everyone in the eurozone and the United States is obliged to accept payment in euros or dollars. However, even though more and more e-commerce sites, and even some physical stores, accept bitcoin as a means of payment, there is no obligation for merchants to accept it and no guarantee that it will be accepted in the future. As a result, bitcoin can only be exchanged between people who voluntarily agree to use it; this is known as a « customary » currency, as opposed to a « legal » currency, which is legal tender.

2. In addition, the use of traditional currencies such as the euro or the dollar is regulated by centralized systems via central banks (the ECB in the euro zone and the Fed in the United States). For example, when one of these currencies gains or loses too much value in relation to economic policy objectives, the central bank can potentially intervene to try to regulate these fluctuations. Bitcoin, on the other hand, is based on a decentralized system, meaning that its value depends solely on supply and demand. Therefore, the more people buy bitcoins, the more its value will increase. Conversely, the less people buy, the more its value will decrease.

3. Furthermore, in a centralized system, the use of currency is governed by rules. For example, in France, in the event of fraudulent use of a credit card, banks are legally obliged to reimburse the victim. In a decentralized system such as Bitcoin, there is no legal recourse in the event of fraud, but users can take out insurance with specialized organizations to obtain compensation if necessary. In this regard, it should be noted that this activity is bound to develop in the wake of Bitcoin.

How Bitcoin works

Bitcoin is a unique currency in terms of how it works. Like other currencies, the exchange rate of Bitcoin (usually expressed in US dollars) is based on supply and demand. However, unlike traditional currencies, where the amount available changes according to the actions of the institutions that issue them, Bitcoin evolves according to a pre-established mathematical and cryptographic algorithm (i.e., the art of encoding and decoding secret messages) that cannot be manipulated and is capable of developing autonomously. In this context, the money supply (number of bitcoins in circulation) of bitcoin is capped at 21 million units in the long term. To achieve this, they were initially issued at a rate of 1 bitcoin every 25 minutes, but this rate is programmed to slow down and has been about half as fast since 2013 as it was when it was created. According to the Bitcoin protocol, bitcoins will be issued automatically until 2040, at which point it will no longer be possible to create more bitcoins. Since its creation in 2009, nearly 12 million bitcoins have already been issued and are in circulation.

There are two ways to obtain bitcoins: either by finding them or by buying them

– Creation of bitcoins. While in a traditional centralized monetary system, money creation is left to the discretion of financial institutions, in the decentralized Bitcoin system, anyone can create bitcoins. To do so, you simply need to « find » them by solving complex equations with a computer, i.e., by putting the computing power of your computer at the service of the network searching for the solution: the greater the computing power made available, the higher the chances of finding a bitcoin. In this context, bitcoin can be compared to digital gold in the sense that a bitcoin is the equivalent of a nugget in a digital gold rush. Like gold, the number of bitcoins that can be found is limited, and its value is therefore largely based on its scarcity. In this context, « searching » for the computer code that validates the creation of a bitcoin is similar tomining, where the people and servers involved are calledminers.

– Purchasing bitcoins. However, creating bitcoins is a very time-consuming and costly process (requiring the purchase of highly sophisticated and power-hungry equipment), meaning that this technique is rarely used except by seasoned professionals. Therefore, to obtain bitcoins other than by creating them, all you need to do is download an app or register on a specialized website that provides access to this currency. There are many platforms available and they are easy to find on the internet. Once registered, potential buyers can purchase this e-currency and then store it in a digital wallet, before exchanging it over the counter for goods and services or other currencies without going through the banking system. This means that transactions are carried out without the control of banks (no intermediaries or bank charges) and in complete anonymity (the currency is not linked to the holder’s name but to an anonymous account number).

Conceptual definition of bitcoin

Bitcoin is certainly a virtual currency, but it is above all a digital currency. Bitcoin is a virtual currency because it only exists on the internet, unlike traditional fiat currency, which also has a physical existence (banknotes, coins). The distinction between a traditional currency such as the euro and Bitcoin is primarily linked to the legal status of these currencies: the former refers to a state monetary authority, while the latter does not refer to any authority. However, despite their different legal statuses, all currencies today are primarily digital, meaning that they refer to a set of accounting entries in digital databases. In practical terms, when a euro user pays for a car at a car dealership, they send a transaction message to their bank, which then updates its « account books, » which are in fact a digital database. If the buyer’s bank is not the same as the dealer’s, the two banks will synchronize their databasesvia a mechanism known as digital « bank clearing. » The same applies to coins and banknotes, which technically represent nothing more than an acknowledgment of debt that can be exchanged at a bank for digital euros. Despite different mechanisms, Bitcoin also functions as a digital currency where the holding and exchange of Bitcoins gives rise to a set of digital entries.

Before being a currency, Bitcoin is a network in the same way as the Internet. The Bitcoin currency is built on an open and royalty-free computer language. In this respect, Bitcoin is similar to email, where users also rely on an open and royalty-free computer language. Typically, if a Hotmail (Microsoft) user wants to write to a Gmail (Google) user, the two people can exchange and communicate with each other because neither Microsoft nor Google owns the language. It is a peer-to-peer (P2P) network, where no server has an advantage over the others. In the case of Bitcoin, the mechanism is identical, meaning that anyone can have a Bitcoin server at home while being on an equal footing with other servers in the Bitcoin network. As a result, this introduces a major change in electronic transactions because the central networks that dominate electronic transactions are private networks (PayPal, Visa, MasterCard, etc.) that have built networks between themselves. Bitcoin is therefore an open network because no one owns it, and it is free of charge because anyone can use it without paying for it.

Bitcoin is simply the implementation of the protocol of the same name. In this context, Bitcoin is a « naive » network, meaning that it does not attach any importance to what it transports; what matters is that what it transports arrives correctly, on time, and at the right place, the practical purpose of which is a transaction allowing the transfer of a certain number of bitcoins from one address to another. While the Internet transports text, images, audio, and video, the Bitcoin network transports numbers expressing value. Thus, while the Internet is a medium for facilitating digital communications, the Bitcoin network is a medium for facilitating digital transactions. In this respect, Bitcoin is the practical application of the last tool that was missing from electronic exchanges, namely the monetary tool. Bitcoin is a protocol, just like HTTP (Internet protocol) or SMTP (one of the protocols behind email). Bitcoin is therefore a language, a means of communication between computers.

Bitcoin refers to a « money value » system that is different from the « money debt » system. Traditional currencies (euros, dollars, etc.) are created (for the most part) in lending transactions where a bank creates money ex nihilo (out of nothing) when it grants a loan. Here too, through a set of digital accounting entries, the bank records the amount of the loan in the current account of the economic agent (household, company, etc.) that has taken out the loan (this is the money that the bank owes to the debtor); at the same time, it records the same amount in its assets (corresponding to the loan that the economic agent must repay to it). Ultimately, the bank’s balance sheet increases but remains balanced because its liabilities increase by the same amount as its assets: the money thus created in the case of traditional currencies is « debt money » because it did not exist before. In the case of bitcoin, money creation is different. Like traditional currencies, bitcoins are created ex nihilo, but there is no debt associated with the bitcoins that are issued. It is therefore « value money » where, like a company that issues shares on the stock market, which are securities, the Bitcoin network issues a value. Here, the collateral for bitcoin is not a company but an internet network. While the value of the network is difficult to assess, it nonetheless exists in the same way that the network value of email exists (avoiding the need to go through the postal service, saving time, etc.), but is difficult to assess.

Bitcoin price trends

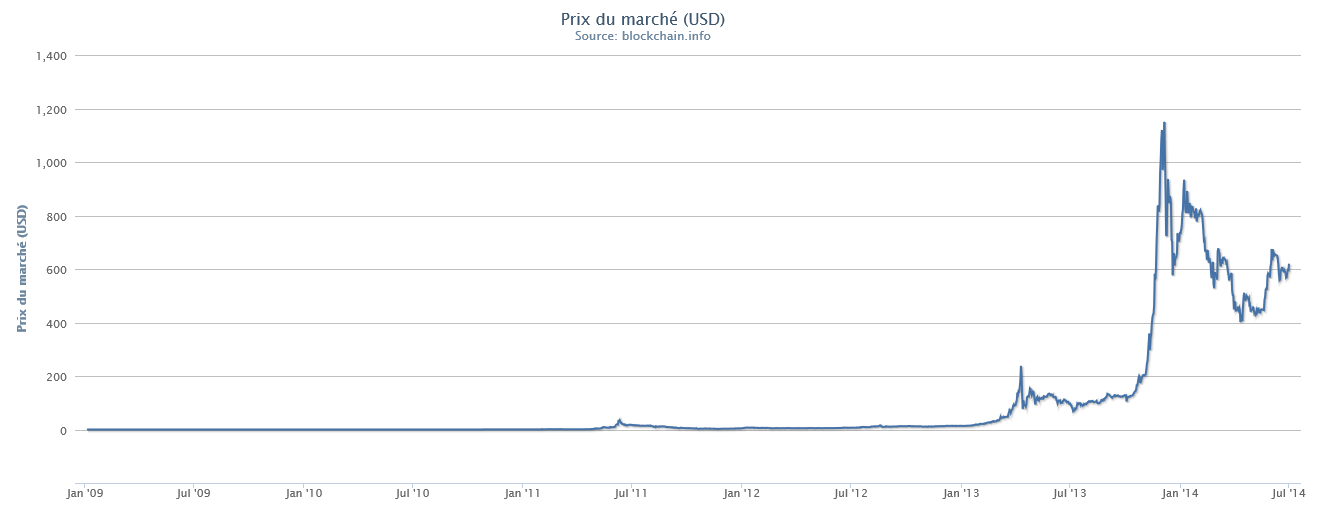

The evolution of the price of bitcoin has gone through several distinct periods. The characteristics of bitcoin make this currency particularly volatile. While the virtual currency was trading at less than a thousandth of a dollar when it was created in 2009, it was worth just over $10 in 2012, before reaching $266 in April 2013, It then « stabilized » at around $100 until the summer of 2013, before rising sharply to over $1,000 at the end of 2013, experiencing several successive « crashes » in early 2014, and finally recovering to around $600 since the summer. Since then, after a relatively long period of very low prices, followed by several months of rapid growth and high volatility (price fluctuations) at the beginning of the year, the evolution of bitcoin seems to be less erratic, even if its valuation is still very approximate and unstable and could still change significantly.

Interest in Bitcoin is very recent. The fact that Bitcoin rose from $10 to over $1,000 in the space of a few months, multiplying its value by more than 10,000%, began to intrigue observers, some of whom feared the formation of a new bubble. However, even if these fears were legitimate to a certain extent, it should be remembered that a bubble can only exist if it is based on fundamentals (real estate, gold, companies, etc.) whose market price deviates too sharply and for too long from its real value. However, in the case of Bitcoin, this is not possible because, by definition, Bitcoin has no value and is not backed by any asset. Only an attempt to value Bitcoin as a network would give it any value. While several attempts have been made to do so, they all rely on strong assumptions, i.e., assumptions that are largely unproven, and the results that emerge are sufficiently different from one another that they cannot be judged individually or collectively as satisfactory in their current state.

The evolution of the Bitcoin price reflects successive, combined, or concomitant phenomena. The initial rise of Bitcoin in the spring of 2013 was linked to the Cypriot banking crisis. Indeed, it seems that the latter prompted investors in that country, and those who had invested there, to take refuge in this currency to protect their funds. The threat of taxation on savers had caused concern about the possibility of the authorities dipping directly into bank accounts. This did not happen, but the safe-haven currency of the moment (Bitcoin) reached an all-time high as a result of the law of supply and demand. Subsequently, concerns about the sovereign debt of European countries, particularly those in southern Europe, led some citizens (mostly Spanish) to turn to this currency. They too feared that part of their savings would be used to bail out their country’s coffers, as was the case in Cyprus. Thirdly, the rise in the price can also be explained by the increase in demand for this currency linked to the increase in websites accepting Bitcoin payments and the media buzz surrounding it, confirming the growing interest in this currency.

However, the most significant rise came at the end of 2013. Several countries announced that they were studying Bitcoin with interest or favor, such as Germany, which officially recognized Bitcoin as a private currency in the fall of 2013. In the United States, the Federal Reserve (the US central bank) announced in November 2013 through its then-chairman (Ben Bernanke) that it endorsed what it considered to be a new stateless currency, presenting Bitcoin as a credible alternative for transferring money around the world, thereby officially recognizing Bitcoin’s potential: « [Bitcoin] may be promising, particularly if innovations enable the creation of faster, more efficient, and secure means of payment. » At the same time, rumors that large companies such as Google and eBay were considering using Bitcoin as a means of payment further increased the growing interest in this currency. In addition, the Silk Road website, which sold drugs and other illegal products using Bitcoin, was shut down by the FBI, boosting the respectability of Bitcoin, which had suffered from a murky image linked to the underground economy. Finally, two events in China have significantly increased Bitcoin’s potential for development, sparking considerable enthusiasm. First, Baidu (the Chinese equivalent of Google) began accepting Bitcoin payments for certain services. Second, a Bitcoin exchange platform (BTC China) was created, which has become the world’s leading exchange platform in terms of volume.

All these phenomena are helping to increase Bitcoin’s credibility and rapidly increase its value, but in a way that is comparable to what can be observed when a bottleneck forms: the number of people wanting to acquire Bitcoins is increasing, but liquidity is limited in quantity. Indeed, given that supply is constrained, the sharp rise in demand has automatically caused the price to skyrocket. It should be noted that the rise in the price of bitcoin has led to a surge in around 40 lesser-known and recently launched electronic currencies (Litecoin, Namecoin, Webmoney, Infinitecoin, Quarkcoin, Peercoin, etc.). Ultimately, the digital currency sector is now worth nearly $15 billion, a paltry sum compared to traditional currencies, but enough to arouse envy.

While remaining highly volatile, the price of Bitcoin has since « stabilized » somewhat. Of course, in the case of Bitcoin, there is no question of stability in the same way as the price of a traditional financial asset. However, compared to past developments, the price has become less erratic. Among the various possible reasons for the decline and relative stabilization of the price of bitcoin at around $600, it is worth mentioning the decision by the Chinese central bank which, after allowing bitcoin transactions, reversed its decision and has since officially banned Chinese financial institutions from using this currency. Although China is the largest market for Bitcoin trading, on December 5, 2013, the Chinese central bank banned its banks (but not individuals) from conducting any transactions in this alternative currency. Following this decision, the equivalent of $5 billion evaporated worldwide in just one hour. Several warnings have also been issued by various governments, banks, and central banks regarding their concerns about the dangers (supposed or real) associated with the use of Bitcoin. In addition, as with any fad, the buzz around Bitcoin has weakened somewhat. Finally, the closure of the main Bitcoin trading platform (MtGox), following the hacking of its computer system, may have led to a wave of mistrust.

The overall evolution of the Bitcoin price closely resembles that of a fashion cycle. Indeed, when a promising invention appears on the market, after a period of intense visibility and hope, disenchantment sets in before the innovation finally becomes a permanent fixture in the landscape, finding stability in its modus operandi.

Position of governments, monetary authorities, and banks

Governments are increasingly considering this issue. Since Bitcoin is a completely unregulated activity, online trading platforms do not need to register with regulatory authorities. Thus, beyond the potential « risk » that this may entail in the eyes of these bodies, it means that governments cannot collect taxes on this activity. Furthermore, despite having recently gained a certain degree of respectability, the anonymous nature of Bitcoin makes it a preferred means for many criminal activities to transfer funds, exchange money, or launder proceeds from activities such as drug and arms trafficking. As a result, several governments, including those of the United States, Canada, and Australia, are beginning to seriously consider ways to regulate these currencies, which are completely beyond their control. Germany has already taken this step, as the country recently announced the official recognition of this currency. From now on, all transactions in Germany can be carried out in this currency. Clearly, beyond the regulatory aspects, the main objective is that the country can now levy a tax via VAT.

The authorities are currently in the process of stigmatizing Bitcoin. Indeed, Bitcoin divides opinion between those who see this new virtual currency as a real revolution in transactions and those who openly mistrust it, such as the Bank of France, which has published a note warning of its « highly speculative » nature and « certain financial risk for those who hold it. » For its part, the European Banking Authority (EBA) states that Bitcoin can be a lax instrument that can be used for tax evasion, money laundering, or terrorist financing. The same applies to the European Central Bank (ECB) and the European Securities and Markets Authority (ESMA), which are urging national banking supervisory authorities to « discourage [the latter] from buying, holding, or selling virtual currencies » as long as they are not regulated. The idea here is to encourage national authorities to regulate bitcoin (and other currencies of the same type) by creating dedicated governance structures, while imposing a minimum capitalization on the various platforms for storing and exchanging these currencies. In the same vein, the Japanese government considers that bitcoin « is not a currency » and that gains from it should therefore be taxable, while the US tax authorities would like any salaries paid in bitcoin to be subject to income tax.

Beyond tax and regulatory issues, it is above all the competition from a currency that escapes the political control of states that worries them. Since the monetary system abandoned the gold standard in favor of paper money, it has entered a virtual world where money creation is a monopoly of banks or monetary authorities, which issue money ex nihilo based on considerations that are not necessarily economic and often political. Indeed, central banks and politicians often use and abuse the monetary tool as a means to achieve short-term electoral political objectives, without taking into account the longer-term economic implications. Therefore, the emergence of a competing currency that cannot be counterfeited, is inherently immune to inflation and state manipulation, and is also backed by a secure, fast, and inexpensive payment system is cause for concern for monetary and state authorities, which derive much of their power and influence from monetary policy. Consequently, the emergence of Bitcoin, facilitated by the development of the internet, raises questions about the future of national currencies and the associated central banks, as the protection of individuals’ savings offered by Bitcoin against state spoliation via inflation may prompt individuals to turn away (at least partially) from traditional currencies in favor of Bitcoins.

As for banks, the reason they are concerned about the emergence of Bitcoin and are calling for its regulation is more prosaic. According to economist Carl Menger, the subjectivity of value can be stated as follows: « value does not exist outside of human consciousness. » In other words, the monetary value of Bitcoin does not come from a tangible commodity but from the value that individuals attach to it as a payment system (instant transactions, universality, anonymity, protection against inflation and monetary and state manipulation, etc.). However, the scarcity of Bitcoin relative to its success automatically increases its value: as the value of bitcoin is bound to rise, bitcoin users do not use this currency so much for exchange (a minority of bitcoin exchanges are used for transactional purposes) as to hold it in the hope of making a capital gain (80% of current holders hoard bitcoin like digital gold). The more people discover Bitcoin and become interested in it, the more attractive it becomes to acquire, as its value increases (the more users the currency gains, the more it appreciates). Then, by its very nature, the more successful Bitcoin becomes (and therefore the more valuable it is), the less it is used for transactions. Consequently, if it becomes more widespread or gains a larger « market share, » Bitcoin will prove to be a problem for the business model of banks because this currency does not encourage people to go into debt (and banks make their profits from interest) but to save (because the value of Bitcoin increases over time).

Conclusion

The future of Bitcoin is still uncertain. In fact, there is no guarantee that it will one day become a major and indispensable currency; perhaps this currency will disappear and another will take its place and succeed in its purpose. On the other hand, the Bitcoin protocol has proven its robustness and applicability. Therefore, while the future of Bitcoin as a currency in its current form is uncertain, Bitcoin as a technology seems perfectly sustainable.

The desire of governments to regulate, tax, or even ban Bitcoin may lead to its disappearance, but the technology is unalterable and other currencies or media of the same type may always emerge. At this stage, three scenarios can reasonably be envisaged: the disappearance of a currency that has failed to gain acceptance among users, regulation of the currency to limit its expansion (and therefore its probable disappearance in the long term if the regulator begins to interfere with the Bitcoin system), or the explosion of the system, which will take its place in the international monetary system. At this stage, any attempt to predict the future is pure conjecture.