Summary:

– Fluctuations in oil prices, particularly increases, have an impact on French GDP growth. A rise in the price per barrel constitutes both a negative supply shock, via an increase in the price of intermediate consumption, and a negative demand shock, via a decline in household purchasing power and a decrease in foreign demand.

– The combination of favorable structural changes in the French economy and the role of exchange rates and taxes has led to a weakening of the link between oil prices and growth rates since the 1980s.

– A 20% increase in oil prices would have a cumulative negative impact on French economic activity estimated at 0.2 percentage points after two years. This figure may seem relatively small, but it is still significant in a period of weak or even zero growth.

Since the 1970s, the price of a barrel of oil has experienced a number of fluctuations and shocks, with significant economic consequences. For example, during the oil shocks of 1973 and 1979, significant increases in the price of crude oil went hand in hand with a general decline in growth rates in most developed oil-importing countries, particularly France.

Although the debate on oil prices and their potential impact on growth was no longer a major concern during the 1990s, recent increases in the price per barrel between 2004 and 2008, and since 2009, have reignited the debate on the link between the price of this raw material, which is central to the functioning of contemporary industrial economies, and the rate of economic growth.

1 – Mechanisms by which changes in oil prices affect GDP growth

Firstly, in the case of France, an increase in oil prices constitutes a negative supply shock for the economy,in the sense that it reduces its capacity to create and distribute wealth. Rising oil prices increase the price of intermediate consumption and have a negative impact on production.

The rise in oil prices also amplifies the inflationary consequences of the price-wage loop that exists in the labor market. Second-round effects can be observed as a result of producers’ reactions to maintain their margins (increase in final prices) and employees’ reactions to maintain their purchasing power (demand for higher wages). Rising oil prices can thus lead to higher inflation in the economy of the importing country.

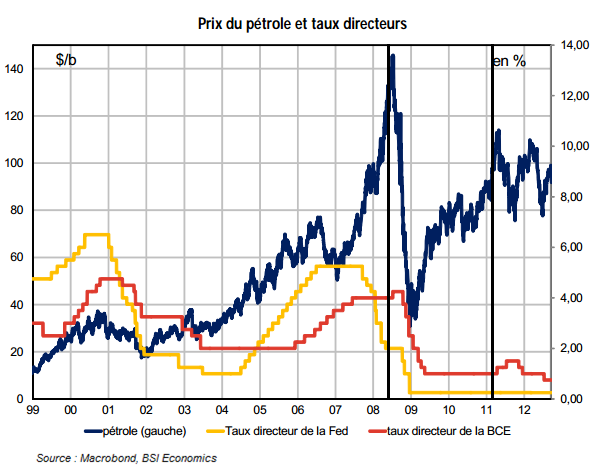

The transmission of oil shocks can thus prompt a reaction from monetary authorities in a situation of rising prices, with a view to stabilizing inflation, as evidenced by the 0.25 basis point increases in the ECB’s key interest rate in July 2008 and April 2011.

This monetary tightening can exacerbate the recessionary impact of an oil shock. Conversely, in the event of a downward price shock, central banks do not generally change their policies or behavior, as inflation expectations remain well anchored.

In addition to the supply shock caused by the rise in oil prices, there is also a negative demand shock in the form of reduced demand for domestic products. These products have become more expensive, but they are also facing structurally weaker demand as our main trading partners, which are net oil importers, reduce their demand for French products.

Finally, more generally, high volatility and frequent increases in oil prices have an overall impact on the economy by contributing to a decline in household disposable income, as demand for oil is virtually inelastic, and to apprehension about an uncertain environment on the part of economic agents. This apprehension and uncertainty have consequences for the expectations of households and businesses. On the one hand, they contribute to a contraction in the consumption of durable goods and, on the other hand, to a decline in investment due to producers’ downward revision of their anticipated demand forecasts.

2 – Changes in the structure of the French economy have increased its resilience to oil price fluctuations

While the shocks of 1973 and 1979 had a significant impact on growth, employment, and inflation, the situation was different in the 2000s. French growth strengthened at the end of the previous decade and was particularly conducive to job creation, especially in the public sector. The decline in unemployment was not slowed by the rise in crude oil prices, and inflation remained limited.

Changes in the structural characteristics of the French economy may explain why oil price fluctuations have had less of an impact on growth than in the 1970s.

Since the first oil shock, developed countries have managed to reduce the energy and oil intensity of their production. According to INSEE, it now takes one-third of a barrel of oil to produce €1,000 of GDP in France, whereas in 1973 it took three times as much to produce the same real value. The reduction in household consumption, thanks to the adoption of more energy-efficient technologies and the substitution of oil with other energy sources such as gas, nuclear power, and renewable energies, has made it possible to reduce dependence on oil. The national energy bill is estimated at 2.3% of GDP in 2012, compared with around 5% of GDP in 1981.

In terms of price formation, certain nominal rigidities partially offset the effect of rising oil prices on the economy. On the French labor market, the deindexation of wages from inflation in 1983[1]limited the indirect and second-round effects discussed above. According to Bousharain and Ménard (2000), this deindexation of wages in France is responsible for weakening the link between oil prices and GDP growth. According to their calculations, a 100% increase in oil prices led to a 1% increase in wages after two years between 1985 and 1998, compared with 6% between 1974 and 1986.

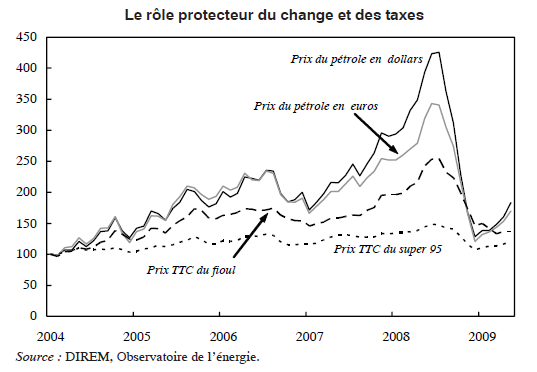

Finally, exchange rate movements and the protective role of taxes made the rise in crude oil prices less noticeable in France than in other countries. Between January 2004 and July 2008, French consumers saw the price of premium gasoline at the pump rise from €1 to nearly €1.5. At the same time, Americans saw the price per gallon rise from $1.50 to $4. There are two reasons for this very clear difference in treatment. On the one hand, the appreciation of the euro allowed the French to buy oil, which is priced in dollars, at a lower price; on the other hand, the TIPP, the domestic tax on petroleum products, even though it no longer fluctuates, introduces a great deal of inertia into the evolution of prices at the pump.

3 – Empirical and econometric analysis

In Économie française 2009, INSEE published a study assessing the impact of the rise in oil prices on French growth between 2002 and 2009. The price per barrel rose from $21 to $89, representing a 2.5-fold increase in the price in euros. This significant increase is estimated to have reduced the growth rate by an average of 0.3 percentage points per year. The three main channels through which oil prices affect GDP are a decline in import volumes due to higher energy costs, the impact on the price of intermediate consumption, and, above all, a change in global demand, which decreases when oil prices rise.

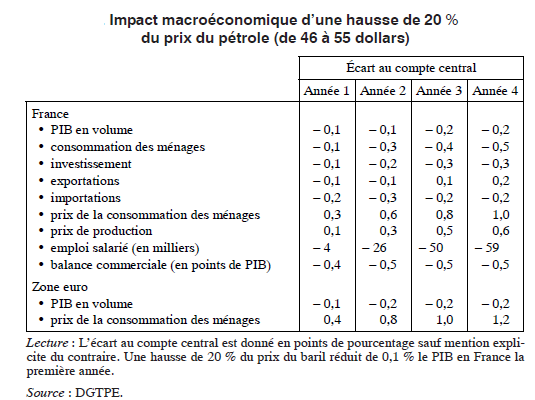

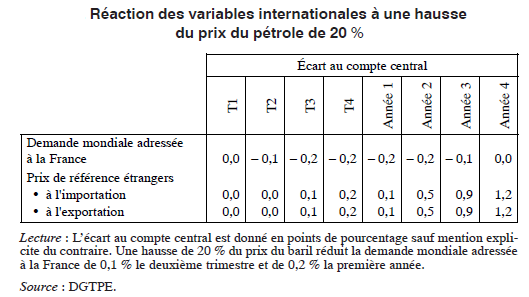

The Centre d’Analyse Économique (CAE) has developed an assessment of the short- and medium-term macroeconomic impact of a 20% increase in the price per barrel in France and the euro zone using two econometric models: the MÉSANGE model[2]and the NIGEM[3]model. The simultaneous use of these two models makes it possible to take into account both the direct reaction of the French economy to this increase and the indirect effects on France linked to the reaction of the rest of the world. The results are as follows: a 20% increase in oil prices would lead to a 0.1 point decline in French GDP in the first and second years, linked to the indirect effects of changes in global demand. In the fourth year, activity would be reduced by 0.2 points.

These figures may seem relatively low, but it should be added that the effects of an increase in oil prices appear to have a greater impact when the economy is in a phase of weak growth or recession. In an expansionary phase, generating greater added value helps to offset the rise in raw material prices, whereas in a recessionary phase, a rise translates into a reduction in the added value to be shared, with consequences for final prices and real wages and/or unemployment, depending on the rigidities of the labor market.

Conclusion

Fluctuations in oil prices have an impact on French growth due to several factors and transmission channels. Thus, an increase in oil prices leads to a decline in import volumes, an increase in the price of intermediate consumption, and, above all, a decrease in global demand for French goods and services.

Changes in the structural characteristics of the French economy may explain why oil price fluctuations have less of an impact on growth than in the 1970s.

According to the CAE, a 20% increase in oil prices would have a cumulative negative impact on French economic activity estimated at 0.2 percentage points after two years. This figure may seem relatively low, but the effects of an increase in oil prices appear to have a greater impact when the economy is in a phase of weak growth or recession.

Although the French economy now appears to be more resilient to oil price fluctuations, the current sluggish growth could, if it continues, weigh on employment in the event of a substantial increase in the price per barrel.

Notes

[1] However, indexation mechanisms remain in place: for example, the minimum wage is adjusted when inflation reaches a level corresponding to an increase of at least 2% compared to the index recorded when the previous minimum wage was set.

[2] The MÉSANGE model, developed by INSEE and the French Treasury, is also a neo-Keynesian macroeconometric model.

[3] The NiGEM model (from the National Institute of Economic and Social Research) is a macroeconometric model characterized by short-term Keynesian dynamics and a long-term equilibrium determined by supply factors.

References

– Bouscharain and Ménard 2000, « Is European inflation less sensitive to oil price fluctuations? », INSEE – Economic Notes, June 2000

– B.S. Bernanke, M. Gertler, M. Watson, (1997), « Systematic Monetary Policy and the Effects of Oil Price Shocks, » Brookings Papers on Economic Activity

– Centre d’Analyse Economique, The effects of high and volatile oil prices, 2010

– Directorate-General for Energy and Climate, « Energy and Climate Overview » report, July 2013.

– Natixis Economic Flash, March 2012, Growth and Oil Prices (P. Artus)

– INSEE, 2007, Working Papers: What impact do oil price fluctuations have on French growth? (Muriel Barlet, Laure Crusson)

– J. Hamilton, (1983), « Oil and the macroeconomy since World War II, » Journal of Political Economy

– J. Hamilton, 2009, « Understanding crude oil prices, » Energy Journal

– L. Kilian, (2008), « The Economic Effects of Energy Price Shocks, » Journal of Economic Literature

– Nathan S. Balke & Stephen P. A. Brown & Mine Yücel, « Oil price shocks and the US economy: where does the asymmetry originate? », Working Papers Federal Reserve Bank of Dallas, 1998

– Robert Schuman Foundation, Questions d’Europe n°85: The impact of rising oil prices on growth in the euro zone (JF Jamet), 2008