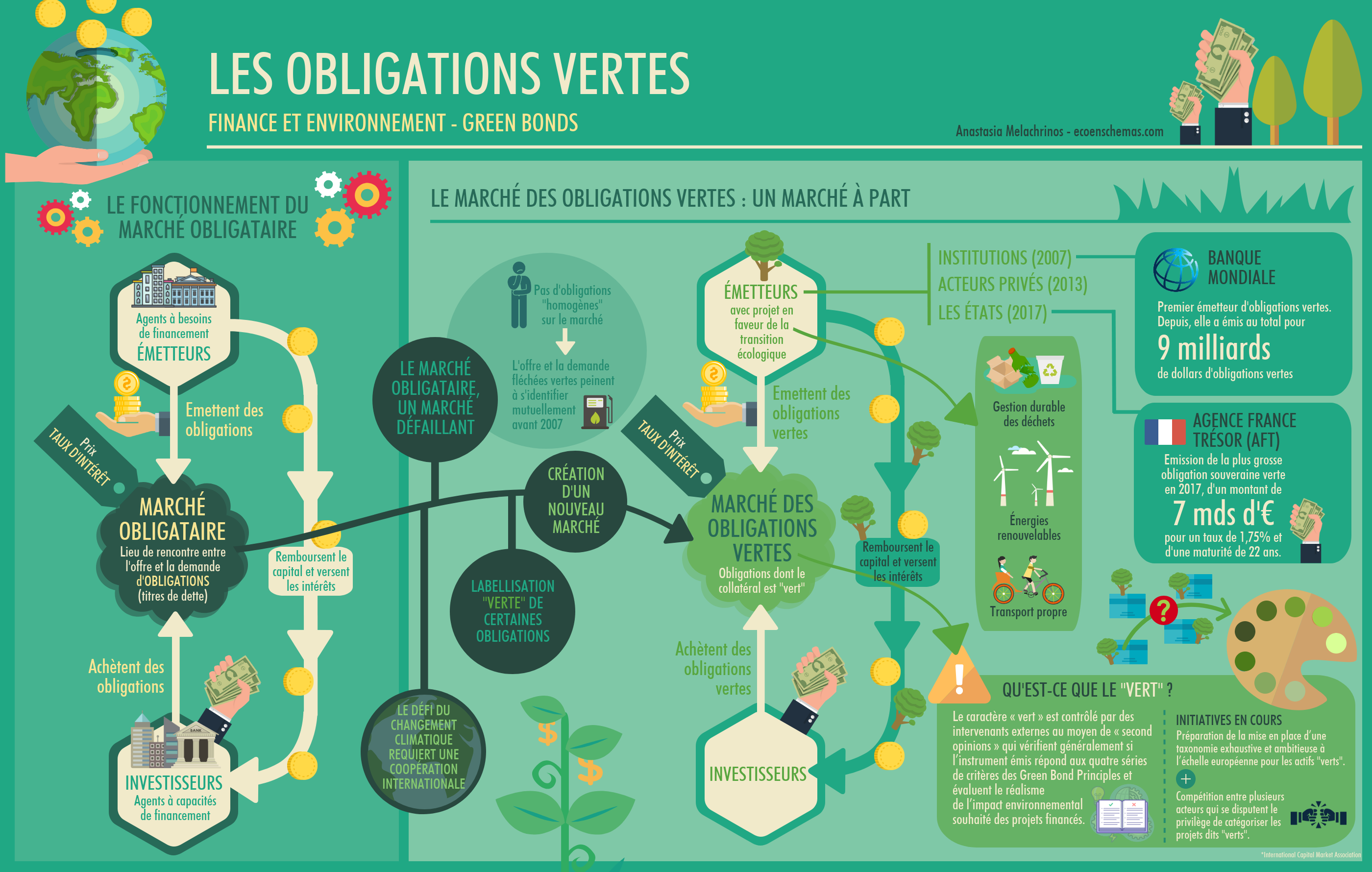

Since their creation in 2007 on the initiative of the European Investment Bank (EIB), green bonds have enjoyed growing success: in 2017, USD 155.5 billion of green bonds were issued, 78% more than in 2016, according to the international organization Climate Bonds. These bonds function like conventional bonds but are labeled « green. »

This additional information contributes to the structuring of a new « homogeneous » market where supply and demand for financing specifically contributing to the energy and ecological transition meet. At the time of issue, the term « green bond » thus makes it possible to directly target investors wishing to finance responsible projects. However, at present, no standardized definition has emerged for a green bond. While there are a number of safeguards that investors can request (a second opinion from a specialized organization, a third opinion from a rating agency, reporting throughout the life of the bond), there is still a risk of greenwashing.

A decade after its launch, the main challenge for this market is therefore to harmonize reporting standards. This reinforcement should help consolidate market homogenization by creating a reliable signal regarding the « green » qualities of projects and limiting the risk of adverse selection, which could lead to the market’s disappearance.