Employee share ownership: boosting employee savings through stronger tax incentives for companies (1/2)

Summary:

– Employee savings are a key issue both in terms of the internal functioning of companies and as a real asset for the economy as a whole.

– It is an entrepreneurial innovation dating back to the 1960s, which has developed slowly and in stages;

– In addition, this scheme is subject to very specific tax rules and is advantageous for all stakeholders.

– However, it appears that employees are relatively unfamiliar with the ins and outs of this scheme.

Since the end of 2014, employee savings have been the subject of renewed interest in the media since they are « on the agenda » of the Macron law. In this context, it seems worthwhile to revisit the fundamentals of this advantageous but little-known scheme. We will discuss the new impetus and the debates surrounding it in a second article.

Employee savings are a set of collective savings mechanisms, often little known, which allow employees to share in the company’s results. They refer both to mechanisms for sharing the company’s added value (profit-sharing, incentive schemes) and to mechanisms for saving and financial capitalization within the company. It takes the form of plans in which money is saved and frozen for a fixed period (five years, or longer term until retirement) depending on the objective of this accumulation (generating savings in the form of a securities portfolio, preparing for retirement, investing in stock options, etc.).

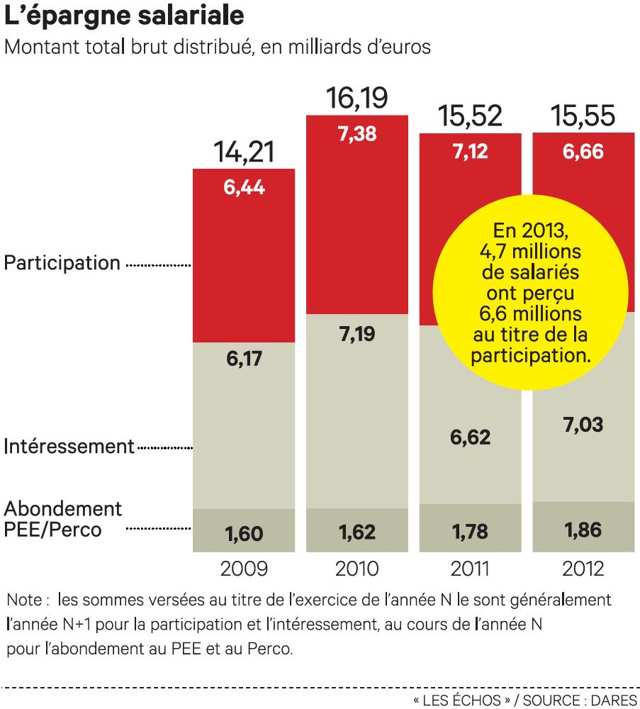

The emergence and, above all, the democratization of employee savings schemes represents a cultural revolution with significant economic implications. Indeed, it raises issues such as increasing competitiveness for companies, diversifying share ownership, boosting motivation (thereby creating a win-win situation for managers and employees), and shifting focus towards growth in order to better finance the economy. Profit-sharing, initially optional, was introduced in 1959, while it was not until 1967 that employee share ownership appeared.[1]. While the former simply refers to a reward intended to motivate employees[2], profit sharing is a real recognition by employees of the achievement of the company’s profit targets. Employee savings are also made up of employer contributions, i.e., payments decided by the company. As shown in the graph below, employee savings reached €15.5 billion in France in 2012, with profit sharing accounting for €6.6 million, incentive schemes €7.03 million, and employer contributions to savings plans (PEE and PERCO) €1.8 million.

Figure 1:

However, these schemes were long shunned by companies because profit-sharing required approval by the CERC[3]and involved various implementation costs. Since then, various attempts have led to its development in stages:

– 1970: introduction of stock options;

– 1973: introduction of share ownership plans;

– 1980: Giscard law on the exceptional distribution of shares;

– 1986: renewal and strengthening of the stability of employee savings with tax exemption on the PEE once the savings have been paid in;

– 1990: participation via the PEE made mandatory by the Soisson law for all companies with more than 50 employees.

It should be noted that between 1986[4]and 2001, profit-sharing grew significantly. This can be explained in particular by the increasing difficulties in financing pensions. Employee savings[5]can therefore be seen as an attractive tool for employees wishing to protect themselves against potential financial difficulties.[6]This is a supplement to retirement pensions that appears necessary over time: employees prepare for retirement with an additional « annuity » financed in and by the company. Share ownership experienced a real boost in France between 1995 and 1998, rising from 26% to 38% of total employee savings. Since the beginning of the 2000s and the Balligaud-Foucaud report, there has been a real desire to open up employee savings to all employees, and no longer just those in large companies.[7]. However, in 2009, the share held by employees represented only around 2% of the share capital of CAC 40 companies.

There are now a variety of employee savings plans available, symbolizing a genuine desire for partnership between companies and employees. These plans include a number of immediate and deferred compensation systems, which are encouraged and regulated by law[8]. Thus, under the generic term of employee savings, there are various plans: PEE, PERCO, PPESVR, PEI, and PPESVRI[9], which are available to small businesses. Their development has also been accompanied by a number of advantages. Indeed, financial optimization has been in full swing since the late 1980s. This can be explained in particular by changes in management methods (focused on skills, partnership value, and increased financial support in business management) and by a reorientation of value-added sharing to the detriment of employees. As a result, the PEE emerged as the only legal means of making profit-sharing tax-exempt through a collective agreement.

Today, these employee savings represent more than €110 billion in France and are growing significantly (+12% year-on-year), while becoming increasingly closely linked to corporate share ownership. More than 88% of employees (all types of companies combined) have access to at least one type of employee savings plan: 94% of employees are covered by at least one plan in companies with more than 50 employees, 74% in companies with 50 to 499 employees, and 17% in companies with fewer than 50 employees. Employee savings therefore concern around 8.8 million French employees, with an average amount of €1,482 for profit-sharing and €1,505 for incentive schemes.

Furthermore, it has been observed that this type of scheme is more common[10]in large companies (90% at France Télécom, 72% at Air France), but small, dynamic companies are also experiencing strong growth in employee share ownership depending on company policy.

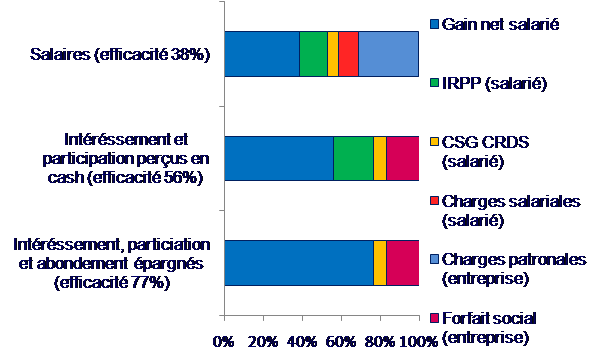

However, despite its remarkable growth, employee savings schemes are still developing slowly. The main obstacle is psychological, as employees remain reluctant to invest in the stock market, which they perceive as too opaque and volatile. The second obstacle is the legislative inflation surrounding employee savings schemes. Over the past decade, there have been numerous legislative changes affecting employee savings schemes. However, there are many advantages to these schemes. First, they allow employees to share in the company’s profits and performance, using them as a communication tool. Second, they are a means of empowering and retaining employees, as well as introducing them to wealth management, its distribution, and the workings of the financial markets associated with it. As Figure 2 shows, they appear to be more attractive than a salary increase.

Figure 2: Employer cost (source: Debory Eres)

Indeed, the benefits of using employee savings schemes are clear. For the same cost to the employer, the net gain for the employee is 1.45 times higher when profit-sharing and cash bonuses are used than when a salary is paid. And it is even almost twice as high for these same schemes when paid in the form of savings. In addition, payroll taxes are replaced by a social security contribution that is almost half the amount, as are payroll taxes. The social security flat rate is defined as » a contribution payable by the employer which, with some exceptions, applies to elements of remuneration or earnings that are exempt from social security contributions but subject to the CSG (general social contribution), or those that do not meet these conditions but are subject to the CSG by law. « (URSSAF). On the other hand, the CSG and CRDS employee contributions remain in place and are increasing by nearly 22%.

Furthermore, to continue their beneficial effects, these schemes enable individuals to build up precautionary savings or purchase real estate in the long term. However, in these difficult times for pension financing, this is becoming a common concern for companies seeking to set up PERCOs. This is especially true since the advantage is mutual, as it allows for the accumulation of long-term savings for corporate investment. Long-term savings finance the company while stabilizing the economy. In addition, when the company’s capital is increased, a discount (a preferential price) for employees is applicable under employee savings schemes. But above all, it is a question of tax optimization for the company’s cash flow and employee compensation. This tax incentive is also presented as a way to combat inequality by directing savings toward the long term, with the tax allowance proportional to the number of employees.

Thus, employee savings, as an instrument for « restructuring social ties within the company, » appear virtuous and inclusive, strengthening motivation and a sense of belonging to the firm. Necessarily, the company’s results, finances, and governance must reflect this. This tool for motivation and constructive social dialogue truly steers corporate financing toward socially responsible investment.

Conclusion

Employee savings are a real innovation of the Trente Glorieuses, a period during which the French saved a significant portion of their disposable income. The development of these schemes is a central element of the transformation of savings in the context of Fordist wage relations.

Today, this mechanism has taken on an important but insufficient role. Employees are generally poorly informed about it, and the system is not particularly simple, particularly due to technical tax issues. Yet employee savings are presented as a vector for growth. But what is their actual current use? What laws govern their use? What amendment proposals affect them?

References:

« How can employees be involved in the company’s performance? », CroissancePlus report Grandir ensemble, January 2011.

Employee savings, instructions for use, France info guide, Patrick Lelong, Ed. Jacob-Duvernet, 2004

Understanding and advising on employee savings, Gilles Briens, Les essentiels, Ed. L’Argus de l’assurance, 2014

« Increasing the economic performance of the company by improving its governance and employee participation, » monitoring note, Centre d’analyse stratégique, June 2010.

« Employee participation and social performance: new challenges for French companies as they emerge from the crisis, » analysis note, Centre d’analyse stratégique, January 2011

Notes:

[1]However, these two financial benefits must be distinguished. Profit-sharing is a bonus paid as a supplement to salary based on the company’s results. Targets are set between the employee and the company for the annual results to be achieved. Profit-sharing is therefore an « optional » reward paid only if these targets are met. To earn more, you have to perform better. Profit-sharing, on the other hand, is a mandatory scheme for all companies with more than 50 employees. It involves redistributing a portion of the company’s net profits to its employees. It guarantees that added value is shared and can be combined with profit-sharing.

[2]The company has a budget that it decides how to allocate in the form of bonuses, with the best performers receiving the most attractive bonuses. These can be collective (proportional to the number of hours worked) or individual (with specific targets). The aim is to develop an entrepreneurial spirit in which employees feel involved in the company’s economic and financial results.

[3]Center for the Study of Income and Costs

[5]Via the Company Savings Plan and/or the Collective Retirement Savings Plan.

[6]However, we will see that the cost to public budgets of developing employee savings is significant and that this can also have a negative impact on pension funding.

[7]Including self-employed professionals and merchants.

[8]Labor Code, Commercial Code, and General Tax Code

[9]Respectively: Company Savings Plan, Collective Retirement Savings Plan, Voluntary Employee Retirement Savings Partnership Plan, Intercompany Savings Plan.

[10]Furthermore, this system can also be criticized for creating a problem of distortion of competition when companies use profit-sharing, employee share ownership, employee share purchase plans, or even free share allocation or employee savings plans.