Summary:

– Devastated by the economic crisis of 2008-2009, which depleted their financial reserves, companies in the agri-food industry (France’s leading industry) were then hit hard by the exceptional volatility of agricultural commodity prices.

– Since then, the agri-food industry has struggled to recover significantly, and its economic situation remains hampered by a downward trend in competitiveness and persistent overcapacity.

– However, there are levers for growth: high product quality, reinforced by regular innovation in the sector, could satisfy demand, which for the first time in several years is being stimulated by gains in purchasing power.

The importance of the agri-food industry (IAA) in France is well established. Accounting for more than 18% of industrial turnover, 16% of added value, and nearly 500,000 jobs, the sector is a major player in our country’s economic activity.

It is important because it processes 70% of our agricultural production and supports many farms, but also because 80% of the food consumed in France is produced locally. The agri-food industry is made up of 98% small and medium-sized enterprises (SMEs), which therefore contribute to the development of the French economy. This is essential when we consider that over the last 20 years, 80% of jobs created have been in SMEs. Finally, because we all need to eat, the agri-food industry is one of France’s safe havens, even in the midst of financial and economic turmoil.

To illustrate this, at the end of 2014, production in the food industry accounted for around 7% of French GDP. Signs of tension in this sector are therefore not insignificant for the growth of economic activity as a whole.

1) The agri-food industry is losing momentum and facing numerous obstacles, some of which are structural.

The rise of large-scale distribution and its concentration have disrupted the agri-food industry landscape. The large-scale distribution sector is structured around seven major chains, while the agri-food industry remains highly fragmented, with nearly 16,000 companies, 98% of which are SMEs.

The situation has changed radically: consumers are more influential and large retailers have grown stronger. Defending the « purchasing power » of the former has become the battle cry of the latter.

a) The exceptional length of the crisis, coupled with rising raw material prices, has weakened the financial situation of the food industry.

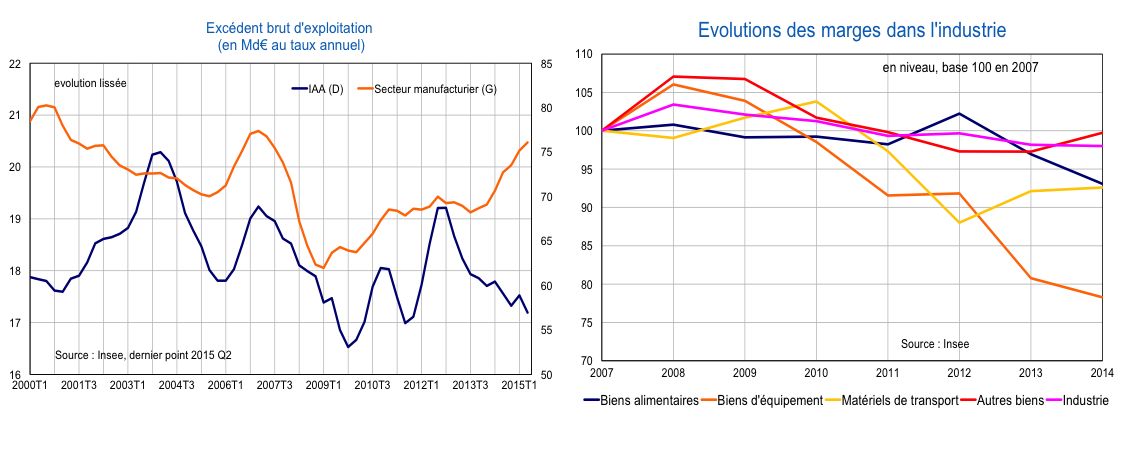

The gross operating surplus of agri-food companies has fallen considerably over the last three years and, in mid-2015, was close to the low point reached in 2009 at the height of the financial crisis. The agri-food sector is thus one of those that has seen its margins erode most significantly over the last seven years. The surge in raw material prices (up 150% in 10 years) is one factor, but it is not the only one. The increase in agri-food taxation, which has intensified since 2012, is also weighing on the margins of agri-food manufacturers.

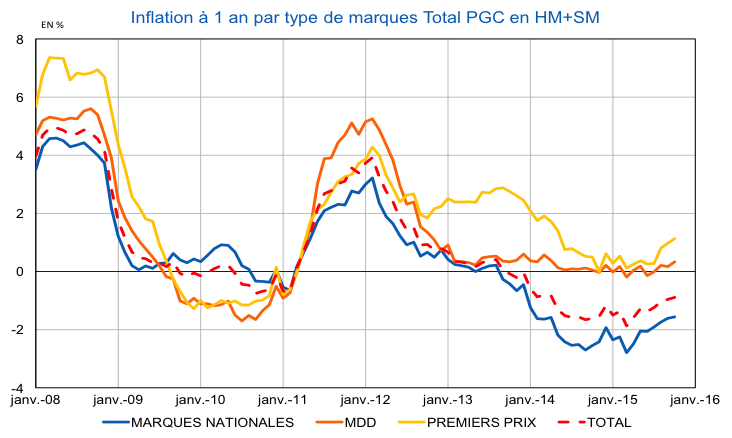

In this value chain under pressure, the links least well equipped to defend their positions are the first to suffer. Since 2013, in a context of modest purchasing power and weak household consumption, large retailers have embarked on a frantic race to the bottom on prices. When the overall market is not growing, the best way to make progress is to capture market share from competitors. Each of the major retailers is therefore striving to be as competitive as possible on price, which has become the main, if not the only, basis of their commercial policy. However, due to the significant imbalance of power mentioned above, this price competition is essentially financed by suppliers, who often have no choice but to agree to the retailers’ pricing demands for fear of being delisted.

In this context, agri-food industries are now facing an erosion of their profits. This illustration of the loss of competitiveness of agri-food companies is worrying.

b) This deterioration in economic and financial performance is weighing on the innovation and investment capacity of agri-food companies.

For a company, investment measures its ability to plan for the future. In the agri-food industry, the economic situation, which has deteriorated significantly since the summer of 2015, is severely affecting manufacturers’ visibility and confidence in the future. All of these factors are prompting them to postpone their investments in 2015. Last year, investment in the food industry grew at a slower pace than in 2014 (1% forecast at the end of October compared with an estimated 3% for 2014), whereas an acceleration was expected at the beginning of summer 2015 (9% anticipated in July).

Like the rest of the economy, the food industry is suffering from excess production capacity. The outlook for demand is struggling to recover (sluggish and declining consumption over a long period, low investment), leaving production capacity partially unused.

As a result, all industrial sectors have seen a loss of nearly 800,000 jobs since 2000, representing 19% of the workforce observed that year. The agri-food industry has seen a decline of 16,000 jobs, or 3.2% of its salaried workforce at the time. The agri-food industry is therefore generally more resilient than the rest of the industry, with jobs spread across the country.

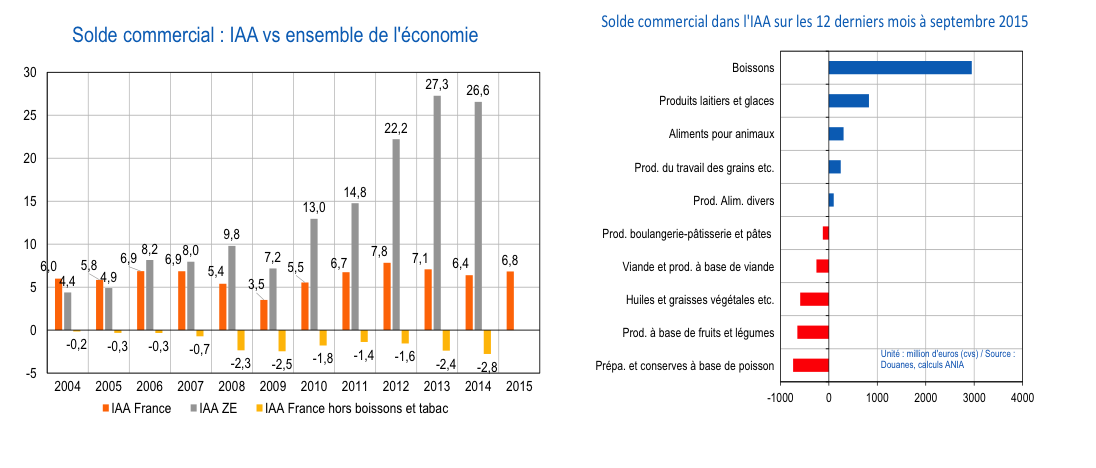

c) The deterioration in French competitiveness can be measured by a loss of export market share.

France’s agri-food industry market share is declining in almost all regions of the world, with the exception of China, Taiwan, Hong Kong, South Korea, and Japan. The most significant decline is in North Africa, the Near East, and the Middle East. France controlled less than 9% of imports to this region in 2013, compared with nearly 13% in 2005. Comparable to that of the euro zone in 2004, the French food industry’s trade balance is now four times lower. The deficit widened particularly for agri-food products excluding beverages and tobacco (-€2.8 billion in 2014).

2) However, there are levers for growth in the agri-food industry

a) Innovation is a key driver of competitiveness and responsibility for IAA companies.

Food companies use it regularly: more than 3,000 product innovations are launched on the food market every year. Every five years, half of the products in supermarkets are renewed. In total, nearly 61% of food companies innovated in 2010 (compared to 54% in otherindustries). It should also be noted that in the food sector, two out of three innovations have a positive impact onthe environment.

However, there is still significant room for improvement in this area of innovation. In addition to insufficient investment in the food industry, the decline in business performance could also be due to a lack of technological innovation, particularly product innovation, which enables diversification in the face of competition.

The importance of scientific research in the economy is generally undisputed. Corporate R&D expenditure, which is not included in theinvestment rate, appears to be a good indicator of technological innovation capacity. Companies in the agri-food industry still devote a small proportion of their turnover to R&D: 0.7% compared with 2.3% for allcompanies.

In the agri-food industry, this underinvestment can be explained in particular by a market failure in the financing of the activity. In the agri-food industry, equity financing is more likely to come frompublic funding. The fragmentation of the agri-food industry landscape means that traditional private equity investors, the main source of financing for innovative companies, are rarely present.

For agri-food companies, the difficulties mainly relate to the administrative complexity of the financing systems and the multiplicity of interlocutors. If a company wants to be able to benefit from aid, it must be able to:

o Identify the support system best suited to its project. This requires knowledge of the myriad public financing organizations (BPIfrance, regional development agencies, competitiveness clusters, ANR, etc.).

o Be able to use the form and vocabulary required by the expert committees. In most cases, it is necessary to call on companies that are familiar with the mechanisms to facilitate the acceptance of applications.

It is therefore important to provide better guidance to IAA companies in navigating the complex landscape of innovation support, especially since, from a macroeconomic perspective, the lack of personal funds and the high cost of innovation activities are the primary obstacles to innovation for SMEs.

b) The recent recovery in confidence and purchasing power could stimulate demand for agri-food products.

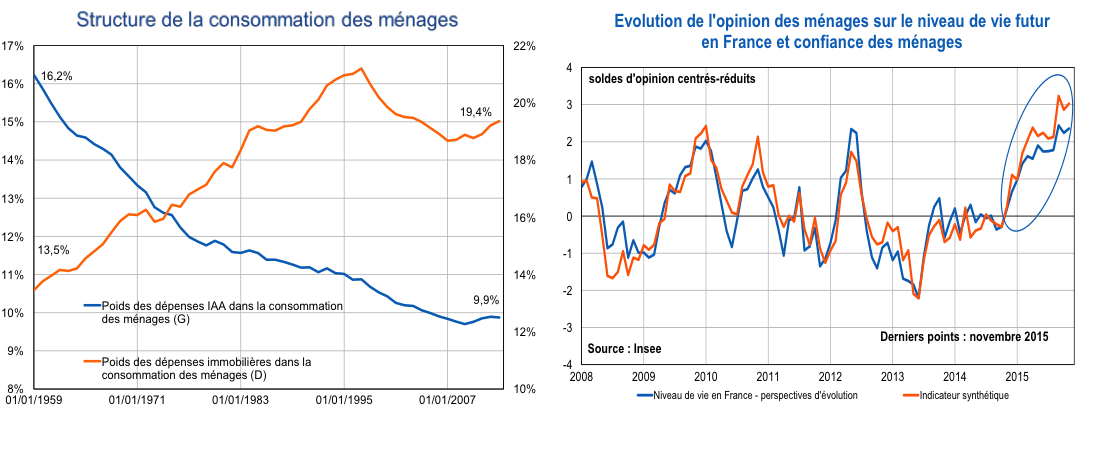

Contrary to popular belief, household food consumption falls into the category of « discretionary spending, » which continues to be determined by purchasing power. In a context of weak purchasing power, food consumption has slowed significantly in recent years. The sharp decline in prices since mid-2014, which has continued in recent weeks, is boosting purchasing power, which could be conducive to a recovery in spending from a forward-looking perspective.

Household confidence, an important driver of consumption, has also gradually improved over the past several months. In particular, the outlook for living standards has reached a level not seen since 2007. Purchasing opportunities are also improving, reflecting a greater appetite for consumption and a decline in precautionary behavior. These factors could therefore halt the structural decline in food spending in household budgets. For more than 30 years, the share of household budgets spent on food has been falling. It has lost a total of 4 percentage points since 1975.

Conclusion

Although the agri-food industry is following the same downward trend as the rest of the industry, it has nevertheless shown its willingness to resist: fewer job losses, continued growth in turnover, a trade balance that is the second largest contributor to France’s overall trade balance, a strong regional presence that allows everyone to find a job nearby, high-quality products, and a significant outlet for French agriculture.

Notes:

[1] Source: Les Echos Agri-Food Think Tank, What needs to be done to restore the competitiveness of the French food industry, 2015 edition

[2] Source: CIS survey (2012), Eurostat

[3] Source: Agreste (2011) « The agri-food industry innovates in favor of the environment »

[4] In France, research expenditure is generally recorded as an expense when incurred.

[5] Source: Ministry of Higher Education and Research, Office of Statistical Studies on Research, IGF/CGAAER report

[6] Source: Ministry of Agriculture, Agri-Food, and Forestry, Panorama of the agri-food industries, 2014 edition

[7] In the agri-food sector, traditional private equity investors are not very active. As of December 31, 2010, among the 3,326 companies for which the AFIC (French Association of Investors for Growth) has NAF codes (out of a total of 4,525 companies), only 36 are active in the agri-food sector (i.e., 1.1%). Between January 1, 2003, and June 30, 2011, of the 2,828 companies in which French private equity funds invested and for which the AFIC has NAF codes (out of a total of 6,538), only 44 were active in the agri-food sector (i.e., 1.6%).