Summary:

– French companies were able to weather the crisis thanks to the consolidation of their balance sheets during the 2000s

– Maintaining a healthy financial position, accompanied by a decline in SME profit margins, was possible by reducing their level of investment

– Despite very favorable credit conditions for SMEs, there has been a decline in demand for credit due to a lack of confidence in the economic and fiscal outlook in France, as well as endogenous constraints on access to bank financing

French SMEs represent 99.8% of the French business population, nearly 60% of added value, and more than 60% of jobs. Their representativeness of SMEs in the French economic landscape is roughly in line with the European average. Their weight in the economy leads us to take an interest in how they are managing the economic crisis and their development in a context that remains difficult in 2013 and, according to half-yearly surveys conducted by BPIFrance, is likely to remain difficult in 2014.

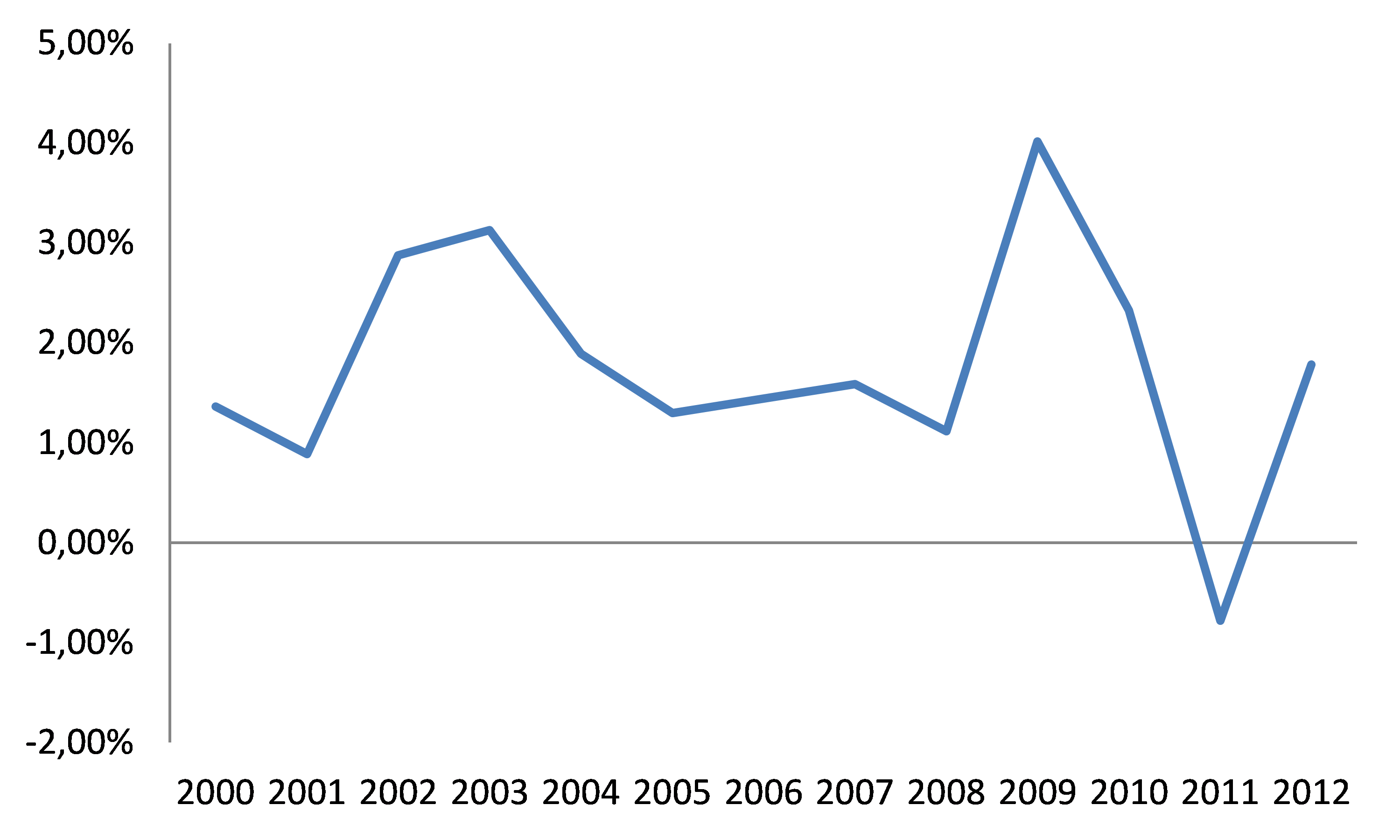

The strengthening of SME equity capital in the 2000s and its effect on private investment

French SMEs generally strengthened their balance sheets during the 2000s, particularly the smallest entities with turnover of less than €10 million. According to Banque de France data, the average financial autonomy ratio (the financial ratio relating the value of equity to the balance sheet total) increased by nearly 7% between 2000 and 2012. This financial strength prior to the 2008 crisis enabled French SMEs to withstand the downturn in activity. However, a more detailed analysis of this phenomenon reveals that disparities between companies’ financial structures have increased.

Growth rate of the average financial autonomy ratio for all French SMEs

Sources: BACH, BSI Economics

Thus, the interquartile range, which corresponds to the difference between the first and third quartiles of financial autonomy ratios, has increased by approximately 6% since 2000. Growing heterogeneity can lead to greater disparities in access to financing. These fears are exacerbated by the sharp increase in business failures since 2008.[1]to nearly 63,000 in 2013, a level close to that observed in 2009. Most of the failures involve young and generally small companies.

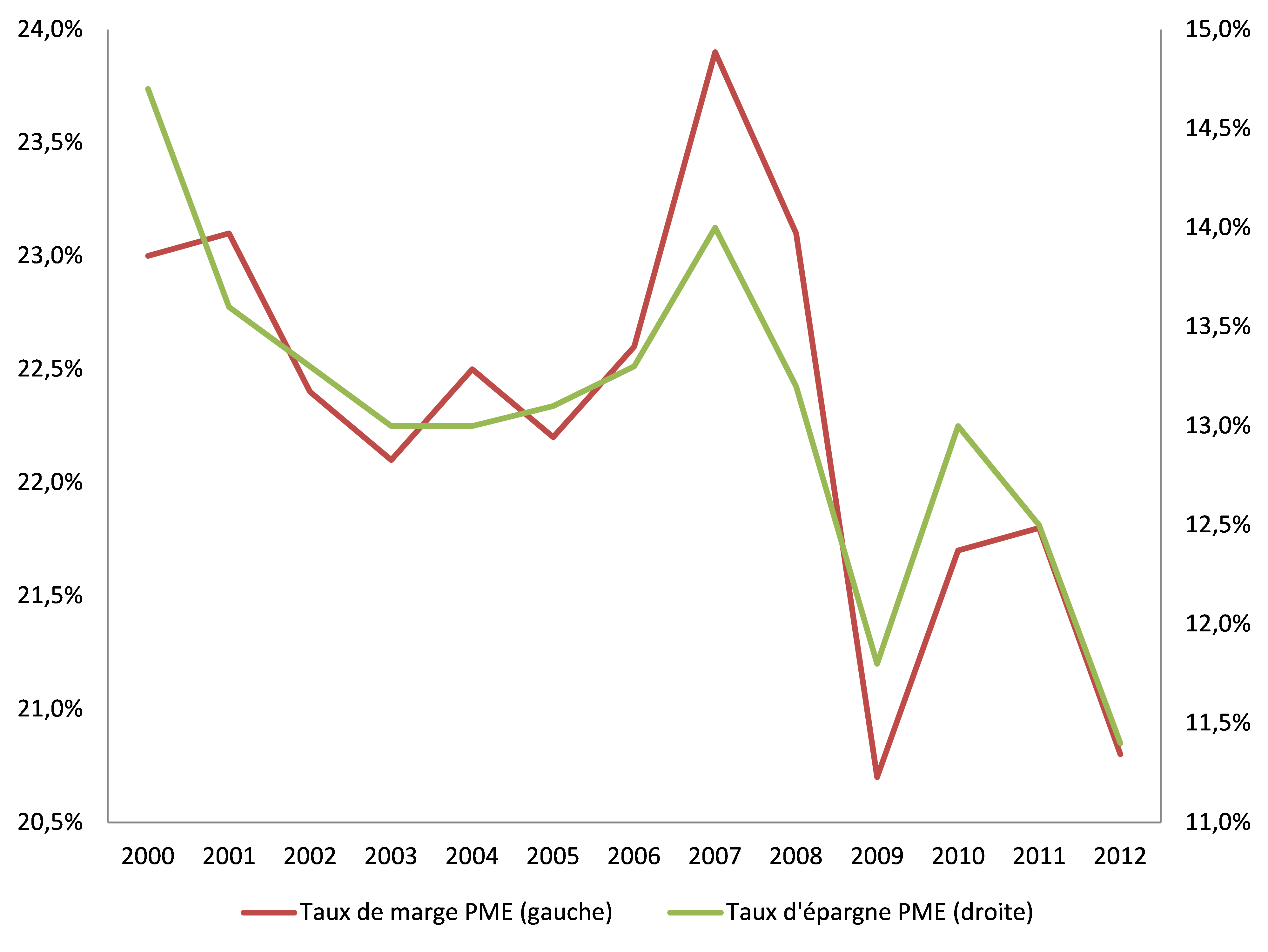

This overall strengthening of the balance sheet structure was accompanied by a sharp increase in the size of balance sheets over the entire period, but seems to have stabilized since 2008. In order to maintain a stable financial structure, in the period 2009-2011, when activity slowed sharply, leading to a general decline in operating results, companies had to give up saving in particular. The decisions made by SMEs during the slowdown led them to curb their longer-term investments in order to maintain balanced balance sheets. According to data from the Banque de France, the savings rates of French SMEs followed the same trajectory as profit margins.[2][3]. The latter, which correspond to the portion of wealth available for investment, increased over the period 2003-2007 but have fallen sharply since the crisis.

Comparison of margin rates and savings rates for SMEs

Sources: Banque de France, Fiben data, BSI Economics

According to INSEE, the decline in profit margins since the crisis brought them to their lowest level since the early 1980s in 2012. As for SMEs, their profit margins in 2012 reached their 2009 levels, at the height of the crisis. This situation directly affects their savings rates and investments.

The consequences of the decline in private investment on the growth potential of French SMEs

This situation is particularly worrying for the development of productive investment by SMEs. Such investment has been postponed or even canceled in favor of less risky investments. According to the Banque de France, investment by SMEs consists mainly of renewing existing production capacity and is therefore not productive enough to improve the profitability of businesses in the medium term.

The decline in investment is hampering the growth potential of small and medium-sized enterprises, making it more difficult for them to move upmarket and therefore to establish an international presence. However, 96% of exporting companies have fewer than 250 employees.[4]. The total number of exporting SMEs has been declining since 2002, when France had more than 122,000 exporting SMEs, to less than 115,000 in 2012.

Various economic surveys on the morale of executives and business leaders reveal a high level of mistrust among these key players regarding the French economic and fiscal context[5]. The risk aversion revealed by these recent surveys shows no sign of abating. This lack of confidence in the improvement of market conditions has a direct impact on companies’ investment decisions. This lack of business investment comes at a time when the financial environment is very favorable to investment. At the same time, credit conditions are very favorable for businesses in general, and SMEs in particular.

Financing private investment: credit access conditions and trends in lending

Credit access conditions for French companies are among the most favorable in Europe. At the end of January 2014, the ECB published an average rate for new loans of 1.9%, below the eurozone average[6]. However, these favorable conditions do not seem to encourage SMEs to take risks, as they remain cautious in their investment choices. The Banque de France notes that investments made by French SMEs are defensive in nature, i.e., they are made with the aim of confirming a position in a market rather than creating new growth opportunities. However, it is bold investments in innovation and research that would promote their growth in the medium term and enable them to embark on a path of sustainable growth. In light of this observation, it is worth considering the causes of this investment deficit. Is it due to a high level of risk aversion among entrepreneurs and managers, or to risk aversion among banks, which, in anticipation of regulatory constraints and a deterioration in corporate performance, are rationing credit?

There are numerous microeconomic studies seeking to understand whether what we analyze as low levels of SME investment are the result of low demand for credit from businesses or a phenomenon of credit rationing. The Banque de France, for example, has observed a decline in demand for credit[7]. However, it should be noted that, although investment loans have a high acceptance rate, obtaining cash loans appears to be more difficult. In the fourth quarter of 2013, only 68% of cash loan applications resulted in the release of at least 75% of the funds requested. According to banks, low demand for credit is the main cause of the slowdown in the growth of outstanding loans to small and medium-sized enterprises.

Studies conducted by the European Central Bank allow us to further analyze this decline in credit demand from SMEs. When SME business leaders are asked about the obstacles to obtaining credit, they say they are increasingly discouraged from applying for credit, mainly due to the collateral requirements used as guarantees by banks. Business leaders believe that banks are demanding more and more guarantees, making it increasingly difficult to obtain credit. As a result, business leaders are self-censoring, leading them to abandon or restrict their credit applications. Business leaders have therefore internalized the constraints on access to bank financing, effectively causing a decline in demand. Furthermore, French SMEs remain among the most pessimistic in Europe regarding their economic outlook. This sentiment, combined with their perception that banks are too demanding, has a negative impact on SME credit demand, which is not offset by favorable credit access conditions.

Conclusion

The cautious management observed by SMEs is not allowing them to sufficiently revitalize their business. Although borrowing conditions are very favorable, the expectations of small and medium-sized enterprises are leading them to postpone their investments. However, investment is crucial for SMEs to grow and establish themselves sustainably in the international economic landscape.

Although French SMEs are solid, there is reason to fear that their performance will not improve in the short term. Given their weight in the economy, the consequences for economic growth may not be negligible. A return to growth in France would seem constrained without a virtuous cycle of bold investment by SMEs.

Notes:

[1] See data on business failures, Banque de France, Webstat.

[2] Source: Report by the Business Financing Observatory, January 2014

[3] Ratio between EBITDA and added value

[4] Source: Customs

[5] See: Business Leaders Barometer, Vivavoice, CCI France, Les Echos, Radio Classique

[6] Source: ECB – New variable-rate loans exceeding €1 million with a fixed-rate period of less than one year.

[7] Two-point drop in demand for cash loans and three-point drop in demand for investment loans between Q2 2012 and Q4 2013.

References:

– « Report on the economic and financial situation of SMEs, » Business Financing Observatory, January 2014

– « SME Financing: Major Challenges, New Approaches, » Les cahiers du cercle des économistes, November 2013

– « Report on the evolution of SMEs, » SME Observatory, BPIFrance, 2013

– « Survey on the access to finance of small and medium-sized enterprises in the Euro Area, » European Central Bank, November 2013