« Financial depth » could be translated as « depth of the financial system. » The term we are explaining here describes a macroeconomic attribute of a country, unlike the term « market depth, » which is often used at the microeconomic level to define the depth of a specific financial market or a particular security (a concept similar to liquidity). The World Bank defines it as « the size of banks, other financial institutions, and financial markets in a country, taken as a whole, relative to a measure of economic output (a factor that allows countries to be compared on the same scale). » In other words, it is the relative level of development of the financial system in quantitative terms.

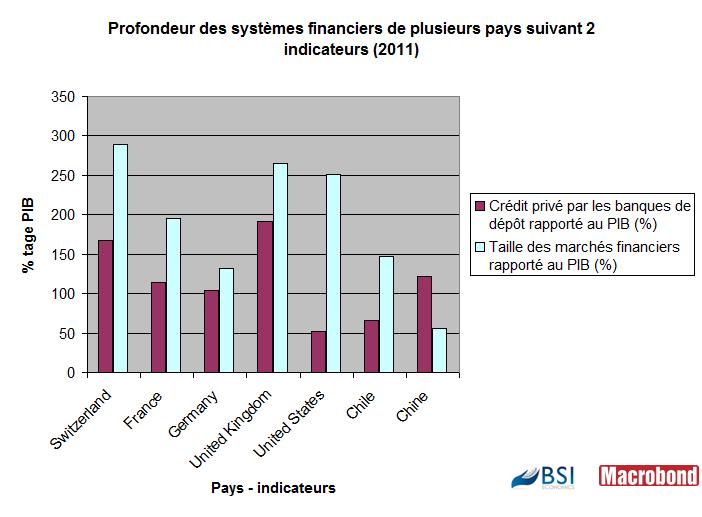

There are several indicators of financial depth, the most common of which is certainly private credit relative to GDP (private credit being credit extended to non-public agents). This indicator reflects the development of the credit intermediation system (credit by banks) rather than the development of the market intermediation system or direct financing (financial markets). According to this indicator, the United States has a less deep financial system than China. The explanation for this is that the United States has a financial system that relies much more on market financing, which is not taken into account in this indicator.

Another indicator used is the sum of total bank assets relative to GDP. This indicator has the advantage of also including loans made by banking agents to public entities, and also takes into account assets held by banks that are not loans (a large part of the banks’ balance sheets). One shortcoming of this indicator is that it does not take into account the assets of non-bank financial institutions, which account for a large part of today’s financing.

An indicator of the size of financial markets, complementing the two previous indicators, is the result of two indicators: financial market capitalization relative to GDP and the volume of private debt securities relative to GDP.

Using the two previous indicators, we can compare the size of financial institutions with the size of financial markets. This gives us a picture of a country’s financial structure: is it based more on credit intermediation (the usual structure in many European countries) or more on financial markets (the Anglo-Saxon model)? Countries such as Sweden, Singapore, and India have a ratio of financial institution size to financial market size below 2.5, while countries such as Bolivia and Bulgaria have ratios exceeding 356.

Finally, it should be noted that the depth of a financial system, in terms of its quantitative development, has been associated in some economic literature as a determining factor in economic growth, at least up to a certain threshold (see Arcand et al 2011).

Julien P.

References:

Arcand et al (2011) « Too much finance, » summary of their article at http://www.voxeu.org/article/has-finance-gone-too-far