Abstract:

– In 2014, rising geopolitical risk and imbalances between dynamic supply and weakening demand will have taken their toll on oil prices.

– Oil supply will remain strong in 2015, thanks in particular to an aggressive OPEC policy and increased shale oil and gas production in the United States.

– Oil demand is slowing down due to the proven slowdown in the Chinese economy.

– In 2015, oil prices are expected to remain at abnormally low levels but will experience some volatility until oil supply and demand adjust and a new equilibrium price emerges.

Oil lost nearly half its value in 2014 (price per barrel of Brent in $) and the adjustment was brutal. The consequences of such low price levels will depend on the net export or import position of the economies most affected by oil price fluctuations.

Following on from 2014, 2015 is likely to be another bad year for oil. Supply will remain dynamic for the Organization of Petroleum Exporting Countries (OPEC), which, under the leadership of Saudi Arabia, wants to sell its production rather than lower its production quotas. In addition, the supply of black gold will continue to diversify, particularly thanks to growing shale oil and gas production in the United States. However, weak demand for oil is likely to persist at a time when China is slowing down, dragging global trade down with it without any real trend…

The key question is whether oil prices will remain at such low levels in the long term. The answer lies in the formation of a new equilibrium price between dynamic supply and declining demand.

2014: a bleak year for black gold!

The price of a barrel of Brent crude lost half its value in the second half of 2014, falling from $112/bbl at the beginning of July to $56/bbl at the end of December. At the beginning of 2015, the price of a barrel of Brent crude was below $50. Most of this decline occurred during the last quarter of 2014. This sharp decline was the result of a confluence of factors that led to a structural change in the balance between oil supply and demand: (i) rising geopolitical risk, which precipitated the fall in oil prices; (ii) OPEC’s desire to sell its very large production of black gold at lower prices; (iii) the existence of credible alternatives to fossil fuels (shale oil, electricity, renewable energies, etc.); (iv) the relative sluggishness of aggregate demand and therefore of world trade, with the slowdown in China as the main brake; (v) the dollar appreciating in real terms.

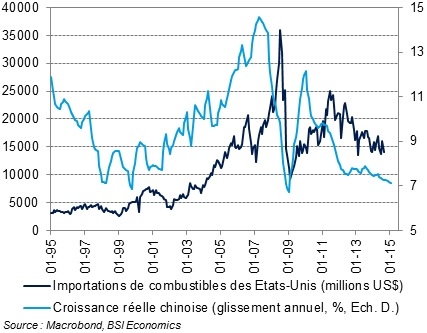

In 2014, the dynamics of oil supply began to undergo cyclical and even structural changes, leading to a rapid and sustained decline in prices. The Russian-Ukrainian geopolitical crisis is dragging on, and Western embargoes against Russia are undermining the economy (see Russian-Ukrainian crisis: is one man’s misfortune another man’s fortune?); just like oil, in just a few months, the ruble has lost half its value against the dollar. The Russian economy is highly dependent on oil. Oil exports account for around 65% of total exports and nearly half of the country’s tax revenues. At the same time, OPEC, mainly under the impetus of Saudi Arabia, is maintaining its production quotas at a high level relative to demand, gradually lowering the equilibrium price of oil. In the United States, imports of petroleum products have fallen sharply (see chart below) as shale oil and gas production has intensified (production tripled in three years, from 7 to 21 million barrels per day in 2014). In addition, the slow realization of the negative externalities caused by the intensive use of fossil fuels is driving the move towards a more diversified and eco-friendly supply, particularly under the impetus of developed country governments. Supply is certainly changing, but what about demand in 2014?

Fuel imports by United StatesUnited States and Chinese growth

The diversification of supply is mainly in response to changes in demand. In 2014, aggregate demand remained very sluggish and global trade evolved without any real trend. The slowdown in China was the main obstacle to a genuine global recovery. At an estimated +7.4% in 2014, Chinese growth reached its lowest point in nearly 25 years (see chart above). The United States performed well, with growth forecast at +2.4% in 2014, above its potential estimated at around +2% by the IMF. Strong employment momentum and the recovery in the real estate market have overcome the unconventional policy (QE3) pursued by the Federal Reserve, giving way to a real appreciation of the dollar and a steepening of the yield curve in the United States. However, the eurozone and Japan are facing significant deflationary pressures and weak growth, forcing the ECB and the Bank of Japan to remain very accommodative and further exacerbating the appreciation of the dollar, particularly against the euro and the yen.

Oil supply in 2015: on the cusp of structural change!

The political and civil crisis between Russia and Ukraine has already claimed thousands of lives, and the economic fallout from Western embargoes against Russia is beginning to be felt. 2015 is likely to spell the end for the world’s second-largest exporter of petroleum products, with growth expected to turn negative. The fall of the ruble has led to a fall in oil prices, but it seems that a new equilibrium price is settling in 2015, with Saudi Arabia, which advocates a strategy that is far from unanimous within OPEC, implicitly showing its willingness to sell its production at a lower price while leaving production quotas unchanged. On the other hand, if the price per barrel of oil falls too low (around $50), Saudi Arabia, which cannot afford to sell below this price for too long, will certainly react…

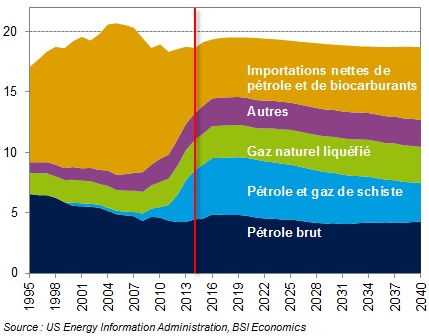

At the same time, the United States is importing much less oil than before, in favor of more diversified domestic production (see chart below). This diversification of the supply of petroleum products is expected to continue in 2015. The United States has seen its net imports of oil and biofuels fall from more than half of its supply to a quarter in five years. Over the same period, shale oil and gas production has risen from 1% to a quarter of supply, and this change appears to be structural according to local sources (see chart below).

Breakdown of petroleum product supply in UnitedUnited States (millions of barrels per day)

In 2015, the US recovery is expected to continue in the wake of 2014, with growth of +2.7% according to the IMF, still above its potential. Shale oil and gas production will continue to play a more than positive role in US employment. And with good reason: according to estimates by IHS Global Insight, nearly 870,000 direct jobs will be created in 2015 in the United States in the shale oil and gas sector. In addition, the US dollar is expected to continue its real appreciation, while the question of the first rate hike will have to be decided this year. However, the rise in the dollar almost automatically leads to a fall in oil prices, ceteris paribus, and therefore changes the demand for oil. How will demand evolve in 2015?

Oil demand in 2015: towards a new equilibrium!

In addition to certain technical factors such as the real appreciation of the dollar, more structural factors explain the sluggishness of oil demand. The most important of these is the slowdown in China, which is weighing on the recovery in global trade. In 2015, China is expected to grow by « only » around +7%. In addition, the country is facing significant disinflationary pressures (inflation averaged +2.3% in 2014, compared with +2.6% in 2013, and the latest figures for December 2014 show inflation at only +1.5% year-on-year). This low inflation is mainly due to the crisis in the Chinese real estate market, but also to the fall in prices of the most volatile components of the consumer price index (i.e., energy and food). The authorities are likely to continue adopting targeted measures in response to the slowdown in the Chinese economy. However, relatively low oil prices are having a positive impact on global trade, primarily through savings on transport costs.

In addition to the slowdown in China, the United States will play an important role in aggregate demand for petroleum products. Indeed, the increase in domestic production, particularly of shale oil and gas, is expected to continue, ensuring the United States relative independence in terms of fuel consumption. The US economy is expected to continue its recovery, with dynamic labor and real estate markets. The real appreciation of the dollar and the strengthening of interest rates are expected to peak when Janet Yellen and the Fed members decide on the date of the first fed funds rate hike (probably not before the second half of 2015). At the same time, the eurozone and Japanese economies are struggling to stem deflationary pressures, and growth will remain relatively weak in 2015. The central banks of these countries will remain very accommodative, particularly through the use of unconventional monetary policies (QE in the case of the ECB and financial asset purchases in the case of the Bank of Japan).

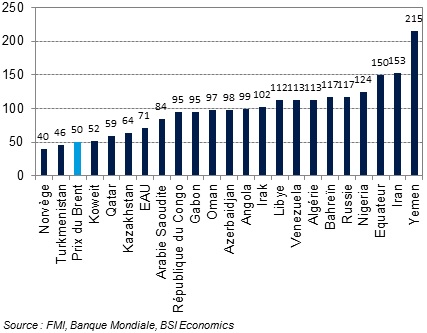

Oil price that balances revenue and expenditure (break-even point) by country of extraction

With regard to the formation of a new equilibrium price between oil supply and demand (see chart above), it appears that very few countries are profitable at the current price per barrel. In terms of the profitability of shale oil in the United States, break-even points range from $40 to $180, according to the IMF. However, in the longer term, oil at around $80 per barrel would be viable given the current low level of demand and the fall in extraction costs, particularly in OPEC countries. Saudi Arabia offers some of the cheapest oil on the market and could well gain market share in this new configuration.

Conclusion:

At the dawn of 2015, it appears that oil prices have entered a new regime in which supply has increased and demand has fallen. This new configuration leads us to consider a lower equilibrium price than before, in the range of $50 to $70 per barrel in 2015.

2015 should be a year of transition for black gold. The negative effects of the Chinese slowdown on global trade should be offset by the positive effects of a lower equilibrium price for oil, which will constrain supply and at the same time boost demand. Oil prices may experience some volatility spikes in 2015 but should remain relatively low in the longer term. Geopolitical tensions in Syria, Libya, Iraq, Ukraine, and of course Russia will continue to weigh on investment, particularly by oil conglomerates.

All models agree that lower oil prices are generally conducive to growth (according to the IMF, a $20 drop in the price per barrel would, ceteris paribus, lead to a 0.5% increase in global GDP in 2015). However, the situation varies depending on exposure to the oil sector: net importing economies should benefit at the expense of net exporting economies…

Written on January 10, 2015