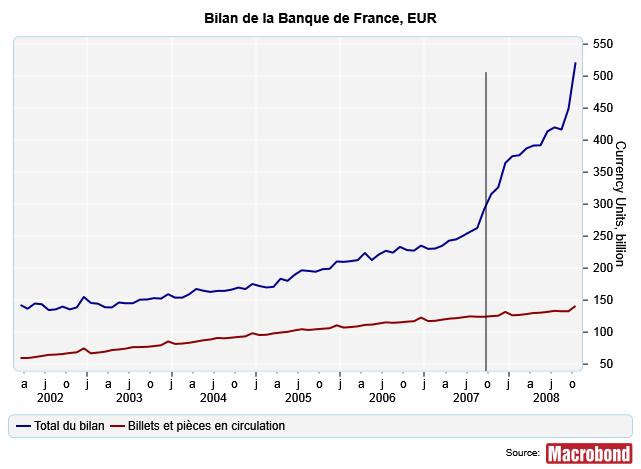

Normally, a central bank’s « banknotes in circulation » item is the one that contributes most to the increase in its balance sheet (before 2007 below):

An increase in banknotes in circulation means that, at a given moment, the citizens of a country have more banknotes than they did before. Since no one generally goes to the central bank to get additional banknotes, how does this increase take place in practice? How do banknotes pass from the central bank into the hands of citizens?

The answer is very simple: the central bank uses commercial banks as intermediaries. Commercial banks provide banknotes directly to their customers, usually via ATMs. When a commercial bank needs more banknotes to provide this service, it obtains them from the central bank, exchanging reserves (electronic money) for banknotes (fiat money). The same thing happens when you withdraw cash from your bank: the commercial bank’s account at the central bank is debited with a certain amount, and the commercial bank obtains banknotes for that same amount. This is how the central bank increases the amount of banknotes in circulation in the economy (or rather, we should say that we force the central bank to increase the amount of banknotes in circulation in the economy).

Julien P.

NB: An interesting set of information on the « practical » operations of a central bank, not usually provided in academic textbooks, can be found in section 4.3 of this document co-authored by Mishkin: http://www.nber.org/papers/

Notes:

[1] In order not to reduce the amount of reserves in the banking system (important for monetary policy!), the central bank will generally offset this reduction by injecting more liquidity.