Usefulness of the article: This article aims to provide a better understanding of the interactions between individual behavior and economic activity. It discusses the impact of behavioral biases and the importance of the self-fulfilling prophecy phenomenon in economics and finance.

Abstract :

- When analyzing a country’s economic situation, we often consider the behavior of economic agents (households, businesses, etc.) as a consequence or as an exogenous factor. However, it is essential to study the impact of agents’ motivations in order to understand changes in economic activity.

- Behavioral biases, emotions, and social influences can lead to decisions that differ from traditional conceptions of economic choices. Understanding these biases helps explain why certain economic decisions run counter to the predictions of traditional models.

- The concept of self-fulfilling prophecy is thus developed: economic agents adapt their behavior to their predictions of the economic situation. Applied on a large scale, this can amplify a recession or a period of growth.

- Applied to finance, a number of behavioral mechanisms will modify the decision-making architecture and thus the price of a given stock or security: momentum strategies, bank runs, etc.

The behavior of economic agents (households, businesses, etc.) is central to understanding economic and financial activity. It has implications in a number of areas, including financial markets, the labor market, inflation, monetary policy, etc. Behavioral biases, the phenomenon of self-fulfilling prophecies, and crisis mechanisms are fundamental to understanding changes in economic activity. The perceptions of different economic agents can have a significant impact on the performance of the economy as a whole.

1. A number of behavioral biases provide a better understanding of individual behavior

Behavioral analysis recognizes that individuals are not always rational in their economic choices. Cognitive biases (emotions, social influences and norms, peer pressure, etc.) can lead to decisions that differ from the classical conceptions ofhomo economicus. Understanding these biases helps explain why certain economic decisions run counter to the predictions of traditional models. Behavioral analysis explores how these factors influence economic decisions, including saving, consumption, and investment.

Each individual is motivated by their own personalincentives. Everyone therefore acts « rationally, » but based on a limited set of information that they consider to be the most relevant. These elements are highlighted inBehavioral Economics: When Psychology and Economics Collide, a book by Scott Huettel that examines how individuals make economic decisions. He approaches incentives and motivations through the lens of behavioral psychology and challenges the assumption of individual homogeneity, which is nevertheless a basis of traditional economic theory.

Traditional models often assume that individuals act selfishly to maximize their own utility. Some rational models go further and model individuals’ actions in an altruistic or cooperative manner: work on utility functions, or models derived from game theory, for example. Behavioral economics highlights the challenges of individual decision-making as such (myopia, information asymmetry, cognitive biases, social norms), which have important implications for understanding economic transactions and personal incentives.

It is important to note that several cognitive biases come into play in individual behavior and, for example, in the investment choices of economic agents.

First, commitment bias refers to the tendency of individuals to persist in an investment, even if it loses value. This tendency is mainly explained by the phenomenon of « sunk costs »: if the losses are very significant in comparison with the investments made, economic agents will not necessarily tend to sell the security or asset in which they have invested, but rather to persist in their decisions.These sunk costs come into play because greater importance is attached to a loss than to a gain of the same amount[1].

Investing in cryptoassets is a good example of this[2]: in 2017, after the sharp fall in the price of Bitcoin, many market players chose not to sell their cryptoasset investments. While several factors may explain this phenomenon (investment diversification, high capital gains even when prices fall, long investment horizon, etc.), some market investors preferred to stick with their initial investments.

Confirmation bias is also symptomatic of investors’ or economic actors’ choices. It highlights the tendency of economic agents to first form an opinion about an investment, consumption choice, or piece of information, and then seek out information that confirms their pre-existing intuitions, gradually ruling out any possibility of questioning their views. Thus, anyone who takes a theory or economic viewpoint for granted will be programmed to cognitively isolate the arguments that validate these assumptions. In the context of self-fulfilling prophecies, this cognitive bias can be particularly dangerous, as it amplifies individuals’ initial choices.

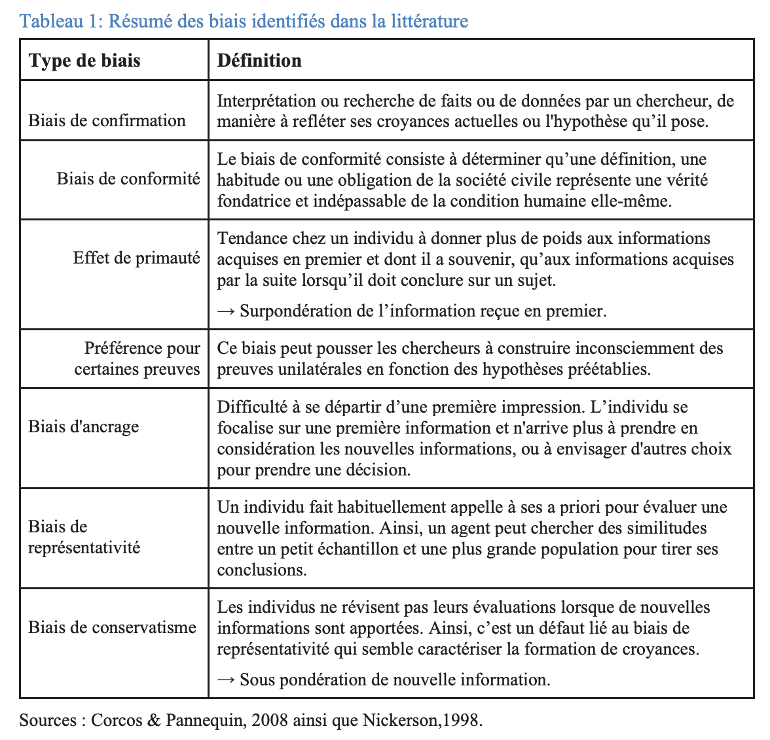

Many other biases are important to note and help us understand individuals’ perceptions and daily choices: anchoring bias (the first impression left on a subject forms a general belief), loss aversion (overvaluing the goods one owns), etc. The table below, taken from the article « The presence of cognitive biases in economic analysis: a case study » by CIRANO, the Interuniversity Research Center in Organizational Analysis, summarizes the various biases identified in the literature that come into play in economic developments.

2. From theoretical analysis to practical application: the phenomenon of self-fulfilling prophecy and the mechanisms of crisis.

Inspired by psychology and behavioral economics, self-fulfilling prophecies occur when the expectations or beliefs of economic actors (such as investors, consumers, or businesses) transform or amplify economic reality. In other words, the mere belief that something will happen causes it to actually happen.

One of the first applications of the principle of self-fulfilling prophecy in economics and finance concerns the emergence of financial crises: the expectations of investors and traders can influence fluctuations in stock prices and financial markets. If a large number of investors expect prices to fall, they will be tempted to sell en masse, which can actually cause a sharply amplified decline, caused by an overreaction of agents, compared to that explained by economic fundamentals.

In his 2011 article« Confidence and financial crisis in a post-Keynesian stock flow consistent model »[3],Edwin Le Heron seeks to explain the origins of the spread of the USsubprimecrisis in 2007-2008 to Europe. In his view, rational economic explanations are not sufficient to explain the emergence of a crisis of this magnitude. According to the author, the spread of thesubprimecrisis to Europe was greatly amplified by a self-fulfilling prophecy phenomenon, which increased the severity of the crisis. Expectations and forecasts played a key role in the transmission of the crisis from the financial sector to the real economy. Among the various types of economic agents, corporate expectations are the most important, largely explaining the evolution of effective demand.

Individual decisions can thus have a cumulative impact on the economy and influence the direction of economic activity. In his bookManias, Panics, and Crashes: A History of Financial Crises, Charles P. Kindleberger examines how the collective and irrational behavior of individuals and financial institutions played a central role in the genesis and development of crises. He highlights thetheory of « herd behavior »as applied to economics and finance (also known as the concept of social proof): economic actors are driven to replicate the behavior of their peers through mimicry. Thus, decisions taken individually become mass phenomena, which can have significant consequences on the economic situation, particularly because of their potentially self-fulfilling nature.

Economic agents thus adapt their behavior to their predictions of the economic situation. This is mainly explained by thetheory of expectations(rational or adaptive, depending on the information considered). Belief in the dynamism of an economy has the effect of reinforcing its dynamism. If businesses, households, and banks are pessimistic about the future, businesses may reduce their investments, households may reduce their consumption and thus favor savings, and banks may become more cautious in granting loans, given a higher perception of credit risk. The combination of these behaviors can thus have a negative impact on economic growth. These expectations and anticipations are based on aset of information that drives decision-making: for example, influential media reports, government announcements and measures, economic data such as GDP, inflation, and unemployment, or information shared on social media or through interpersonal communication can shape economic expectations and behavior.

Beyond the purely financial aspect, self-fulfilling prophecies are also present in other dimensions of the economy:

The expectations of economic actors, including central banks, regardinginflation and interest ratescan influence monetary policy decisions. If market participants anticipate that the central bank will raise interest rates to control future inflation, they may start selling long-term bonds, which has the effect of increasing long-term interest rates, in line with their expectations. The central bank is also extremely attentive to economic actors’ inflation expectations, which can have self-fulfilling effects on the current level of inflation.

Consumers’ expectations regarding price developments, inflation, or economic stability can also influence their purchasing behavior. This is explained, for example, byRicardian equivalence: it is based on the assumption that economic agents take into account the long-term implications of government fiscal policies when making decisions about consumption and savings. More specifically, this means that an increase in public spending financed by borrowing will not have a significant impact on the overall demand for goods and services, as economic agents will respond by adjusting their savings behavior to offset the potential effects of higher taxation to ensure the sustainability of public debt, thereby limiting the effects that might be expected from the Keynesian multiplier.

Finally, in thelabor market, employers’ and employees’ expectations regarding the state of the economy can influence job creation and the unemployment rate. Indeed, in the event of negative economic scenarios (global recession, Brexit, trade war, etc.), companies will tend to adopt a wait-and-see approach to investment, which could affect employment dynamics by reducing hiring.

3. Behavioral finance in practice: crisis mechanisms, momentum effects, bank failures, and bank runs.

Behavioral finance explores how human behavior and emotions influence financial markets and investment decisions. By examiningcrisis mechanisms,momentum effects,bank failures, andbank runsfrom a behavioral finance perspective, we can highlight certain trends and irrationalities that may affect these phenomena.

First, a number of mechanisms will cause and trigger crises.

The panic selling effectisa prime example: in times of crisis, investors may panic and sell off their assets en masse, often irrationally. This can exacerbate the crisis by triggering a negative spiral of sales. During the 2008 financial crisis, many investors panicked and sold off their shares en masse, fearing a global economic meltdown.

Theherding behavior effectthenamplifiesthe phenomenon: investors often tend to follow the crowd, even if it goes against their own analysis. When many investors act in the same way, it can intensify market movements. For example, during the tech bubble of the 2000s, many investors followed the trend by investing heavily in tech stocks without thorough evaluation.

Momentum strategies arealso symptomatic of the application of behavioral science to investment strategies. These are investment approaches based on the idea that assets that have performed well in the past will continue to do so in the future, while those that have underperformed will continue to do so. These strategies are often implemented in financial markets, whether for stocks, currencies, commodities, or other asset classes.

The momentum effect is explained by two behavioral biases that combine:

- Confirmation bias, where investors tend to place more importance on information that confirms their existing opinions. This can lead to momentum movements, where investors follow the current trend without questioning their decision.

- The overreaction or underreaction effect, where markets may react excessively to new information, creating momentum opportunities. For example, an exaggerated reaction to financial results can create a temporary momentum effect.

Finally,panic withdrawalsor irrational confidencecan lead to bank failures: a bank’s customers may panic and withdraw their deposits en masse when they have concerns about the bank’s financial health. This behavior can contribute to a bank failure by creating a liquidity crisis. Trust or mistrust in a bank can often be influenced by emotional factors rather than objective financial data. This effect is amplified in the caseof herd behavior or emotional contagion, explained by the presence of emotional or speculative reactions rather than a rational assessment of a bank’s financial health.

Conclusion

The various elements mentioned in this article show the importance of individual behavior in the evolution of economic and financial activity. By gradually studying the influences that these behaviors can have, we observe that they can have a strong impact on activity and fuel the phenomenon of self-fulfilling prophecy.

Behavior is not always rational, but is guided by behavioral biases that have a strong impact on individual decision-making. Taken from a macroeconomic perspective, these biases increase the risk of financial crises through mechanisms that have been frequently observed in previous crises.

Sources:

- Scott Huettel,Behavioral Economics: When Psychology and Economics Collide.

- Dominique Pepin,Instability of behavior and financial cycles: a reinterpretation in a rational framework with endogenous preferences. 2011. HAL Open Science.

- Edwin Le Heron, “Confidence and Financial Crisis in a Post-Keynesian Stock Flow Consistent Model”European Journal of Economics and Economic Policies Intervention, September 2011

- Corcos, A. & Pannequin, F. (2008). Conservatism, representativeness, and anchoring in a dynamic context: An experimental approach: April 2006. Louvain Economic Research, vol. 74(1), 77-110.

- Charles P. Kindleberger, 1978, « Manias, Panics, and Crashes: A History of Financial Crises. »

- Amos Tversky, Daniel Kahneman, « Rational Choice and the Framing of Decisions, » The Journal of Business, 1986.